-

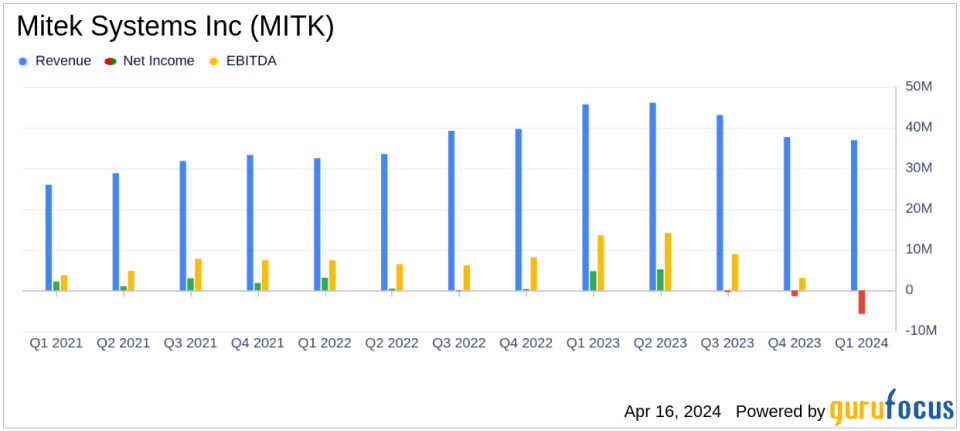

Gain: First quarter revenue of $36.9 million, down from $45.7 million year-over-year, missing the $39.02 million estimate.

-

Net income: GAAP net loss of $5.8 million, compared to net income of $4.7 million last year, which differs from the estimated net income of $8.33 million.

-

Earnings per share (EPS): GAAP earnings per share were negative $0.13, compared to $0.10 last year, while non-GAAP earnings per share were $0.14, below the estimate of $0.18.

-

Cash flow: Negative operating cash flow of $9.5 million, impacted by significant taxes paid and final earnout payments.

-

Accompaniment: Full-year repeat revenue guidance of $180.0 million to $185.0 million and non-GAAP operating margin between 30.0% and 31.0%.

On April 15, 2024, Mitek Systems Inc (NASDAQ:MITK), a leader in digital identity and fraud prevention, published its 8-K filing, detailing financial results for the first quarter ended December 31, 2023 and preliminary revenue results were provided. for the second quarter ended March 31, 2024. Despite a challenging year-over-year comparison due to a major one-time revenue event, the company remains confident in its growth trajectory and has reiterated its guidance for fiscal 2024.

Corporate overview

Mitek Systems Inc is known for its innovative software solutions in mobile imaging, artificial intelligence and machine learning, serving more than 7,800 financial services companies and leading brands worldwide. Mitek’s Mobile Deposit and Mobile Verify are crucial for enabling secure and convenient digital transactions, while CheckReader provides efficient data extraction from check images across multiple channels.

First quarter achievements and challenges

The first quarter of fiscal 2024 was a difficult comparison to the previous year, as the first quarter of last year saw a large one-time, multi-year reorder of mobile deposits. This resulted in a year-over-year revenue decline from $45.7 million to $36.9 million. GAAP operating margin turned negative to 19%, a stark contrast to the 18% positive operating margin a year ago. GAAP net loss was $5.8 million, or negative $0.13 per diluted share, compared to GAAP net income of $4.7 million, or $0.10 per diluted share, in the prior year. Non-GAAP numbers were more encouraging, with non-GAAP net income of $6.3 million, or $0.14 per diluted share.

The company faced challenges including the aforementioned revenue increase over the previous fiscal year and negative cash flow from operations, heavily impacted by cash taxes paid for fiscal year 2023 and a final ID distribution for research and development. These factors are critical because they can impact the company’s ability to invest in growth initiatives and erode investor confidence.

Financial performance and importance

Despite the setbacks, Mitek’s reaffirmation of its full-year revenue guidance of $180.0 million to $185.0 million, with an expected non-GAAP operating margin of 30.0% to 31.0%, provides confidence in its business model and future prospects. The company’s growth engines, using advanced AI and machine learning, are expected to increase trust and convenience in digital interactions, which are crucial in the software industry.

Key financial metrics and their importance

Key financial figures from the earnings report include a decrease in total cash and investments to $123.9 million, compared to $134.9 million at the end of the previous quarter. This metric is critical because it reflects the company’s liquidity and ability to finance operations and strategic initiatives. The balance sheet remains robust, with total assets of $405,390 million, maintaining stability compared to the previous quarter.

Comment from the CEO

With our fiscal year 2024 guidance, which we reiterate today, we expect our deposit product revenue to grow 10 to 12% year-on-year on a normalized basis, and our Identity product revenue to grow year-over-year 10 to 12% will grow. We expect much of this growth to occur in the second half of the fiscal year, and for growth to continue into fiscal year 2025,” said Max Carnecchia, CEO of Mitek.

Looking forward

Mitek’s preliminary revenue estimates for the second quarter range from $46 million to $47 million, indicating a potential recovery and a positive outlook for the remainder of the fiscal year. The company’s continued investments in new products such as Check Fraud Defender, MiVIP, MiPass and ID R&D biometrics software products position the company to take advantage of market opportunities and meet evolving customer needs.

For detailed financial tables and a complete reconciliation of GAAP to non-GAAP net income and operating income, investors are encouraged to review the full 8-K filing.

Value investors and potential GuruFocus.com members can find more in-depth analysis and current information on Mitek Systems Inc (NASDAQ:MITK) by visiting GuruFocus.com.

Check out Mitek Systems Inc’s full 8-K earnings release (here) for more details.

This article first appeared on GuruFocus.