It happens regularly every April, but investors still like to see it Procter & Gamble (NYSE:PG) announce its new dividend every year.

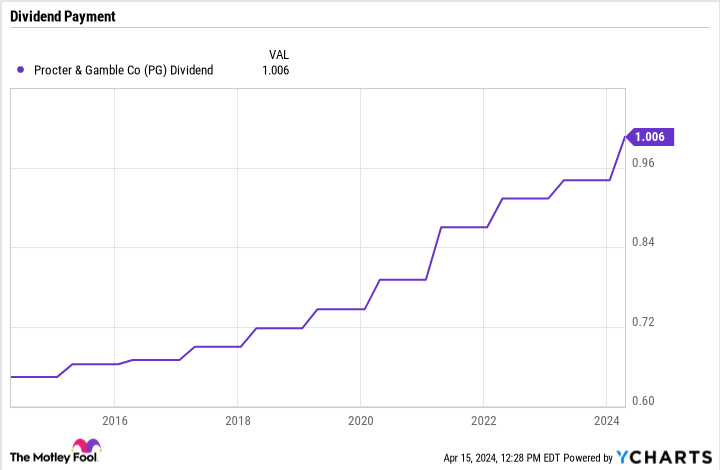

The consumer goods giant has one of the longest payout-raising streaks in the market, with dividends rising in each of the past 67 consecutive years. And P&G has been sending out dividend checks since it was founded in the 1890s, which is to say the 1890s.

The raise management announced for 2024 is more generous than investors have seen in recent years. It’s just one part of a generous capital return program that also includes heavy share buyback spending. Let’s take a look at P&G’s new payout and whether it makes the stock more attractive today.

The growth challenges

P&G hasn’t shown impressive growth in recent quarters. Sales volumes have even turned negative over the past year. This slump coincided with slower price increases, causing organic growth to fall to just 5% in the second quarter, compared to 7% in the previous quarter. Most investors are bracing for more weakness ahead as full-year 2024 revenue increases fall below that 5% mark.

P&G is facing several issues that could hinder revenue growth in the coming quarters. For example, consumers are shifting their spending habits back to pre-pandemic norms. And easing inflation is taking the tailwind off the higher prices that have driven sales higher for most of the past two years. The company also has competition problems with the Gillette shaving brand.

The good news is that the company is still outgrowing its peers Kimberly Clark (NYSE: KMB), indicating that P&G’s market share is holding up well in a tough sales environment. And slower growth hasn’t hurt earnings prospects. Instead, the company expects a higher profit margin and accelerated earnings growth in fiscal 2024. These positive factors help explain why management felt confident about increasing the dividend this time around.

The new dividend

The new dividend, which will arrive in investors’ portfolios from the end of April, rose to over $1 per share, representing a 7% increase over the previous payment. That is more than double the percentage increase compared to 2023, when P&G increased its dividend by 3%.

P&G can afford it as its profit margin returns to a pandemic-era high of 24% of sales. The company converts almost all of its earnings into free cash flow, meaning it can spend more on its dividend while delivering additional cash to shareholders through share buybacks. Expect $15 billion in spending in these categories by 2024.

Keep an eye on stock

P&G’s new dividend yields about 2.4% based on current share prices. That’s about a full percentage point higher than you’d get if you owned the broader market through a S&P500 index fund that yields about 1.4%, but an income investor can earn better returns elsewhere in the consumer staples sector. Rival Kimberly Clark, which isn’t as profitable and isn’t growing revenue as quickly, is fetching almost 4% today.

P&G is valued at a high premium of nearly five times sales, or more than double what Kimberly Clark fetches. As a result, it’s not worth buying P&G just for the dividend, and the stock seems expensive too. That’s why income investors may want to look at Procter & Gamble for now and wait until a market downturn might offer a better purchase price for this successful consumer goods giant.

Should You Invest $1,000 in Procter & Gamble Now?

Before you buy shares in Procter & Gamble, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Procter & Gamble wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $526,933!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Demitri Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is Procter & Gamble’s new dividend too good to pass up? was originally published by The Motley Fool