The fact that many investors are underperforming S&P500 is often a poorly understood part of investing. Although shares like Nvidia And Tesla have achieved huge returns that beat the market, countless others are underperforming the index, and some are losing value. Investors who can meet that index benchmark are therefore doing well.

However, some exchange-traded funds (ETFs) have beaten the S&P. Plus, they don’t have to buy shares in the hope of finding the next Nvidia. One of these ETFs focuses on semiconductor stocks, and given the asset mix, investors have a huge incentive to outsource the heavy lifting of investing to the managers of these funds.

What is this fund?

It is this market-beating fund VanEck Semiconductor ETF (NASDAQ: SMH). It includes 26 companies that together cover all aspects of semiconductor design and manufacturing.

VanEck founded this fund in December 2011 and its twelve-plus year history is long enough to encompass some of the cyclical downturns that have always plagued the sector, amplifying the fund’s strength.

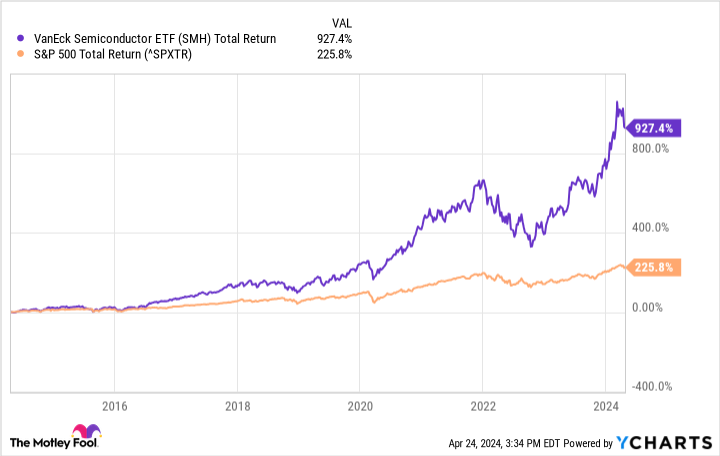

Furthermore, the sector has changed since 2011, with the growing importance of smartphones and the rise of chip technologies such as artificial intelligence (AI). That technological change has typically allowed the ETF to outperform the S&P 500 by a significant margin.

Of course, S&P 500 funds carry less risk because they invest in the 503 holdings across many sectors that mirror the S&P itself. Nevertheless, taking a gamble paid off in the case of the VanEck Semiconductor ETF. Over the past year, total returns have been nearly three times that of the index, reflecting a recent sell-off in chip stocks. If you pull the timeline back ten years, the VanEck ETF performs by an even greater margin.

Why the VanEck Semiconductor ETF is performing better

The secret to the ETF’s success (besides active, disciplined management) is likely its relatively aggressive investments in a small number of companies that increase user productivity.

Unsurprisingly, the largest holding is Nvidia, accounting for just over 20% of the fund. Nvidia dominates the market for AI-enabled chips, allowing it to post triple-digit revenue growth in recent quarters, a benefit that trickles down to VanEck shareholders.

The second largest position is that of Nvidia’s main manufacturer, Taiwanese semiconductor manufacturing. TSMC makes the most advanced chips in the world for its customers. Its market share of external production, which is 61% according to TrendForce, gives it enormous influence within the sector.

The third largest position in the ETF is Broadcom, at 8 o’clock%. Broadcom and other companies owned by the ETF, including Qualcomm, AMDAnd Intelare also major TSMC customers.

Moreover, VanEck’s investment discipline makes the fund demonstrably worth its costs. The annual ETF expense ratio is 0.35%, well above that of S&P 500 ETFs such as the SPDR S&P 500 ETF Trust And Vanguard S&P 500 ETF Trust. These funds charge expense ratios of 0.09% and 0.03% respectively.

Nevertheless, VanEck’s costs closely approximate the 0.37% average expense ratio identified by Morningstar in 2022. Given the significantly higher returns, these costs probably shouldn’t deter potential shareholders.

Consider the VanEck Semiconductor ETF

Ultimately, the VanEck Semiconductor ETF provides market-based returns without excessive costs or excessive risks. Granted, a fund with 26 stocks in one sector is riskier than a general fund with hundreds of stocks, like an S&P 500 ETF.

However, the chip industry has built a long-term track record of high returns, and the fund’s 26 stocks significantly reduce the risks associated with large stakes in individual companies. The VanEck Semiconductor ETF is therefore an investment where adding a little bit of risk could continue to yield significantly higher returns.

Should you invest $1,000 in VanEck ETF Trust – VanEck Semiconductor ETF now?

Consider the following before purchasing shares in VanEck ETF Trust – VanEck Semiconductor ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and VanEck ETF Trust – VanEck Semiconductor ETF was not one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

Will Healy holds positions in Advanced Micro Devices, Intel and Qualcomm. The Motley Fool holds positions in and recommends Advanced Micro Devices, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls to Intel and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

Do you want to outperform the S&P 500 with minimal risk? Buy this ETF. was originally published by The Motley Fool