Investing in the stock market has been an incredible wealth-building tool for Americans for decades. Not all investments produce the same results. That’s why it makes sense for many investors to set aside part of your portfolio to invest in market-tracking index funds and exchange-traded funds (ETFs) and take advantage of the market’s overall rise.

Some investments in individual stocks have created millionaires, and others can still be valuable for balancing risk. If you had invested € 1,000 in it bank of America (NYSE: BAC) shares five years ago, where would it be today?

One of Buffett’s favorite stocks

Bank of America, or BofA, is the second-largest U.S. bank by assets and one of Warren Buffett’s favorite stocks. It accounts for 10.1% of it Berkshire Hathaway‘s stock portfolio, making it the second largest holding.

Buffett likes bank stocks, but BofA is his favorite. Banks have a lot of cash, which generally provides stability and allows them to finance businesses and loans and create the cycle of economic growth. It also funds dividends, which many banks pay, and which create shareholder value. Banks are generally not growth stocks, and the dividend makes them attractive for passive income.

The big reveal

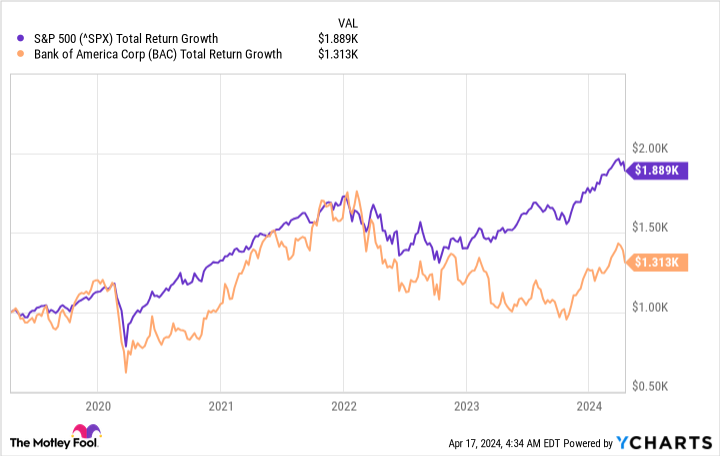

That leads to the answer to the main question, which could surprise investors. If you invested $1,000 in Bank of America stock five years ago, you would have $1,313 today, including dividends. That follows the S&P500 by a wide margin.

As you can see from the graph, the big difference is a recent development. At various points over the past decade, BofA stock has matched or even surpassed the broader market.

Five years may be a while, but a decade or more is where investors can experience the magic of compounding and the value of holding on to established blue chip leaders.

Not all banks are stable, as evidenced by the collapse of several medium-sized regional banks last year. That’s why Buffett likes BofA, which is big, safe and consumer-oriented. These factors lower risk and provide benefits beyond market performance.

Should You Invest $1,000 in Bank of America Now?

Consider the following before buying shares in Bank of America:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jennifer Saibil has no positions in any of the stocks mentioned. The Motley Fool holds positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

If you had invested $1,000 in Bank of America five years ago, this is how much you would have today. originally published by The Motley Fool