Investors often have different objectives. Some investors may simply be looking for the highest possible return, while others may be looking for a solid income stream from dividends.

For the latter group, it is of utmost importance to determine whether a stock’s dividend is safe. Dividends can be cut due to underlying problems, which is not something income-oriented investors like to see and usually causes a stock to plummet. Therefore, it is often best to avoid these situations.

Let’s look at two stocks with ultra-high yields and super-safe dividends.

1. Altria Group

Tobacco giant Altria Group (NYSE:MO) has long been a favorite of income-oriented investors. The stock currently has a juicy yield of 9.6% and the company has consistently increased its dividend payout over the past 15 years.

When looking at the safety of a dividend, the first place to look is the company’s cash flow statement. The reason for this is that dividends are paid from a company’s free cash flow. If the dividend exceeds a company’s cash flow for an extended period of time, it is likely to be cut in the future.

For 2023, Altria paid $6.8 billion in dividends to its shareholders. Meanwhile, it generated free cash flow, that is, operating cash flow minus capital expenditures, of $9.1 billion. As such, the company paid around 75% of its cash flow for its dividend, demonstrating a high degree of coverage and giving the company room not only to maintain its current payout, but also to increase it in the future. Any number above 100% could indicate that a dividend cut could occur in the future.

The other important aspect to look at when it comes to the safety of a company’s dividend is its leverage, which is its net debt divided by its earnings before interest, taxes, depreciation, and amortization (EBITDA). The reason for this is that if debt levels become too high, companies could be forced to cut their dividends to pay down their debt loads. Altria ended 2023 with 2.2x leverage, which is solid given its free cash flow.

Last month, Altria also sold 35 million shares Anheuser-Busch InBev it owned for $61.50 per American Depositary Share (ADS). It then used the proceeds to buy back $2.4 billion of its own shares. The reduction in the number of shares will reduce the total cash Altria will pay out in dividends, improving its payout ratio.

Overall, Altria seems to have a super safe dividend.

2. Vector group

That is another tobacco share with an attractive return Vector group (NYSE:VGR), which sells cigarettes at a discount and owns a real estate portfolio. The share yields approximately 8.1%.

Looking at the same numbers as Altria, Vector paid $126.2 million in dividends in 2023. The company generated free cash flow of $199.4 million, meaning its payout ratio was just 63%. However, the company does invest in real estate, but even taking into account the $17.4 million in real estate investments made in 2023, its payout ratio was 69%, lower than Altria’s.

Looking at the balance sheet, Vector ended 2023 with a leverage of 2.6 times, taking into account its cash and investments in the holding company. That’s slightly higher than Altria but also solid.

Vector cut its dividend in 2020, but for good reason, as dividend payments exceeded operating cash flow.

For example, in 2019 the company paid $238.2 million in dividends but only had operating cash flow of $124.1 million. Dividend payments also exceeded cash flow over the past two years. That’s not something that’s sustainable, and with debt starting to rise, the company has decided to halve its quarterly dividend to 20 cents per share starting in the first quarter of 2020, where it has remained.

However, the dividend payout ratio and leverage are both in good places now. At the same time, the company has gained market share by expanding its deep-discount brand Montego to all US markets in 2021. This has helped to increase the market share from 4.1% in 2021 to 5.5% in 2023. Given Vector’s smaller size, the company has been gaining market share. it is also currently exempt from the 1998 Master Settlement between states and tobacco companies, giving it a cost advantage over larger players.

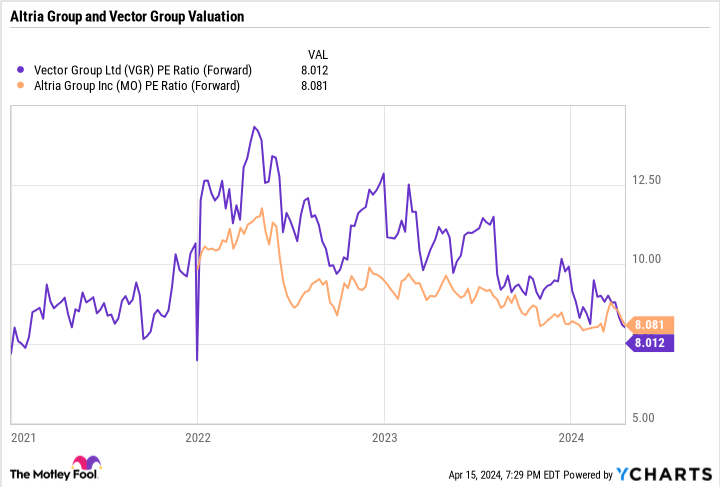

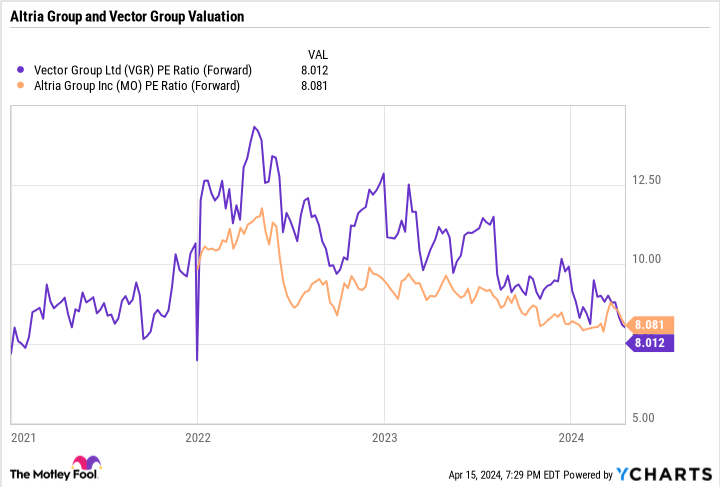

High yields at reduced prices

Both Altria and Vector trade around 8 times price-to-earnings (PE) ratios, which is historically cheap. Although stocks have struggled over the past year, their returns have risen to attractive levels. At the same time, both dividends seem very safe.

VGR PE ratio (forward) data according to YCharts.

Given their valuations and returns, this could be a good time for investors to jump into these two tobacco stocks. Both dividends are currently well covered and their balance sheets are solid.

Should You Invest $1,000 in Altria Group Now?

Consider the following before purchasing shares in Altria Group:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Do you want super-safe dividend income in 2024? Invest in the following two ultra-high yield stocks. was originally published by The Motley Fool