A funny thing happened in the market on Thursday: the most highly anticipated report of the entire earnings season, Nvidia’s, delivered by a wide margin, and while the chipmaker’s investors benefited, the rest of the market collapsed. Blame fell on rising interest rates after better-than-expected economic data.

Cathie Wood, the CEO and Chief Investment Officer of ARK Invest, offered a broader perspective: “In our view, the search for cash and safety in the stock markets today is as intense as it was during the Great Depression of the early 1930s.” she said Thursday evening on the social media service

Most read from MarketWatch

Before we go any further, the elephant in the room in mentioning Wood and Nvidia NVDA in the same story is that she infamously exited the stock at exactly the wrong time and sold most of her stake before Nvidia’s meteoric rise as due to the demand for artificial intelligence.

Its flagship fund, the ARK Innovation ETF ARKK, is down 17% this year, pressured not only by Tesla TSLA — more on the automaker later — but also by other top companies that have struggled, including Roku ROKU, Block SQ and UiPath PATH. in one year, Nvidia has risen 110%.

Wood’s argument is that market concentration is evidence of the quest for money and security.

Evidence of this concentration is that the weight of Nasdaq 100 companies in the S&P 500 now stands at 45%.

“The Nasdaq used to be a very fertile place for mid-to-large companies,” she said in a recent presentation. “They were the innovators, they were the disruptors. We believe the Nasdaq 100 is doing very little of that right now.”

She also points to an analysis Goldman Sachs conducted earlier this year showing that the market capitalization of the largest stocks relative to the 75th percentile is the highest since 1932.

Her main point, along with a pessimistic view of the US economy, is that once interest rates start falling, market profits will expand.

“Last year the market seemed to be moving… in that direction, so that was the beginning of us thinking about this move, but if we’re right this [Goldman market concentration] chart would suggest the move still has miles to go,” she said.

The market

Following Thursday’s 606-point drop for the Dow DJIA, its worst in more than a year, stock futures ES00 NQ00 pointed slightly higher. There was some sell-off action in Ethereum ETHUSD after the Securities and Exchange Commission approved spot ETFs containing the cryptocurrency.

|

Performance of key assets |

Last |

5d |

1 m |

YTD |

1y |

|

S&P500 |

5267.84 |

-0.55% |

4.35% |

10.44% |

26.90% |

|

Nasdaq Composite |

16,736.03 |

0.23% |

7.20% |

11.49% |

31.80% |

|

10-year treasury |

4,466 |

4:00 am |

-20.30 |

58.51 |

65.99 |

|

Gold |

2342.1 |

-3.21% |

-0.32% |

13.05% |

20.35% |

|

Oil |

76.65 |

-3.61% |

-8.40% |

7.46% |

5.19% |

|

Data: MarketWatch. The interest rate on government bonds changes, expressed in basis points |

|||||

The buzz

Durable goods orders rose 0.7% in April as the latest consumer sentiment figures from the University of Michigan are expected to be released soon.

Fed Governor Christopher Waller speaks at a conference after saying Wednesday that he needs several more months of good inflation data before supporting rate cuts. Goldman Sachs, meanwhile, pushed back its expectations for the Fed’s first rate cut to September, from July.

Tesla TSLA has aggressively scaled back production of its Model Y car in China. Elon Musk denied a report that SpaceX was about to make a bid for existing shares, valuing the rocket launcher at $200 billion.

Discount department store operator Ross Stores ROST reported stronger-than-expected profits.

Business software provider Workday WDAY lowered its sales guidance.

The best of the internet

Barry Sternlicht’s Starwood Real Estate Income Trust is limiting withdrawals.

Archegos accidentally sent $470 million to Goldman Sachs as the company was collapsing.

This popular SUV has received approval in Australia to send power back to the grid.

Top tickers

Here are the most active stock market tickers as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

TSLA |

Tesla |

|

AMC |

AMC Entertainment |

|

FFIE |

Faraday Future Intelligent Electric |

|

AMD |

Advanced micro devices |

|

AAPL |

Apple |

|

SMCI |

Super microcomputer |

|

TSM |

Taiwanese semiconductor manufacturing |

|

NIO |

Nio |

The graph

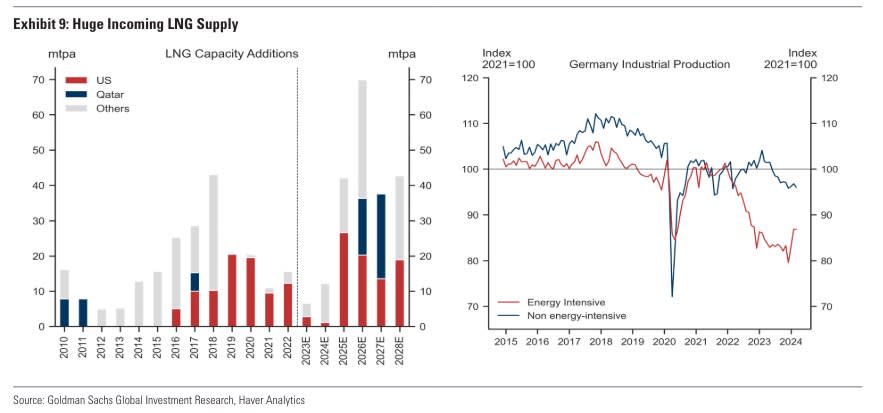

Can Germany, whose economy has lagged behind the US by about 9% since the fourth quarter of 2019, recover? Economists at Goldman Sachs led by Sven Jari Stehn say so, and one reason is that the liquid natural gas coming to Europe will more than compensate for the gas that Russia used to supply. That in turn should boost industrial production, which is sensitive to energy prices, they say.

Random readings

It turns out that competitive hot dog eating isn’t healthy.

The dog behind the Doge meme has died.

This dog fashion show aims to copy the latest Met Gala looks.