Even though the broader market has recently set new all-time highs (as measured by the S&P500 And Nasdaq-100) over the past month, there are still plenty of buying opportunities in the stock market.

I’ve identified three stocks that seem like great buys, and you should consider them for your next investment.

1. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is a giant in many industries. Google’s product family has long been successful, with the search engine still dominating global market share despite competitors introducing generative, AI-powered options.

It also has a thriving cloud computing business, a product line that will be critical as artificial intelligence (AI) grows. About 70% of generative AI unicorns (private companies valued at over $1 billion) use Google Cloud, proving it to be the platform of choice for any company looking to create an AI model in the cloud.

Even though Alphabet hit a new all-time high a few days ago, I still think it looks attractive at these levels.

When we consider Alphabet’s future price-to-earnings (P/E) ratio, the stock doesn’t look too pricey.

At just under 23 times forward earnings, it is slightly more expensive than the S&P 500, which trades at 21.3 times forward earnings. Furthermore, it also looks cheap compared to other “Magnificent Seven” members.

|

Company |

Forward price-to-earnings ratio |

|---|---|

|

Microsoft |

35.4 |

|

Apple |

26.3 |

|

Nvidia |

34.5 |

|

Amazon |

43.7 |

|

Tesla |

58.1 |

|

Metaplatforms |

25 |

Data source: YCharts.

With Alphabet still performing well and being much cheaper than its big tech peers, I think it’s a no-brainer purchase at this point.

2. MercadoLibre

MercadoLibre (NASDAQ: MELI) is a powerhouse in Latin America. It has a thriving e-commerce and logistics business (similar to Amazon), but also has elements such as digital payments and consumer credit. If it is essential that e-commerce can take place, MercadoLibre probably has a hand in that.

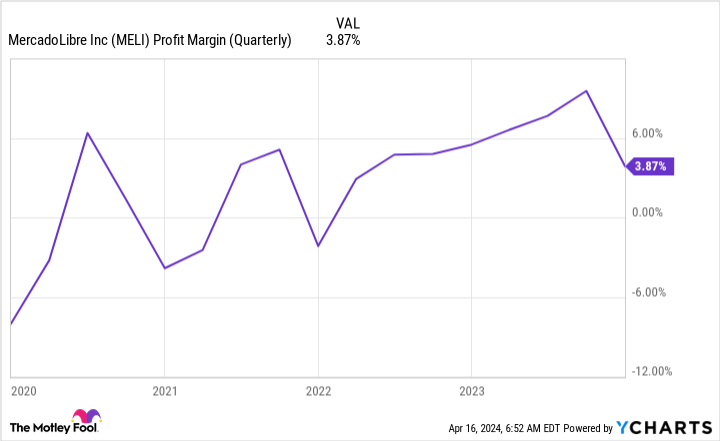

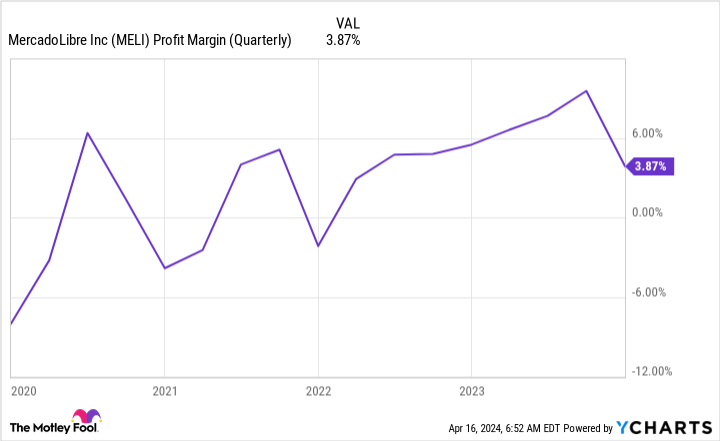

It has also grown at an incredible pace, with fourth-quarter net sales rising a currency-neutral 83% to $4.3 billion. It also improves profitability, which has faltered as MercadoLibre rapidly expanded to secure new opportunities.

Although the profit margin fell to around 4% this quarter, if not for one-time costs it would have been 9%. Even with strong success, MercadoLibre stock has had a bad 2024, down almost 10% this year. This decline has also caused the price/sales value (P/S) to fall to historically low levels.

Due to MercadoLibre’s strong sales and significant pullback, I think now is an excellent time to buy some shares of MercadoLibre.

3. UiPath

Finally there is UiPath (NYSE: PAD). The software is critical for the implementation of robotic process automation (RPA) tasks. When combined with AI, RPA enables its users to automate a significant number of repetitive tasks. By eliminating these employee workflows, they can perform other tasks that require original thinking, making companies more efficient and improving employee morale.

UiPath has been quite successful, with annual recurring revenue (ARR) increasing 22% to $1.46 billion in the fourth quarter of fiscal 2024 (ending January 31). UiPath also converted about 4% of revenue into operating profit. This will be an important metric to watch in the coming quarters as it shows investors that they are starting to value earnings above the growth rate.

Still, UiPath has a huge market opportunity ahead. Grand View Research predicts that the US RPA market will grow from $2.9 billion in 2023 to $30.9 billion in 2030. Already a major player in this sector, UiPath still has a lot of growth ahead of it.

Despite this, UiPath’s shares don’t trade at a premium, as many software companies do.

At just 8.4 times revenue, UiPath is a reasonably priced software stock with strong growth. That’s why I’m taking the recession as an opportunity to buy more UiPath stock now.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, MercadoLibre, Meta Platforms, Tesla and UiPath. The Motley Fool holds positions in and recommends Alphabet, Apple, MercadoLibre, Meta Platforms, Microsoft, Nvidia, Tesla, and UiPath. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 No-Brainer Stocks I’d Buy Right Now Without Hesitation, originally published by The Motley Fool