Nike (NYSE: NKE) reports quarterly earnings on a different schedule than most publicly traded companies, and the updates often give the market a glimpse into what’s happening in the retail industry before other earnings announcements. Because Nike has such a strong presence in the retail industry, its performance can be a harbinger of things to come. In late 2021, for example, it was Nike that provided some of the first indications of the supply chain crisis that eventually hit retailers and roiled the economy.

It is therefore not surprising that investors have also become pessimistic about other companies after Nike’s worrying report at the end of June. Lululemon Athletics (NASDAQ: LULU)One of Nike’s biggest challengers in recent years, has shown resilience and has not changed its outlook, but its shares are down 17% since Nike’s update. Is there anything to worry about? Or is Lululemon sending a big buy signal?

Is what’s bad for Nike also bad for Lululemon?

Nike’s update for the fiscal fourth quarter of 2024 (ended May 31) had two sides. One was negative news related to its own business, and the other was negative news related to retail in general. Most of the issues were related to its own business, but management cited “macro uncertainty” as a lingering issue. Nike has been particularly affected by ongoing pandemic-driven issues in China, where it has had heavy promotional activity to sell inventory. It has a broad strategy that focuses on several areas to drive higher sales and expand its margins.

This is a tough time for Nike, which is attracting interest from a broad spectrum of demographics. Inflation is causing mass consumers to reduce their spending and potentially switch to lower-priced brands, while affluent customers may be swayed by new, premium brands like the fast-growing Pending or by athlete-focused brands such as Brooks (owned by Berkshire Hathaway).

But is this a new signal of what awaits other major sports brands?

Is there something wrong?

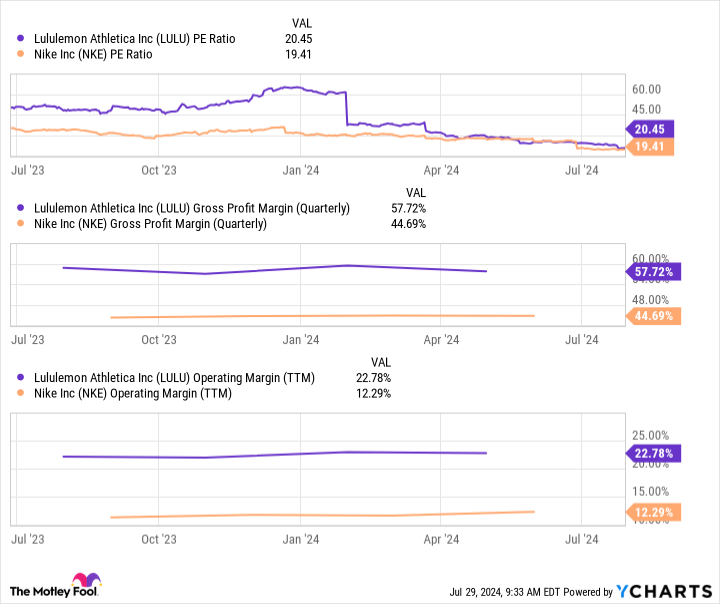

Lululemon’s most recent update was for its fiscal first quarter of 2024, which ended April 28, a period similar to Nike’s fourth quarter. Revenue rose 10% year-over-year, and the company enjoyed a 0.2-point increase in gross margin to 57.7%. Operating margin fell 0.5 points, but earnings per share rose to $2.54 from $2.28. All in all, it was a good quarter.

Management cited some of its own struggles in the quarter. It said business got off to a slow start due to several missed opportunities related to colors in women’s apparel and handbags, as well as limited selection and low inventory in some of its core products. However, company executives felt they had the situation under control and were correcting it. The market did not object to management’s update, and Lululemon stock held steady after the report.

Lululemon has a few things going for it that Nike doesn’t. For example:

-

The company is not yet very successful internationally and is growing faster there than in the US. International sales increased by 35% compared to the previous year. Generating higher international sales is an integral part of the growth strategy.

-

The brand is also positioned and priced as a premium brand that has more presence in the market than Nike, and its wealthier target audience is more resilient despite inflation.

Recently, however, Lululemon provided another update on a product issue. The company is halting sales of a new line of products featuring a fabric called Breezethrough because customers find the designs unflattering. (I should note, in Lululemon’s favor, that the product wasn’t released until early July.) That’s a pretty swift response to consumer feedback. It’s not the first time Lululemon has made a misstep with a new product, but the company recovered then and should recover now.

This, combined with previous product issues and the dynamic operating environment, caused analysts on Wall Street to downgrade their ratings and Lululemon to plummet further.

Is it time to buy Lululemon stock?

At its current price, Lululemon shares are trading at a price-to-earnings ratio of 20, nearly as low as Nike’s (and near a 10-year low), despite the fact that the company is growing much faster, has a stronger direct-to-consumer business, and has much higher gross and operating margins.

Lululemon appears to be in a strong position right now and at its current price, it could be considered a bargain. Investors should go in with an open mind and understand the context in which Lululemon is currently operating — I don’t want to minimize the challenges. However, it performs well under pressure and has many of the advantages you’d want in a great long-term investment.

There’s a chance that Lululemon stock could fall further, and that will happen if the company doesn’t meet Wall Street’s expectations in its next quarterly update. But you can’t time the market, and if the company does meet its guidance, the stock will rise again. As long as you can handle some potential near-term volatility, now is a good time to buy Lululemon stock.

Should You Invest $1,000 In Lululemon Athletica Now?

Before you buy shares in Lululemon Athletica, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Lululemon Athletica wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $669,193!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 29, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway, Lululemon Athletica and Nike. The Motley Fool recommends On Holding and recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.

Lululemon Stock Flops After Nike News: Why Now Could Be a Great Time to Buy was originally published by The Motley Fool