Markets are once again starting the day with uncertainty and a lack of direction as investors digest Netflix’s earnings and cryptocurrency traders prepare for the bitcoin halving.

Netflix Inc. reported earnings after the bell on Thursday, and while the tech and media giant reported strong subscriber numbers, investors remained pessimistic after the company gave a weaker-than-expected forecast for second-quarter earnings. Netflix fell about 8% mid-morning Friday, dragging the tech-heavy Nasdaq with it.

Netflix was among the first of the mega-cap tech companies to report profits, and limping out of the gate on the weaker forecast hasn’t given investors the boost needed to shake off the recent market pullback.

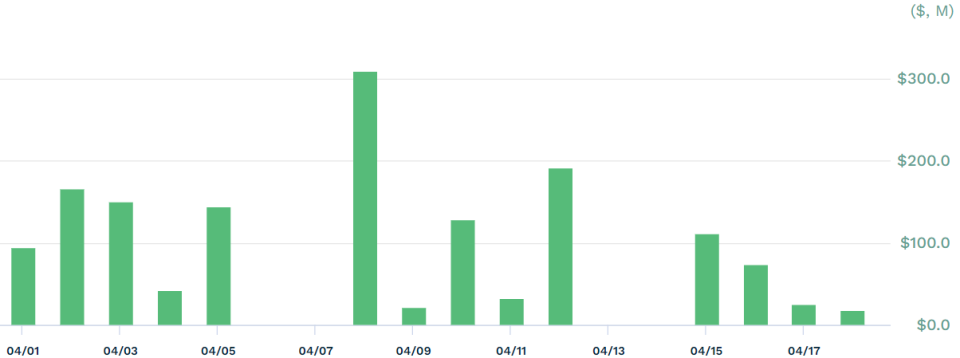

QQQ, the Invesco QQQ Trust which tracks the Nasdaq, fell 1% on Friday. QQQ saw outflows of more than $425 million on Thursday, according to data from etf.com.

QQQ April flows

Source: etf.com

XLK, the Technology Select Sector SPDR Fund had a hard time on Friday too. The fund does not own Netflix, but looks broadly at the technology sector as investors took into account the potential for disappointing technology revenues. Next week, investors will turn their attention to Meta, Alphabet (Google) and Microsoft.

SPIE, the SPDR S&P 500 ETF Trust was in the red Friday morning as the S&P 500 wobbled. DIA, the SPDR Dow Jones Industrial Average ETF Trust was the only index on Green Friday, as investors overlooked rising tensions between Iran and Israel.

Crypto ETFs are surging as Bitcoin’s halving approaches

And cryptocurrency ETFs took off on Friday. The increase comes as investors await Bitcoin’s long-awaited halving. BTOP, the Bitwise Bitcoin and Ether Equal Weight Strategy ETF was one of the biggest winners on Friday, according to data from etf.com. The GraniteShares 2x Long COIN Daily ETF (CONL)and the First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT) were also in green.

The event is, simply put, a time when the reward for bitcoin miners to create new bitcoin is halved. Halvings occur every four years and maintain the scarcity of bitcoin. Historically, events precede a rally in bitcoin prices. It is not certain exactly when a halving will occur, but traders expect the event to occur anytime between Friday and Sunday morning.

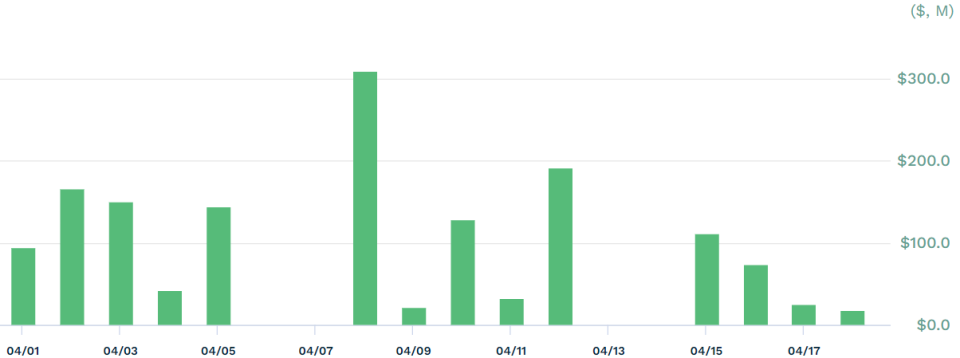

And the largest spot bitcoin ETF, IBIT, the iShares Bitcoin Trust rose almost 2% before the halving. According to data from etf.com, flows into the ETF have increased since early April, surpassing $1 billion in the past two weeks.

IBIT April flows

Source: etf.com

Many investors see the halving as a potential buying opportunity, hoping for a possible rise in bitcoin prices. But it is unclear whether this year’s halving will have the same effect since the launch of spot bitcoin ETFs, which have already fueled a surge in bitcoin prices.

Permanent link | © Copyright 2024 etf.com. All rights reserved