-

Mining stocks have underperformed bitcoin this year.

-

CEOs of these companies remain optimistic ahead of the halving, citing stronger balance sheets, the report said.

-

Some CEOs pointed to the potential for consolidation in the industry, Bernstein said.

Bitcoin {{BTC}} miners may have underperformed the cryptocurrency this year, but their CEOs remain optimistic as the reward halving approaches, broker Bernstein said in a research note on Monday.

The underperformance has been driven by strong moves in spot bitcoin and exchange-traded funds (ETFs), which have sucked “retail liquidity” out of mining stocks, and by concerns about the impact of the halving on miners’ earnings, analysts Gautam Chhugani and Mahika Sapra wrote .

The quadrennial halving is when rewards for miners are reduced, slowing the growth of bitcoin supply. The next halving will be around April 19-20.

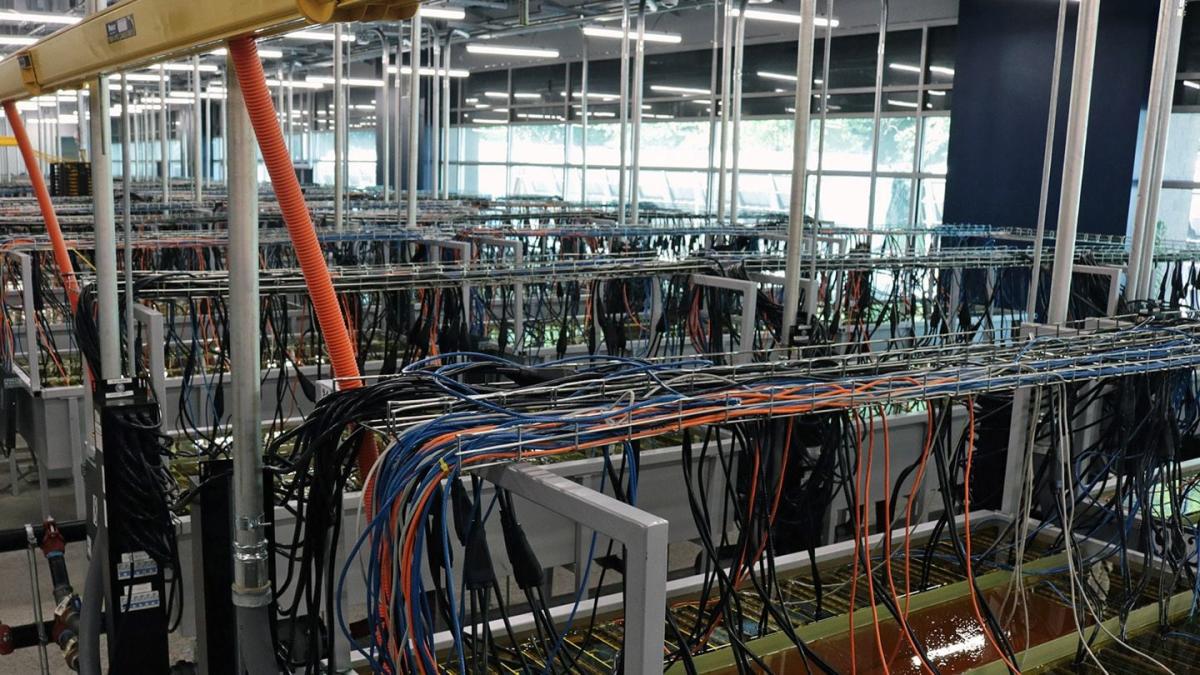

The broker interviewed the CEOs of Riot Platforms (RIOT), CleanSpark (CLSK), Marathon Digital (MARA), Cipher Mining (CIFR) and Hut 8 (HUT). Companies are in a relatively comfortable financial position this cycle and are thus better prepared to withstand the impact of the halving, Bernstein said.

The CEOs point out that miner dollar revenues are at an all-time high, providing a solid cushion for miners ahead of the halving, and they also pointed to the “relatively low debt burden on the balance sheet.”

Some CEOs highlighted the potential for miner consolidation, the report said.

“The CEO of CleanSpark expects the industry to consolidate into four leading miners and believes RIOT, MARA, CLSK and CIFR will take the lead,” the note said, adding that the “CEO of MARA also charts a path to industry consolidation highlighted and named CLSK as an arch-competitor in the race for acquisition targets.”

Another notable change this time around is application and layer 2 development on the Bitcoin blockchain, which has led to an increase in network fees that flow back to miners as incremental revenue streams, the report said.

Riot and CleanSpark expect to double capacity by the end of the year, which will offset any impact from the halving, the report said.

Read more: Bitcoin Halving Sends Crypto Miners Racing for ‘Epic Sat’, Potentially Worth Millions