The technology industry has long dominated stock market gains, and this has become even more evident with the rise of artificial intelligence (AI). Due to the rapid growth opportunities offered by many technology companies, it makes sense that many growth-oriented investors are choosing the technology route.

Regardless of the opportunities technology stocks present, it’s still important that investors maintain a long-term mindset and don’t approach them expecting to get rich quick.

For investors who have $5,000 available to invest, the following three options are good long-term choices, and you can divide your money evenly among them. They each operate in different technology industries, but are market leaders in their own right.

1. Amazon

From an online bookstore to a technology conglomerate, Amazon (NASDAQ: AMZN) is debatable the excellent example of growth stocks in the technology sector. A $1,000 investment in Amazon in May 1997 initial public offering (IPO) would be worth more than $1.8 million today.

Amazon gained a dominant position due to its e-commerce activities, but has since become the leading company cloud services provider with its platform, Amazon Web Services (AWS). It has also made a mark in the entertainment industry with its Prime Video.

E-commerce is responsible for the majority of Amazon’s revenue, but AWS is responsible for a large portion of the company’s profits. Both factors explain why the company is poised to be a strong player in the long term. On the e-commerce side, it is starting to leverage its logistics network, which cost the company billions to develop, to generate new revenue streams with its Amazon Supply Chain.

Amazon’s Supply Chain is a fully automated set of supply chain services that allows sellers to leverage the company’s complex logistics, warehousing, distribution, fulfillment capabilities and transportation (including international). If Amazon can grow from its own e-commerce business to serve the broader e-commerce market, Amazon’s position in the industry will only be strengthened.

2. CrowdStrike

CrowdStrike (NASDAQ: CRWD) is one of the largest cybersecurity companies in the world and seems to be in the right place at the right time. The need for cybersecurity is increasing as the world becomes more digital.

According to IBMAccording to the ‘Cost of a Data Breach Report 2023’, the average cost of a data breach globally is $4.45 million, and 51% of organizations plan to increase their cybersecurity spending as a result. These are just data breaches, but there are many more cyber attacks that can threaten a company’s business operations.

IBM’s report also notes that organizations that use AI and automation to combat this problem save $1.76 million, compared to organizations that do not. This works to CrowdStrike’s advantage as the company is one of the pioneers in using AI exclusively to combat cyber attacks.

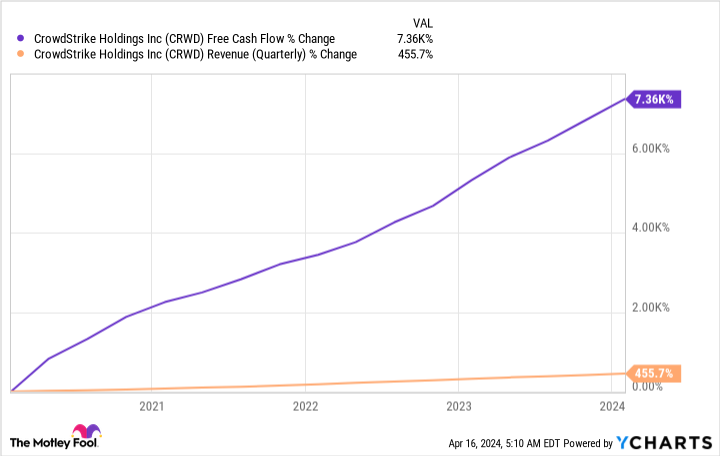

There is no doubt that CrowdStrike’s platforms are effective; the business results speak for themselves. About 27% of its customers use seven or more products in its ecosystem (called ‘modules’), 43% use six or more and 64% use five or more. As a result, the company’s free cash flow has increased dramatically in recent years.

CrowdStrike can still cover a lot more ground in the cybersecurity industry. According to the company and market intelligence firm IDC, the AI-native cybersecurity market is estimated to grow from $100 billion this year to $225 billion by 2028. Of course, CrowdStrike won’t be able to capture everything, but it’s poised to become a largely benefiting company of this expected growth.

3. Metaplatforms

Despite some well-documented PR mishaps, Metaplatforms (NASDAQ: META) has been a gift to its investors over the past year and a half. The share price is up more than 450% since the November 2022 slump.

The owner of Facebook, Instagram, WhatsApp and Messenger has positioned itself as a platform for advertisers looking to get their products and services in front of Meta’s 3.98 billion monthly active users (MAUs). It’s also done wonders for the company lately, with its financial health in many ways as good as it’s ever been.

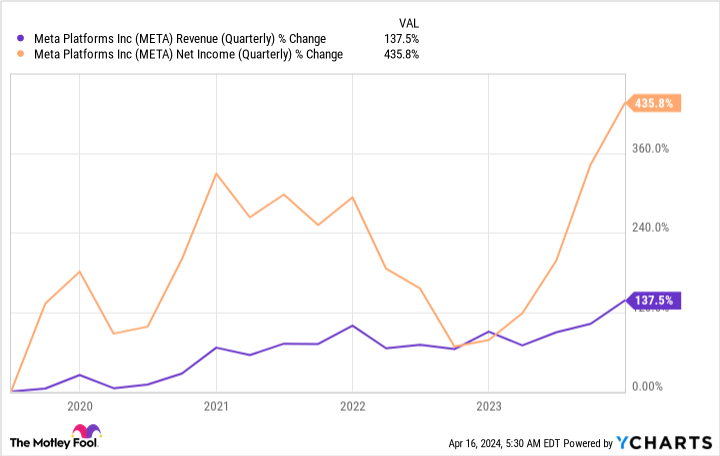

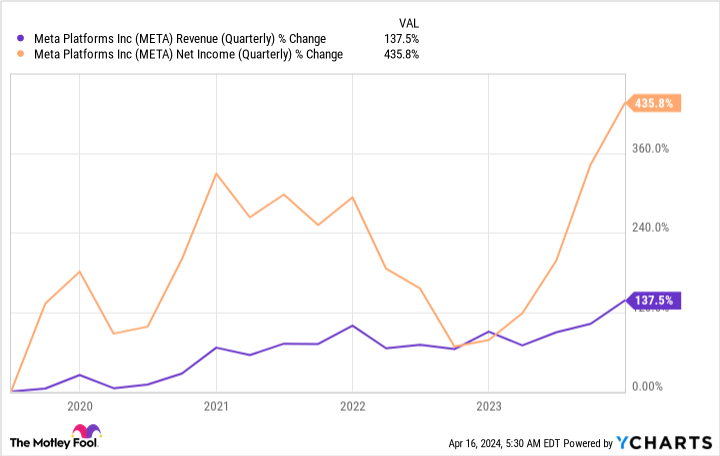

Meta has always been a cash cow for revenue, but lately its net income has soared. In 2023, Meta’s net income was over $39 billion, an increase of 69% compared to 2022.

Meta’s net income growth relative to revenue growth shows that the company is starting to operate more efficiently and use its capital more effectively. Meta announced a dividend for the first time in its history in February.

The company’s quarterly dividend is $0.50 per share, and I believe it wouldn’t have paid it at this point if it didn’t plan to increase it annually. Meta is far from every dividend investor’s dream, but it can be a real two-for-one for long-term investors.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Stefon Walters has no positions in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, CrowdStrike, and Meta Platforms. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Do you have $5000? 3 tech stocks to buy and hold for the long term. was originally published by The Motley Fool