When my 94-year-old grandfather asks me about artificial intelligence (AI), as he did last week, I think it’s safe to say that AI is the most hyped trend in business and investing today. But so much attention can make expectations sky-high. And sky-high expectations often lead to overvalued stocks.

Unfortunately for investors, many companies overstate their AI capabilities; it’s so bad that the Securities and Exchange Commission (SEC) is starting to investigate false claims. The fakers clearly won’t make good AI investments. But legitimately good AI companies may also not be making good investments today because of their high valuations.

And that’s why today I want to put two lesser-known companies in the spotlight AppLovin (NASDAQ: APP) And Xometry (NASDAQ:XMTR). Both are legit AI stocks. But they are under the radar and possibly undervalued, making them much better buys right now.

1. AppLovin

AppLovin owns about 200 mobile games, and they generated revenues of more than $1.4 billion by 2023. But management doesn’t plan for this to be the long-term business model; the company is even open to selling these apps directly if it can find a buyer. Instead, it developed these apps to help collect data to train the AI models for its software business.

Businesses want users to be able to find, download and use their apps and they turn to AppLovin for help. The company’s AppDiscovery software product is powered by AI and the latest version was launched in 2023. Based on the sales growth, I’d say it was an overnight success story. In 2023, AppLovin’s software revenue rose 76% year over year to $1.8 billion.

What’s exciting is that AppLovin is experiencing this level of growth during a downturn in the mobile app economy. According to Statista, global mobile app spending reached $171 billion in 2023. In perspective, in 2021 this amounted to $170 billion. That’s why the space isn’t growing, but AppLovin is.

What’s also exciting is that AppLovin is still powering the AI models. Management hopes that things will only get better from here, leading to more discovery and revenue generation for its customers. And if it benefits its customers, it’s reasonable to expect it to take market share from the competition.

AppLovin’s software business has a higher margin compared to its app business. Therefore, the company’s profits increase with the growth of its software business. It had a net profit of more than $350 million in 2023, almost half of which came in the fourth quarter.

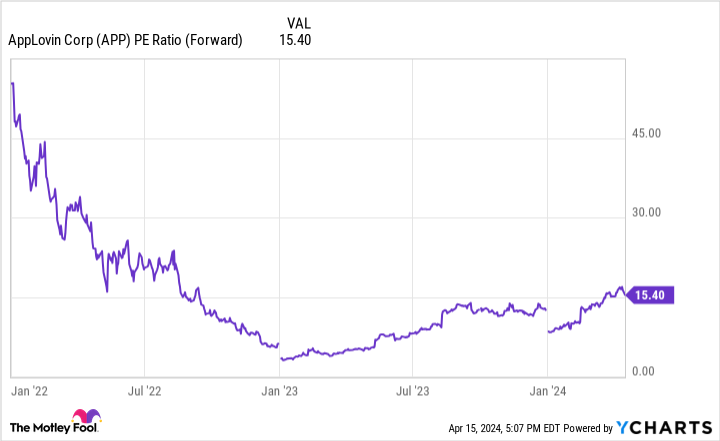

The fourth quarter results show that AppLovin has momentum when it comes to profitability and this trend is expected to continue. As a result, AppLovin shares trade at just 15 times forward earnings. That’s a reasonable valuation for an AI stock that’s thriving like this one.

2. Xometry

Xometry isn’t jumping on the AI bandwagon. On the contrary, the company’s entire business model was based on AI before it went public in 2021, and that was before the current AI trend really took off.

Xometry is in the manufacturing space: an estimated $260 billion global market opportunity that has historically been resistant to technological disruption. But the company hopes its AI software will change the game.

In short, Xometry has an online marketplace where people who need customization can get an instant quote. And the company’s AI offers buyers instant prices. The company then looks for third-party manufacturers willing to do the work at a lower price than what the buyers quoted. Xometry makes money with the spread.

It’s easy to see why the effectiveness of the AI software will make or break Xometry. If prices are too low, outside manufacturers will not want to take over the jobs. But if prices are too high, there won’t be much spread for Xometry to make money. The AI has to find the sweet spot.

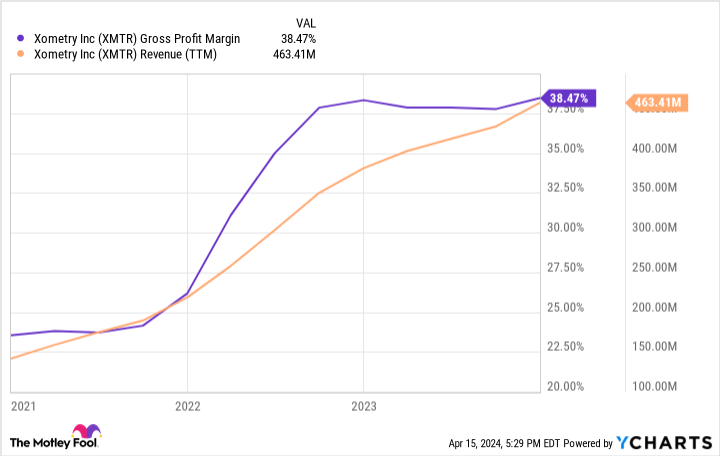

I’d say things are off to an encouraging start for Xometry. As the chart below shows, sales are continuously increasing and gross margin has improved. The latter indicates better prices for the AI software.

Xometry is poised to disrupt this lucrative market, and the financials suggest its AI software is increasingly up to the task. That alone is worth investors’ attention. But on top of that, the stock is trading at less than twice sales, which is quite cheap.

I believe AppLovin stock and Xometry stock could both be good buys today. But most of all, I hope readers will be encouraged. A trend can be exciting, but that doesn’t mean you should buy a stock that is fundamentally overhyped and overvalued. Better opportunities in a hot trend may lie just beneath the surface for those willing to dig a little.

Should you invest €1,000 in AppLovin now?

Consider the following before purchasing shares in AppLovin:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and AppLovin wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

View the 10 stocks

*Stock Advisor returns April 15, 2024

Jon Quast holds positions in Xometry. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Investors are chasing the biggest names in artificial intelligence. But these two lesser-known companies are AI stocks you can buy now. was originally published by The Motley Fool