Volatility is a given when you put your money to work on Wall Street. While the major stock indexes have a long track record of long-term value appreciation, we have been through two bear markets since the start of this decade.

When the going gets tough on Wall Street, investors – including members of Congress – often turn their attention to proven, industry-leading companies that offer a rich history of outperformance. While the “FAANG stocks” are a perfect example of what I’m talking about, it’s the companies that implement stock splits that investors (and lawmakers) are attracted to.

Investors (including lawmakers) are turning to stock splits en masse for good reason

A ‘stock split’ is an event that allows a publicly traded company to change its share price and the number of shares outstanding by the same magnitude, all without any impact on its market capitalization or operating performance. It’s a purely cosmetic maneuver that can make a company’s shares nominally more affordable to ordinary investors, as in a forward-stock split, or increase a company’s stock price to secure its listing on a major stock exchange, as would happen in a reverse stock split. -stock split.

By all accounts, most investors tend to focus on companies that implement forward splits. While there are select cases where reverse split companies have become phenomenal investments (perhaps none more so than an online travel booking site Bookings of holding companies), companies that implement forward stock splits are typically firing on all cylinders from an operational perspective.

Since mid-2021, nearly a dozen high-profile companies have completed or announced a forward split. Among the most prominent of these companies are e-commerce giants Amazon (NASDAQ: AMZN)internet search giant Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG)and the North American lead for electric vehicles (EV). Tesla (NASDAQ: TSLA). Amazon and Alphabet respectively implemented a 20-for-1 stock split, while Tesla completed a 3-for-1 forward split.

What these companies have in common are easily identifiable competitive advantages that have helped them perform better over longer periods of time.

-

Amazon accounted for nearly 38% of estimated U.S. online retail sales in 2023. But more importantly, it is the parent company of Amazon Web Services (AWS), the leading global cloud infrastructure services platform. Although AWS accounted for “only” a sixth of Amazon’s net revenue last year, it generated two-thirds of the company’s operating revenue.

-

Alphabet’s Google gobbled up a whopping 91% of the global Internet search share in March and has gone less than a month without securing at least a 90% share of the global Internet search share in nine years. It is also the parent company of YouTube, the second most visited social site in the world.

-

Tesla is the first car manufacturer to successfully build itself from the ground up to mass production in over half a century. The company produced nearly 1.85 million EVs last year and is the only pure EV manufacturer that generates recurring profits.

In other words, it’s not hard to see why ordinary investors and lawmakers alike have flocked to stock split stocks.

Congress’s most active stock trader is buying shares of this beautiful stock split

Thanks to the STOCK Act, which requires lawmakers to report trading activity of $1,000 or more within 45 days, retail investors can keep an eye on what our elected officials are buying and selling. Based on periodic transaction reports, we have learned that Congress’s most active trader, House Rep. Ro Khanna (D-California), bought shares of the most prominent stock split of 2024: retail giant Walmart (NYSE:WMT).

Khanna is one busy representative from a stock trading perspective. In 2023, he made 4,253 trades, based on data from Capitol Trades. For context, this is more than twice as many trades as the next most active stock trader in Washington, DC, Rep. Michael McCaul (R-Texas), who completed 1,826 trades last year.

According to the documents, Khanna acquired between $50,000 and $100,000 worth of Walmart common stock on October 31, 2023, another $15,000 to $50,000 worth of stock on January 10, 2024, and between $15,000 and $50,000 worth of stock on February 13, 2024.

What’s especially notable about Khanna’s eventual purchase is that it came after Walmart announced its plans to execute a 3-for-1 forward split.

Doug McMillon, Walmart’s president and CEO, noted in his company’s press release announcing the split:

Sam Walton felt it was important to keep our share price within a range where purchasing whole shares, rather than fractions, was accessible to all our employees. Given our growth and our plans for the future, we thought it was a good time to split the shares and encourage our employees to participate in the coming years.

Walmart completed its 3-for-1 split before the start of trading on February 26.

Stock split Walmart offers clear competitive advantages, but its shares are pricey now

In addition to causing a stir with its stock split, Walmart has also historically used its size as its biggest competitive advantage.

