On April 11 Apple (NASDAQ: AAPL) Shares fell 4.3% in one session, the biggest gain in almost a year. However, the stock gave back some of those gains in subsequent sessions due to a broader market pullback and reports of lower iPhone shipments.

Here’s a look at what’s moving Apple stock, where the investment thesis stands, and whether the stock is worth buying now.

AI absence

Apple has been noticeably absent from the broader market rally in technology, growth stocks and artificial intelligence (AI). In fact, Apple’s stock lost its value in 2024 and drastically underperformed S&P500 about the last year.

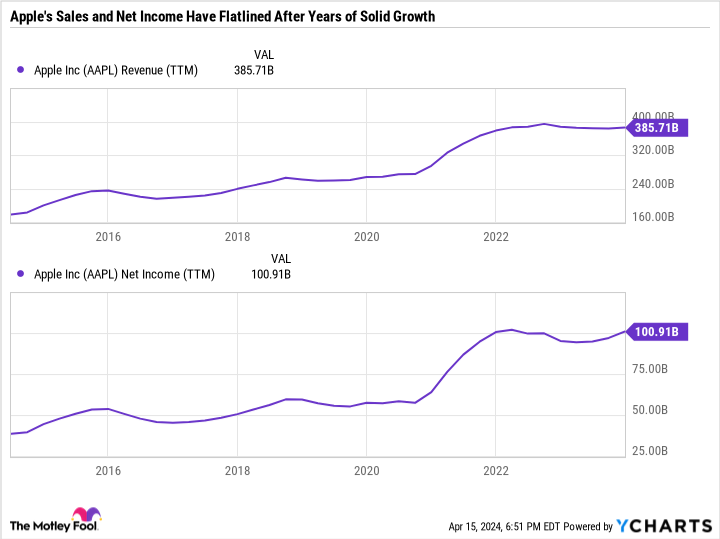

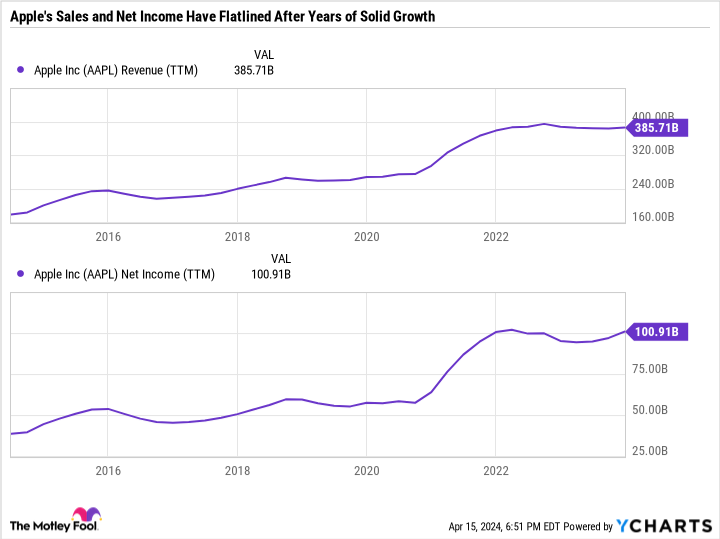

There are plenty of valid reasons for Apple’s underperformance. The main problem is that Apple’s profits have stalled and growth has stalled.

The company has failed to make a quantum leap in AI, while other major tech companies have been able to measure the impact of AI on their bottom lines and chart a multi-year run towards further AI-powered growth. Apple’s AI and virtual reality investments, such as the Vision Pro, are still in the early stages and have not yet had a material impact on the company’s performance.

However, investors got a much-needed vote of confidence on April 11 when reports surfaced that Apple was nearing production of computer processors with AI capabilities.

AI chips have been a major catalyst for semiconductor companies Advanced micro devices and could help revive interest in consumer electronics. The COVID-19 pandemic has increased demand for Apple products, which has boosted results in the short term but has led to sluggish growth in recent years. Apple needs a defining product feature for the next upgrade cycle, as marginal product improvements have not been enough to meaningfully drive demand. Embedding more AI capabilities into the iPhone would be the natural way to help Apple return to growth.

The short-term challenges are increasing

For the time being, Apple remains stuck in a decline in demand. International Data Group (IDC) reported that Apple’s iPhone shipments fell nearly 10% in the first quarter of 2024. Apple has so far managed to offset slower demand from China with rising or flat demand in North America and emerging markets.

Investors will have to wait until May 2 to hear from Apple on the exact numbers for the second quarter of fiscal 2024. However, the IDC report is concerning and illustrates the importance of Apple’s product improvements. Apple needs to convince investors that next-generation products will sell because they are better, not just because consumers are ready for an upgrade.

Apple’s Worldwide Developers Conference from June 10 to 14 and its annual new product unveiling in September are the two main events this year. These events are good opportunities for Apple to develop its innovation. But if Apple disappoints, they could also accelerate the downward pressure on the stock.

Think long term with Apple

Apple shares have been noticeably more volatile lately. At the end of March, the stock experienced its biggest single-session decline in more than seven months, followed by its biggest single-session gain in more than eleven months just a few weeks later. Apple’s brand and market positioning need no introduction, but its growth is in question, especially as consumers remain under pressure.

Now that the growth story is out the window, Apple is starting to look more like a value stock, at least for now. It is the cheapest ‘Magnificent Seven’ stock in terms of price-to-earnings ratios and price-to-free cash flow ratios. It’s even trading at a discount to the S&P500.

Apple is not dirt cheap, but it does not deliver nearly as much as its gigantic technical colleagues. Investors who are confident that Apple can turn the tide will have the opportunity to buy the shares at a good price. However, it’s important to understand that Apple has fallen for mostly good reasons, and it could fall even further if the market sells off more broadly.

Buying Apple now shouldn’t be a bet on stocks that will suddenly deliver an epic turnaround, but rather a long-term investment in an excellent company that will make money with AI and has a long way to return value to shareholders and over to grow over time.

It’s worth noting that even in times of slowing growth, Apple is generating enough extra cash to continue buying back a boatload of stock and raising its dividend. Apple is a buy for patient investors, but the stock could come under pressure if its AI investments don’t pay off.

Should You Invest $1,000 in Apple Right Now?

Before you buy shares in Apple, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Daniel Foelber has the following options: July 2024 long calls of $180 on Advanced Micro Devices. The Motley Fool holds positions in and recommends Advanced Micro Devices and Apple. The Motley Fool has a disclosure policy.

Apple just posted its biggest single-session pop in more than 11 months following its artificial intelligence (AI) update. Will the ‘Magnificent Seven’ share return to growth? was originally published by The Motley Fool