Devon Energy (NYSE: DVN) is an acquired taste – only suitable for a certain type of investor. That’s true, despite a generous dividend yield of 4.6% and a shareholder-friendly dividend and share buyback policy. This is why this oil and natural gas company could be a buy or hold for some investors, but many more will likely want to avoid it.

Buy Devon Energy

Devon Energy is an upstream player in the American energy sector. That means it produces oil and natural gas in the United States, which it then sells to generate revenue. While the day-to-day operations of the company are likely very complex, the big picture is quite easy to understand. When U.S. oil and natural gas prices rise, so do Devon’s financial results. When oil and natural gas prices decline, the company’s results reflect that accordingly.

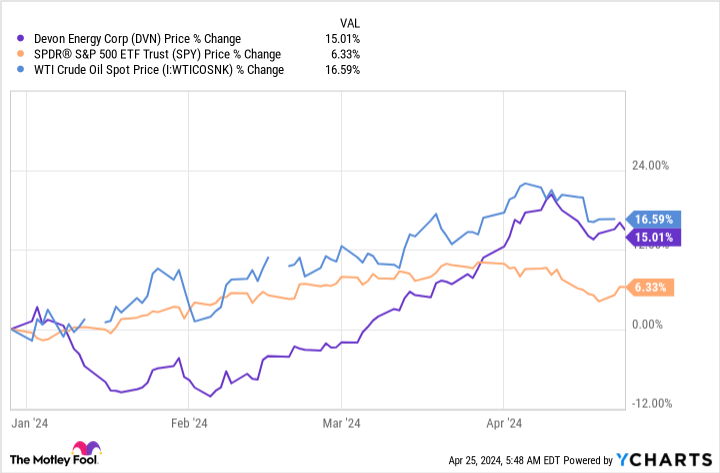

If you’re looking for exposure in the energy sector, Devon Energy is a fairly direct way to get that exposure. All you need to know is that its financial performance – and its share price – will likely be as volatile as energy prices. With West Texas Intermediate crude oil prices up so far in 2024, Devon shares are up about 15% so far this year. That’s more than double the profit of the S&P500 Table of contents.

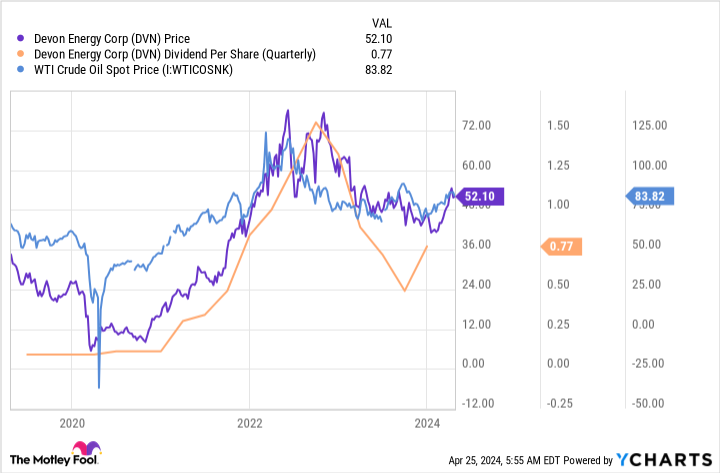

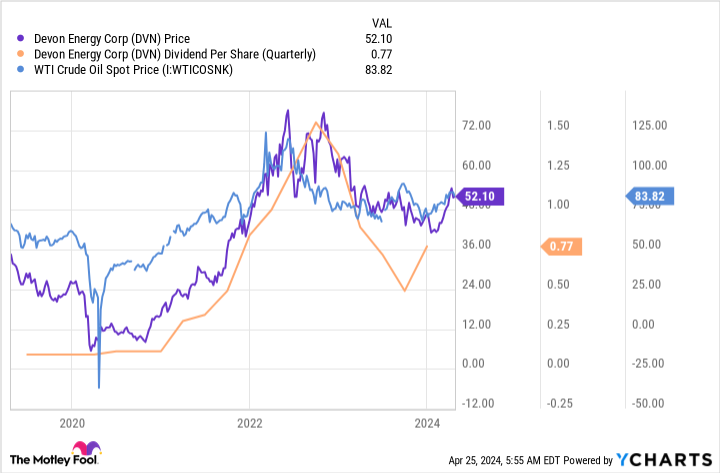

But that’s not the end of the story. Devon’s dividend and share buybacks are directly linked to its financial results. In short: the dividend will increase and the company can buy back more shares if its financial performance is good. It will likely perform well when oil and natural gas prices are high and/or rising. In this way, the share offers some extra leverage on rising energy prices. If you’re looking to have that in your portfolio, Devon Energy is an option you should strongly consider.

Devon Energy sale

That said, there is a downside to the focus on oil and natural gas. When energy prices fall, Devon shares are likely to follow suit. And when performance declines, along with falling energy prices, the company will return less money to investors through dividends and stock buybacks. That won’t be an attractive proposition for investors looking for an energy investment that can provide a reliable income stream.

This variability is simply part of the story here and there is nothing that can be done about it. Devon Energy is an upstream producer and its revenues and earnings are directly tied to the ups and downs of the energy sector. Unless you can handle the often dramatic and rapid price changes of oil and natural gas, you won’t want to own Devon Energy. There are other companies in the energy sector that have historically paid more consistent dividends.

Hold Devon Energy

In the meantime, if you step back from assessing Devon Energy as a company and consider what impact owning the shares could have on your wider life, there could be a place for it in a long-term investment plan. If you’re not trying to time the ups and downs of energy commodity prices (which isn’t something most people should try to do), then you could see Devon’s variable dividend policy as a hedge against the real energy costs you face have. .

Just as higher energy prices force you to pay more at the pump and heat your home, Devon’s dividend is likely to rise (with a slight lag). So Devon will likely give you more dividend income just when you need some extra cash. Of course, you have to understand that the extra money dries up when energy prices drop, but you probably no longer need the extra money at that point. That can be a valuable addition to an income portfolio, but you need to understand why you own Devon and what you can expect from it.

A complex investment thesis

If you’re a conservative dividend investor who likes consistency, then you’ll probably hate Devon Energy. It’s just not designed for that, and you’d be better off with a midstream player like this Enbridge or Partners for business products. Integrated energy giants such as ExxonMobil or Chevron would also be better choices. However, if you want to gain near-direct exposure to energy prices or hedge your real energy costs, Devon could be a good fit for your portfolio. The key is to understand what you are buying and why.

Should you invest $1,000 in Devon Energy now?

Before buying shares in Devon Energy, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool holds positions in and recommends Chevron and Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Devon Energy: Buy, Sell or Hold? was originally published by The Motley Fool