Uncertainty is the word of the day when it comes to the short-term economic future. Sentiment will depend on the inflation figures to be announced next week. The March figure rose to 3.5%, and the April jobs figures showed a clear slowdown in the labor market; that combination has fueled fears of stagflation.

But first-quarter corporate earnings beat expectations, and the stock market has taken a positive turn, with the S&P 500 closing just below 5,200 yesterday. Economic strategists are still optimistic that the Federal Reserve will cut interest rates later this year.

So there is business to be done right now for both the bears and bulls, making the environment ripe for smart stock picking.

With this in mind, Morgan Stanley analysts are zeroing in on two stocks in particular, arguing that they are well positioned to deliver strong returns over the next year – in one case as high as 110%.

Using the TipRanks platform, we looked up the big picture of both choices and it appears the rest of the Street agrees with the MS’s view. Both are rated as ‘Strong Buys’ by analyst consensus. Here are the details, with commentary from Morgan Stanley’s analysts.

Auna SA (AUNA)

We’ll start in the healthcare sector, where Auna is a leading provider of healthcare services in many of the Spanish-speaking countries in Latin America. Auna’s presence is particularly strong in Mexico, Colombia and Peru, and the company has built one of the largest – and most modern – healthcare networks in Latin America.

If you look at the numbers, Auna is impressive. The company operates 31 healthcare facilities with a total of 2,308 hospital beds and employs approximately 14,900 people within its network. Auna boasts 1.3 million subscriptions, a strong customer base and generates approximately $1 billion in annual revenue. The company uses a patient-centered model that encourages preventive care and focuses its resources on treating “highly complex diseases.”

The company went public on the New York Stock Exchange in March this year, through an initial public offering that saw 30 million Class A shares floated at $12 each. The offering generated $360 million in gross proceeds. In financial disclosures related to the public offering, Auna reported that 2023 revenues totaled $1.05 billion, while adjusted EBITDA stood at $223 million. These totals rose sharply year-over-year, by 58% and 90% respectively. Auna is the first Latin American healthcare provider to go public on Wall Street.

In his report on these new public shares, Mauricio Cepeda sees several paths to expansion for Morgan Stanley. He writes about Auna: “We see Auna expanding profits in 2024 on three key fronts: (i) the increase in hospital occupancy in Monterrey, from 42% to 47%, increasing the company’s total EBITDA by 11% ( +PEN 88 million) given the relevance of the Mexican operation; (ii) further maturation of the operations in Peru and Colombia, and (iii) a deleveraging effect due to strong operating costs with little capital investment (organic phase). Additionally, we see growth opportunities in the coming years that could justify strong multiples, particularly the ability to introduce healthcare plans in Mexico (mimicking the success in Peru) and the ability to continue growth in Monterrey (which could be an asset in the area of nearshoring). ”

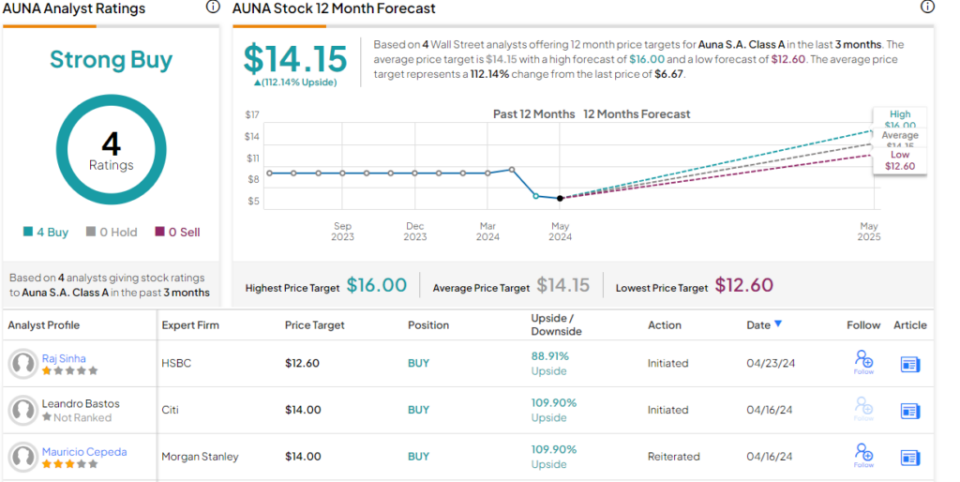

Cepeda’s views support his Overweight (Buy) rating on the stock, and his $14 price target points to a robust 110% upside potential over the next twelve months. (To view Cepeda’s track record, click here)

Overall, it’s clear that Wall Street likes this new stock; AUNA stock has received four recent analyst ratings in a short time on the public markets, and those ratings are all positive – for a unanimous Strong Buy consensus rating. The stock is priced at $6.67, and the average price target of $14.15 is slightly more bullish than MS recommendations, suggesting a 112% upside for the coming year. (To see AUNA stock forecast)

Contineum Therapies (CTNM)

Next up is Contineum Therapeutics, a San Diego-based biopharmaceutical company engaged in clinical research for indications in neuroscience, inflammation and immunology. The company is developing novel small molecule therapeutics that can be used as an oral dose treatment for neuroinflammatory diseases. This is a class of disease conditions with high unmet medical needs – that is, current treatment options are not considered sufficiently effective, and the field is wide open for a biotech company that can create new treatments.

