Investors love their long-term gains, but short-term investors can’t handle volatility. And it’s that fear on the part of shorter-term investors, and especially those nearing retirement, that can potentially provide enormous opportunities for investors with a long-term mindset.

The best-performing sector in the market over the past decade offers such an opportunity. While many investors often stay away from this sector due to its extreme highs and lows, the sector has actually delivered superior long-term returns over the long term.

Don’t let the fearmongers and naysayers shut you out. The sector remains a long-term winner.

Toss in your chips

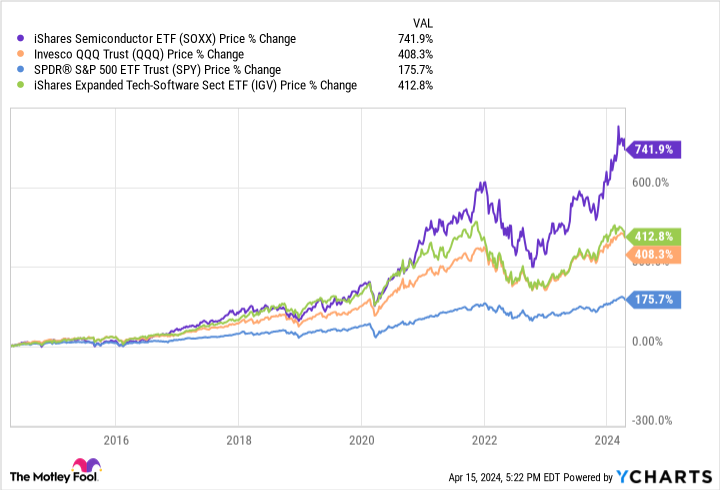

The sector in question is the semiconductor sector. Looking at the performance of a low-cost exchange-traded fund (ETF) that tracks the chip sector, the iShares Semiconductor ETF (NASDAQ: SOXX)one can clearly see how chip stocks in aggregate have crushed the broader market and even outperformed the overall technology and software sectors over the past decade.

The broader S&P 500 has increased in value by 176% over the past decade, providing long-term shareholders with handsome returns that well exceed the rate of inflation. Of course, the technology sector has developed much more strongly thanks to strong innovations in cloud computing, e-commerce, smartphone applications and now artificial intelligence (AI).

The tech heavy Invesco QQQ Trust (NASDAQ: QQQ), intended to closely mirror the Nasdaq 100, is up 408% in that time. Within the technology sector, the super-fast growing cloud software sector has driven growth iShares Comprehensive Tech-Software Sector ETF (NYSEMKT: IGV) an even higher 413%.

But all that pales in comparison to the semiconductor sector, which is up a whopping 742%! That’s almost double the return of the entire technology sector and more than 4.2 times the return of the broader market over the past decade.

Why many avoid the chip sector

In light of the semiconductor sector’s long-term outperformance, it may be surprising that many investors are shying away from this. After all, Warren Buffett had never bought a semiconductor stock until he bought it Taiwanese semiconductor manufacturing (NYSE: TSM) end of 2022, only to sell it all within two quarters due to geopolitical fears.

The refrain from many Buffett acolytes and value investors generally is that the chip sector is moving too fast, with the rapidly changing technology making long-term competitive advantages somewhat difficult to identify or harder for competitors to break.

There is some truth in this; after all, just see how Nvidia (NASDAQ: NVDA) and foundry partner TSMC have been overtaken Intel (NASDAQ: INTC), which just ten years ago was considered the undisputed champion of the sector. Now Intel has suddenly fallen far behind in a relatively short time and the company is trying to make an ambitious turnaround in order to survive.

But that’s the beauty of buying an ETF. With an ETF you bet on the long-term growth of the sector with a diversified mix of winners and losers. Ultimately, the winners rise to a positive, positive outcome.

How have semiconductors done? It’s more than just AI

As you can see in the chart above, the chip sector rose in value basically in line with the broader software sector for the first six years of the past decade, and only started to slightly outperform the Nasdaq around late 2020, when the chips started to come loose from the package.

Yes, the tech sector started to take off in earnest during the pandemic, as companies turned to cloud computing to keep their businesses afloat, and consumers bought new laptops and smartphones amid stimulus checks for the stay-at-home economy. This benefited software, the internet and semiconductors.

But in late 2020 and early 2021, the separation started to happen – even before ChatGPT’s thunderous debut in late 2022. Why was that?

I believe this was due to a renewed investor focus on stock valuations as inflation and interest rates started to pick up from lows. During that period, software valuations tended to be much higher than chip stocks because software is thought to be more of a stable, recurring subscription business and chip sales can fluctuate from year to year.

However, rising interest rates reduce the present value of profits well into the future. That tends to depress valuations of high-value stocks like software.

On the other hand, semiconductor stocks tended to trade at lower valuations, especially back then. Many chip leaders are also dividend payers and stock repurchasers in addition to their technology-driven growth. These shareholder returns only add to the industry’s long-term numbers.

And while semiconductors in general may not be growing as quickly as, say, cloud software, semiconductors are still holding their own when it comes to longer-term growth. While the industry can boom or bust in a single year, the overall industry is expected to grow at an annualized rate of 11.6% from 2023 to 2030, according to DataHorizzon Research.

So starting at a lower valuation and a lower hurdle may have been a key factor behind the sector’s outperformance as rates normalized.

It’s not just Nvidia

Of course, many will scoff at the sector’s rise as the work of Nvidia alone. A pioneer in graphics processing units (GPUs) needed for generative AI applications, Nvidia’s stock has soared over the past two years. And because AI is a potentially transformative technology for society and humanity, Nvidia has become the poster child for success.

But it’s actually not just Nvidia that’s driving profits in the sector. In fact, seven of the 10 best-performing S&P 500 stocks over the past decade are all in the semiconductor sector, including four of the top five.

Producing advanced chips with billions of tiny transistors is difficult, and previous cycles have allowed the chip industry to consolidate into a handful of exceptional companies with these unique technological capabilities. As such, it may not be a surprise that not one but a handful of stocks all participating in the AI chip design and manufacturing ecosystem would reap the rewards.

While the chip sector may not see the gains it has achieved over the past decade in the next decade due to higher starting valuations, our world only seems to become more automated, more intelligent, and more connected. All of that is powered by semiconductors. And that still makes this ETF a must-have for every ETF investor with a time horizon of more than 10 years.

Should you invest $1,000 in iShares Trust – iShares Semiconductor ETF now?

Before you buy shares in iShares Trust – iShares Semiconductor ETF, consider the following:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and iShares Trust – iShares Semiconductor ETF was not one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Billy Duberstein holds positions in Taiwan Semiconductor Manufacturing. His clients may own shares of the companies mentioned. The Motley Fool holds positions in and recommends Nvidia, Taiwan Semiconductor Manufacturing, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 relying on Intel and short May 2024 $47 relying on Intel. The Motley Fool has a disclosure policy.

This ETF Has Crushed the Markets and Even the Tech Sector: Don’t Let Fearmongers Keep You Out was originally published by The Motley Fool