So far this year, stock markets are riding high, with both the S&P 500 and NASDAQ trading just below their all-time highs. However, the picture may not be all roses and moonshine.

Chief investment strategist Paul Dietrich forecasts the markets from B. Riley Wealth Management, predicting a mild recession in the US this year – but also a decline in the S&P index of up to 44%. Dietrich is known for advising his clients to get out of stocks ahead of recessions and market downturns in 2000 and 2007.

Summarizing his attitude to current conditions, Dietrich said: “Despite the fun and excitement of participating in the current Mardi Gras-like stock market bubble, which is completely disconnected from any stock fundamentals, suppose an investor spends most of could miss a drop of 49% or 57%. in the S&P 500 index and then return to the stock market when leading economic indicators and long-term moving averages indicate the recession is over.”

This is a recipe for a defensive portfolio stance, and some Wall Street analysts are currently recommending dividend stocks as solid buys. Div stocks are the classic defensive strategy in a tough investment environment – and for investors looking to earn up to a 13% dividend yield, the analysts suggest two dividend stocks in particular. Let’s take a closer look at that.

Annaly Capital Management (NLY)

We’ll start with Annaly Capital Management, a real estate investment trust (REIT) focused on residential real estate and mortgage-backed securities. The company is a leader in the mREIT segment, with a market cap of $9.45 billion and approximately $11 billion in permanent capital. Annaly has an investment portfolio totaling $73.5 billion, and of that total, approximately $64.7 billion is held in the company’s “highly liquid” Agency portfolio segment.

In addition to its extensive Agency portfolio, Annaly also has major investments in home loans and mortgage servicing rights. The largest of these two segments is the Residential Credit portfolio, valued at $6.2 billion, while the Mortgage Servicing Rights portfolio contains $2.7 billion in assets. These portfolio valuations are current as of the company’s March 31 financial report for the first quarter of 24.

Also in its recent first quarter financial release, Annaly reported GAAP net income of 85 cents per share. The non-GAAP figure for earnings available for distribution was 64 cents per share, down one cent year-over-year. The company generated an economic return of 4.8% in the first quarter and ended the quarter with a book value of $19.73 per share, above the $19.44 reported value for the previous quarter.

On the dividend front, we see that Annaly announced a regular payment of 65 cents per common share on March 14, for a payout today (April 30). This will be the fifth consecutive quarter with a dividend at this level, which annualizes to $2.60 per common share and delivers a forward yield of almost 13.6%, well above the current inflation rate.

In Annaly for Compass Point, analyst Merrill Ross takes a deep dive into the company’s first-quarter portfolio performance, noting: “The driving force behind the improvement in investment portfolio returns (from 4.55% in 4Q23 to 4.88% in 1Q24) the low-yield run-off was investing in the current coupon of 6.25%. The NIM contracted from 158 basis points to 143 basis points in Q1-24, but we expect it to widen from there as investing in short-term coupon assets outweighs the increase in swap-adjusted financing costs as rates remain higher for longer. Unlike its peers, NLY allocates capital at the margin more heavily to home loans and low-coupon MSRs, but is not afraid to miss the positive impact on BVPS (book value per share) that would result from continued spread tightening at staffing agencies. MBS, which accounted for 58% of its equity allocation at the end of the period.”

To reach her conclusion, Ross goes on to say: “We have adjusted the quarterly progression for the remainder of the year to a more moderate pace and have removed any Fed easing from our model. Barring any unexpected exogenous events that could cause volatility, we believe NLY will deliver positive total returns over the next three quarters, creating value through stable dividends and modest increases in BVPS.”

