Twenty years ago, a younger version of myself was strolling the streets of Buenos Aires looking for a place to eat. I finally found a promising place that sells milanesa de carne rolls for 2 pesos. I cannot exaggerate the bargain. It was an incredible sandwich and it only cost me about $0.66.

At the time, $1 was worth about three Argentine pesos. But today, $1 is almost worth it 900 pesos. In short, Argentine inflation has been brutal and damaging to the country’s economy for years, making life difficult for many hardworking Argentinians.

It is difficult for companies that also do business in Argentina, including publicly traded companies MercadoLibre (NASDAQ: MELI). The company now does business in several countries, including Brazil and Mexico. However, it was founded in Argentina and remains MercadoLibre’s third largest market today.

Inflation makes doing business complicated

There are several ways in which Argentina’s inflation impacts an international company like MercadoLibre, which reports financial results in dollars. Consider the company’s lending activities. Even if a loan is repaid on time at a good interest rate, each monthly payment in pesos is less valuable than the previous one because the currency quickly devalues against the dollar.

In addition, consider MercadoLibre’s local activities. Pesos are needed to do business on a daily basis. But the profits it makes today won’t go as far tomorrow. To maintain purchasing power, the country must switch to a more stable currency, such as the dollar. But pesos are needed to do business on a daily basis.

The Argentine central bank has been printing money at breakneck speed for years. According to the International Monetary Fund, from 2012 to 2022… smallest the annual increase in the money supply was 26%. And it has even been 85% – almost doubling in one year.

Inflation is a headwind blowing hard against MercadoLibre’s Argentine operations. The situation was bad, largely due to uncontrolled money printing. However, after decades of problems, the winds may finally be turning.

A new economic direction for Argentina?

In November 2023, political outsider Javier Milei won Argentina’s presidential elections, promising economic reforms. In response, a group of more than a hundred economists wrote an open warning letter. They wrote that Milei’s economic proposals are “likely to cause more real-world destruction in the near term.”

There is beginning to be reason to question the economists. The Argentine government has just achieved its first surplus in sixteen years, and monthly inflation has fallen below double digits for the first time in six months. Granted, the Milei government has laid off government workers, and the economy is likely to slide further into recession. But the changes are already going better than expected.

The International Monetary Fund is apparently optimistic about what it sees in Argentina, as it just released an $800 million payout to the country after a review of the economy.

At a later date, Argentina could even adopt the US dollar as its official currency, eliminating the persistent devaluation of the peso against the dollar. This would also help ensure that MercadoLibre does not lose money due to fluctuating exchange rates, as is regularly the case.

What to do now if you’re considering MercadoLibre

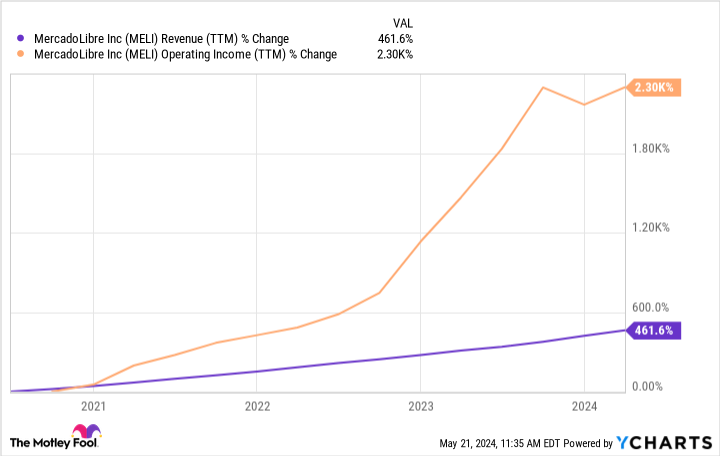

Even with the massive inflation headwinds blowing against it – not just in Argentina but elsewhere – MercadoLibre continues to show incredible growth. The logistics network drives the adoption of e-commerce and digital financial services are in high demand. Furthermore, the company’s operating income increases as sales grow.

It is still very early in Milei’s presidency. Therefore, it is entirely possible that the current bright spots in the economy will be short-lived and that the aforementioned economists will be proven right.

But even if that is the case, the Argentine market has fallen to around 14% of MercadoLibre’s total sales in the first quarter of 2024. This has consequences, but the company would not be destroyed if the Argentine economy were to collapse drastically. The company would still have strong results in Brazil, Mexico and elsewhere to fall back on.

That said, it’s worth noting that key people already believe Argentina’s turnaround. Among them is billionaire Stanley Druckenmiller, who, thanks to Milei’s economic policies, has started investing in Argentine companies. Investors who are optimistic about Argentina’s long-term economic prospects are in good company.

MercadoLibre doesn’t necessarily need a booming Argentine economy to be successful; it has been proven for years that it can withstand headwinds. However, if this turns around in the coming years, it could be a good thing for the company and the company’s shareholders.

Should you invest $1,000 in MercadoLibre now?

Consider the following before purchasing shares in MercadoLibre:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Jon Quast has positions in MercadoLibre. The Motley Fool holds and recommends positions in MercadoLibre. The Motley Fool has a disclosure policy.

Is one of MercadoLibre’s strongest headwinds finally turning into a tailwind for the stock? was originally published by The Motley Fool