Contineum currently has two drug candidates in its research program, PIPE-791 and PIPE-307. The first is a wholly owned business and the second is being developed in partnership with Johnson & Johnson. Each drug candidate showed promise in early testing, and each drug candidate currently has two clinical programs in progress or in preparation.

PIPE-791 is a small molecule antagonist of the lysophosphatidic acid-1 receptor (LPA1R) and is being developed as a potential treatment for two conditions: idiopathic pulmonary fibrosis (IPF) and progressive multiple sclerosis (MS). The drug is currently undergoing a phase 1 trial for the treatment of IPF; The results of this study, conducted in healthy volunteers, will be used to support Phase 1b trials in both IPF and progressive MS.

In the PIPE-307 pathway, Phase 1 studies in healthy volunteers have been completed and the company has initiated a Phase 2 study into the treatment of RRMS. This drug candidate, like -791 above, also has potential for a second indication, namely for the treatment of depression. PIPE-307 is another small molecule compound and is a selective inhibitor of the muscarinic type 1 M1 receptor (M1R).

Moving drug candidates from early clinical testing into more advanced trials isn’t cheap, and Contineum held an initial public offering in April this year to raise money. The company put 6.9 million shares on the market at an initial price of $16 each; this was a downgrade from the original filing, which called for the sale of 8.8 million shares priced between $16 and $18. In that event, Contineum raised $110 million in gross proceeds.

This company has caught the attention of Morgan Stanley analyst Jeffrey Hung. The five-star biotech expert sees -791 as the key point for investors to watch, but is also bullish on PIPE-307. He writes of CTNM: “PIPE-791 has the potential to be best in class… While Contineum’s data is relatively early, we are encouraged by the company’s preclinical data that suggest PIPE-791 is ~30x more potent in reducing LPA-induced collagen. production than BMS-986278. We believe that the increased receptor exposure of PIPE-791 at low doses due to its high oral bioavailability and low plasma protein binding could help improve its safety profile… For PIPE-307, the M1R antagonism has been clinically validated in both depression and RRMS, and the collaboration with JNJ further confirms Contineum’s approach.”

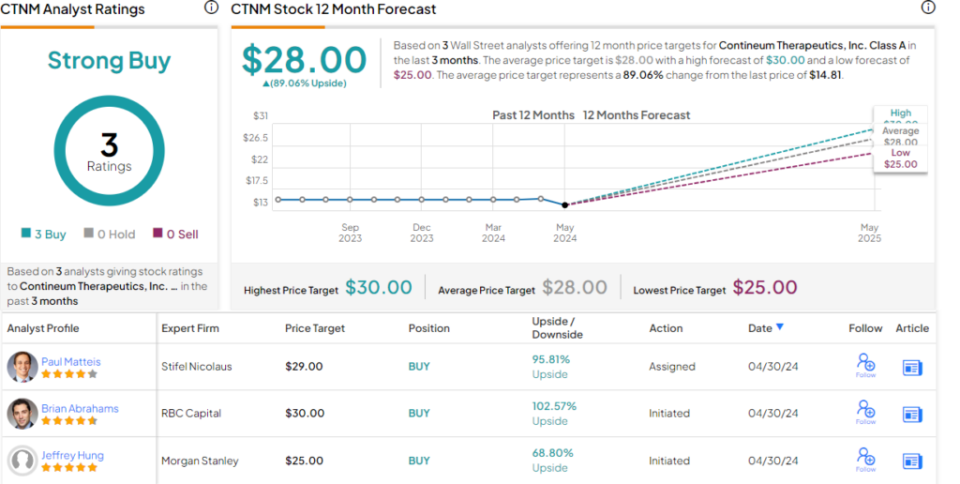

Hung then gives an Overweight (Buy) rating to this stock, and he supplements that with a $25 price target, suggesting the stock has a 69% upside potential over one year. (To view Hung’s track record, click here)

This is another stock with a unanimous Strong Buy consensus rating, based on three recent positive analyst ratings. Contineum shares are priced at $14.81 and have an average price target of $28, implying strong upside potential of 89%. (To see CTNM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is very important to do your own analysis before making an investment.