While size doesn’t always matter in the business world, having deep pockets can be especially useful for retailers. By being able to purchase products in large quantities, Walmart can reduce unit costs and ultimately lower the retail price of those items. The company’s appeal to consumers has long been its ability to undercut traditional supermarkets and local supermarkets on price.

Walmart’s stores aren’t small either. The company buys groceries and home products, which attract all kinds of consumers. Its extensive product offering underlines the idea that it can be a one-stop shopping destination for consumers.

Walmart is also benefiting from its aggressive investments in technology. This includes everything from improving the online ordering process for its customers to ironing out the kinks in the supply chain to ensure stores have the right items.

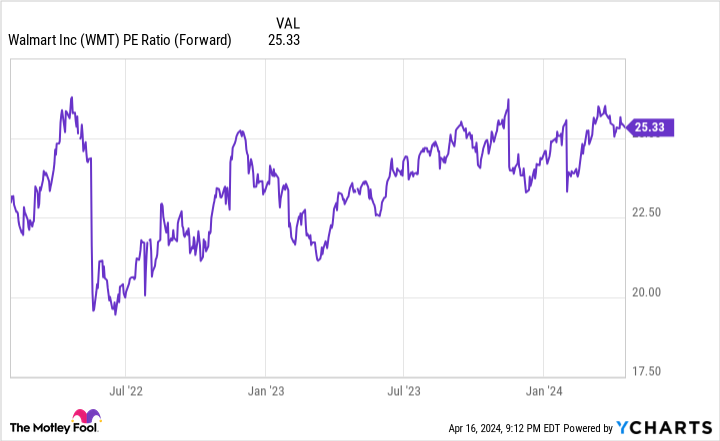

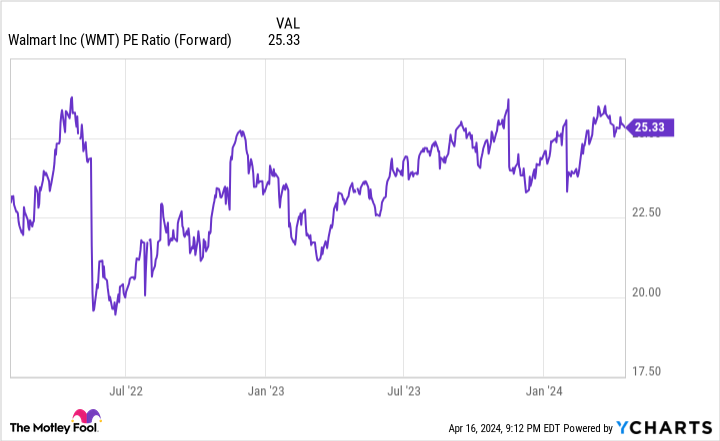

In the long run, Walmart has proven itself to be a phenomenal company. But as things stand now, Walmart stock is undoubtedly pricey.

While stock splits typically command a valuation premium due to their undeniable competitive advantages, a price-to-earnings ratio of 25 may be the upper limit for a company that isn’t growing much faster than inflation.

Excluding currency movements, for example, Walmart posted sales growth of 4.9% in fiscal 2024 (ending January 31, 2024). Wall Street analysts are predicting revenue growth of roughly 4% in fiscal 2025 and fiscal 2026. All three of these figures are not much higher than the prevailing US inflation rate. In other words, there’s not much in the way of true organic growth. growth of Walmart even as e-commerce sales boom.

While patient Walmart investors should do just fine, active traders like House Rep. Ro Khanna, end up getting disappointed.

Should You Invest $1,000 in Walmart Now?

Consider the following before buying stock in Walmart:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $535,597!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions at Alphabet and Amazon. The Motley Fool holds positions in and recommends Alphabet, Amazon, Booking Holdings, Tesla and Walmart. The Motley Fool has a disclosure policy.

The Most Active Stock Trader in Congress Is Buying Shares of This Beautiful Stock-Split Stock was originally published by The Motley Fool