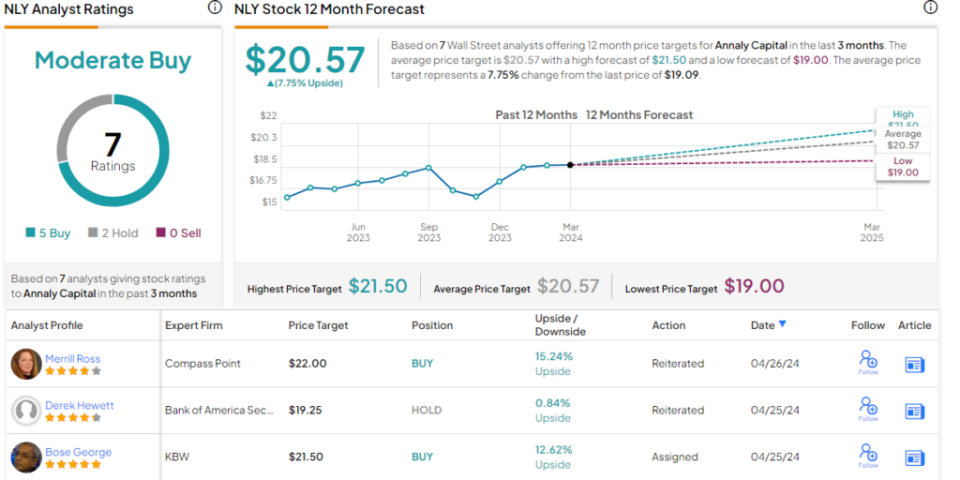

Ross quantifies her view with a buy rating on the stock, with a $22 price target implying a 15% upside for the coming year. Added to the dividend yield, the total return on this share could be more than 28% over the next twelve months. (To view Ross’ track record, click here)

Overall, Annaly gets a Moderate Buy rating from the analyst consensus, based on seven recent ratings, including five Buy and two Hold ratings. The shares are trading at $19.09 and the average price of $20.57 suggests the stock has an 8% upside potential one year from now. (To see NLY stock forecast)

Delek Logistics (DKL)

From a REIT, we will shift our focus to the energy sector where Delek Logistics owns, acquires, builds and operates a broad range of assets for the storage, transportation, distribution and marketing of crude oil and refined products. The company operates in the southern US and its asset map extends from Texas and Louisiana to Oklahoma, Arkansas and Tennessee.

On the hydrocarbon side of the business, Delek’s refinery operates four domestic refineries in Texas, Louisiana and Arkansas, which can maintain a throughput of 302,000 barrels per day. The company’s logistics system handles storage, transportation and distribution activities. In addition, Delek is known as a supplier of asphalt technologies and materials, produced in 7 facilities in the company’s network.

Delek’s hydrocarbon activities make up the bulk of the company’s business, but the company is also heavily involved in the production of renewable biodiesel. Delek operates three biodiesel plants, with a production capacity of approximately 40 million gallons per year.

Delek’s last public quarterly financial report came out in February and covered the fourth quarter of 23. In that quarter, Delek totaled $254.15 million in net revenue, missing forecast by $24.1 million and year-over-year -year decreased by 5.5%. Ultimately, the company posted net income of $22.1 million, which equates to 51 cents per diluted common share. The figure last year was 98 cents per share, and analyst expectations were 85 cents; the large profit loss was attributed to higher interest expenses and a goodwill impairment recorded in the quarter. In another interesting metric, the company generated quarterly free cash flow of $64.57 million, up more than 25% year over year.

On the dividend front, on April 25, Delek announced a $1.07 common stock payment for the first quarter of 24. This represents a 4.4% increase annually, and the $4.28 annualized payment provides a yield up from 10.8%. The dividend will be paid on May 15.

This stock has caught the attention of Neal Dingmann, a five-star analyst and energy sector expert from Truist Securities. Dingmann sees plenty of reason for investor optimism about Delek, especially the company’s estimated free cash flow and dividend yields. He writes: “We believe Delek Logistics Partners units have a substantial advantage due to a combination of stable, high-margin affiliate activity coupled with growing third-party activity with improving margins. We predict that the partnership will generate significant, incremental free cash flow from the strategic business combination. We estimate a 2025 FCF return of ~8% and a distribution return of ~12%. Our PT is based on an EV/’25EBITDA multiple of ~9.0x; all are among the best in their peer group… Furthermore, we believe that an upcoming rebalancing of the indices could drive additional unit price growth.”

These comments support Dingmann’s buy rating on DKL, while his $46 price target indicates room for 16% upside over one year. Together with the high dividend yield, this share is on track to achieve a return of almost 27% over a period of one year. (To view Dingmann’s track record, click here)

Delek shares have only received two recent analyst ratings, but they are both positive, giving the stock a Moderate Buy consensus rating. The shares are selling for $39.63, and the average target price, $45.50, implies they will see a gain of 15% over the next year. (To see DKL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.