The past few weeks have been tough Apple (NASDAQ: AAPL) shareholders. The stock is now 15% below its December high, sliding all the way back to where it was trading at the end of 2021. This is a weakness that most investors simply aren’t used to from this frequent Wall Street favorite.

If you’re interested in a new role at Apple, don’t let the stock’s recent performance fool you. There are still good reasons to make long-term deals in this consumer technology titan. Here’s an overview of the best three.

1. The company is facing headwinds in China

Perhaps the biggest reason why Apple shares have fallen lately is the company’s recent performance in China. It wasn’t great. The country is simply not evolving into the growth engine it should one day become.

After clawing its way to become the country’s smartphone market leader last year (by losing less than its rivals), IDC reports that Apple’s iPhone has regained that lead in the first quarter of this year lost. It’s a microcosm of the company’s struggles in the region.

The company is finally rising to the challenge, if only by turning its attention to more promising markets. Those are Southeast Asia and India, by the way. Earlier this month, CEO Tim Cook visited Singapore and pledged $250 million to expand operations there. Apple is also investing heavily in India as a manufacturing partner and as a market for its goods and services.

Bloomberg reports that India collected $14 billion worth of iPhones last fiscal year, with the country also seeing the opening of its first-ever Apple Store in 2023. Counterpoint Research reports that Apple now leads the Indian smartphone market as measured by revenue, while analysts with Morgan Stanley According to him, India alone could account for 15% of Apple’s revenue growth over the next five years.

It is certainly a compelling start to breaking away from China, where doing business is proving increasingly difficult.

2. Apple is finally getting serious about AI

The advent of artificial intelligence (AI) has taken shape without much apparent involvement from Apple. But that’s going to change. Without elaborating on any significant details, CEO Tim Cook said in February that some AI-powered features of the company’s next-generation technology would be unveiled sometime later this year.

What kind of functions? That’s just it. He didn’t say that. Given the work the company has done, it’s not a stretch to suggest that Apple’s new A17 processor and the next version of its operating system (iOS 18) will likely allow iPhone owners to do generative AI work on their devices instead of in the cloud (where most generative AI tasks are actually handled today). This, of course, has the potential to make Apple’s built-in assistant Siri an even more powerful tool.

And it matters. As Evercore ISI analyst Amit Daryanani describes it, Apple’s consumer-facing AI offering could trigger a “supercycle” in iPhone demand. It’s not just consumer-facing features that will be improved by artificial intelligence. Apple’s technology is also capable of doing things like optimizing ad placements and helping digital cameras (or augmented reality devices) understand what an object or image is.

All told, Wedbush analyst Daniel Ives believes that Apple’s AI offering – just as a starting point – could add another $5 billion to the company’s annual revenue.

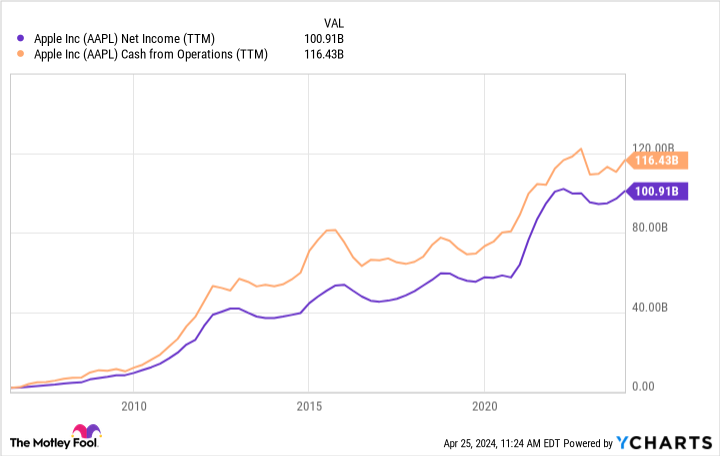

3. The money is still flowing like crazy

While revenue growth has been inconsistent lately, that hasn’t stopped Apple from continuing to pump up its profits. The $100.9 billion in net revenues the company has generated over the past four reported quarters is near a record, following the twelve-month period ending in early 2022 (following the wave of smartphone purchases that were postponed during the crisis period). and due to the pandemic).

What gives? Particularly credit the growth of Apple’s services business. Sales of apps and streaming content improved 11% year-over-year last quarter, but more than that, this revenue is a very high margin. Roughly three-quarters of the company’s services revenue is converted into gross profit, compared to only 40% of product-driven revenue. The slow shift towards a more service-oriented business operation is proving to be disproportionately lucrative. And this will likely remain the case indefinitely.

The final end result is of course the cash flow. And Apple has plenty of that and can do a wide range of things with this money, including increasing its dividend, paying down debt or acquiring complementary businesses. Few other companies have such options.

Apple also has $73 billion in cash and cash-like instruments, plus another $99 billion in marketable securities, increasing fiscal flexibility should it need it.

Before you take the step

Ready to dive in? There is a good reason to wait a little longer. That means the company will release its fiscal Q2 numbers after the market closes on Thursday, May 2. This could lead to volatility; It power Send the stock lower. We just don’t know. For investors who can’t stomach a rough start with a new position, missing out on a post-earnings pop is more palatable than a post-earnings dip.

If Apple stock pulls back after its second-quarter results, it’s definitely a buying opportunity. This year’s stock weakness is already in the worst-case scenario (and beyond) without sufficient consideration of the bullish initiatives the company is currently taking. The market could still have a knee-jerk reaction to any bearish turn in the second quarter numbers.

However, if that takes shape, it should essentially flush out the last potential sellers, leaving buyers behind for a while. That is of course your decision. Just know that these timing-oriented strategies usually don’t make much difference to true long-term positions in the end.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

James Brumley has no positions in the stocks mentioned. The Motley Fool holds and recommends positions in Apple. The Motley Fool has a disclosure policy.

3 Reasons to Buy Apple Stock Like There’s No Tomorrow was originally published by The Motley Fool