Stock indices are formed by grouping companies according to specific criteria – and are often used as comparison points for an investor’s own portfolio.

The most popular and important index is the S&P500, which tracks the 500 largest U.S. publicly traded companies. When it comes to benchmarks, it’s the S&P 500 the benchmark. Given the size and diversity of the companies the S&P 500 tracks, it is often used to gauge the health of the U.S. economy, and investing in an S&P 500 fund is similar to investing in the broader U.S. economy.

Despite how great an investment option the S&P 500 is, one ETF has historically been a better investment: the Vanguard Growth ETF (NYSEMKT: VUG). Let’s see why – and whether it could be a wise investment now.

What is the Vanguard Growth ETF?

The Vanguard Growth ETF is a large-cap fund that focuses on companies with above-average growth potential (hence the name). It’s a great way to get the best of both worlds when investing in stocks.

On the one hand, you get exposure to companies that are able to deliver competitive returns. On the other hand, the large size of these companies means they are generally better established and can provide more stability during tough times in the stock market. For perspective, the smallest company in the ETF, Freedom broadbandhas a market capitalization of approximately $7.1 billion.

It is beneficial to have larger companies in the ETF as many growth stocks are known to be more volatile because their valuations are based on potential. Although larger companies can also be valued for their potential, you usually do not reach their size without having built up a good market position.

Led by some of the world’s largest companies

Because the Vanguard Growth ETF and the S&P 500 focus on large-cap companies, there is a fair amount of overlap between the two, although the former typically only contains about 200 stocks. Below are overlapping companies from the top 10 of the Vanguard Growth ETF and Vanguard S&P 500 ETF and how many of the ETFs they represent:

|

Company |

Vanguard Growth ETF Percentage |

Percent Vanguard S&P 500 ETF |

|---|---|---|

|

Microsoft |

12.96% |

7.08% |

|

Apple |

10.42% |

5.63% |

|

NVIDIA |

8.88% |

5.05% |

|

Amazon |

6.97% |

3.73% |

|

Metaplatforms |

4.45% |

2.42% |

|

Alphabet class A |

3.67% |

2.01% |

|

Alphabet class C |

3.03% |

1.70% |

|

Eli Lilly & Co. |

2.77% |

1.40% |

Sources: Vanguard. Percentages as of March 31.

Having 10 companies accounts for almost 57% of an ETF (Visa is 1.78%) isn’t a billboard for diversification, but it makes sense given that the Vanguard Growth ETF is market cap weighted, and many of the top growth companies we’ve seen explode in value over the past decade are tech companies.

The tech sector makes up more than 56% of the Vanguard Growth ETF, so it’s not quite the one-stop shop that an S&P 500 ETF is, but it can be a fundamental part of a portfolio that investors supplement with other sector-specific ETFs or businesses.

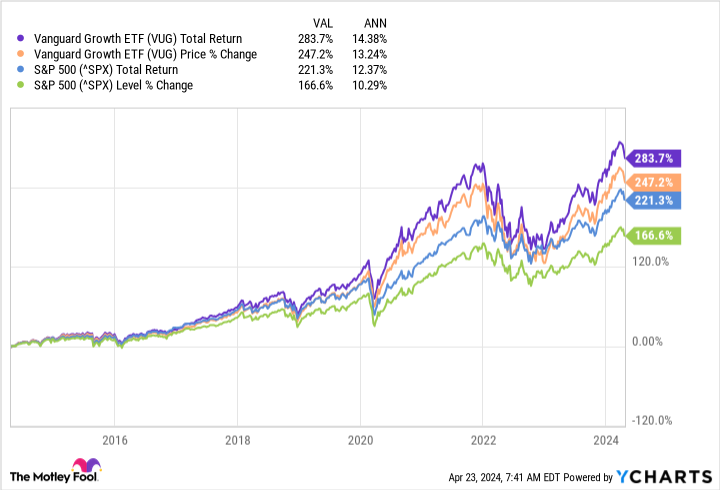

Consistently outperforming the US stock market

Regardless of the similarities or differences between the Vanguard Growth ETF and the S&P 500, it’s the results that matter most. A one-time $10,000 investment in the Vanguard Growth ETF at its inception in January 2004 would be worth just under $79,500 today. The same investment in an S&P 500 ETF would be worth approximately $64,000 (in both cases before fees).

While the Vanguard Growth ETF has outperformed the S&P 500 over that period (average annual returns of 9.6% to 7.5%), the difference has been even greater over the past decade, as growth stocks have soared.

The difference between the Vanguard Growth ETF and the S&P 500 is smaller when examining total returns, but this can be attributed to the fact that the S&P 500 contains dividend stocks that do not meet the Vanguard Growth ETF’s growth criteria.

You never want to use past performance to predict future performance, but given the overlap of companies and current market trends (especially in the technology sector), the Vanguard Growth ETF is in a great position to continue generating market-beating returns over the long term.

Should You Invest $1,000 in Vanguard Index Funds – Vanguard Growth ETF Now?

Consider the following before purchasing shares in Vanguard Index Funds – Vanguard Growth ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Growth ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple, Microsoft and Vanguard S&P 500 ETF. The Motley Fool holds positions in and recommends Alphabet, Apple, Meta Platforms, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, Vanguard S&P 500 ETF, and Visa. The Motley Fool recommends Liberty Broadband and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

The S&P 500 is a great option, but history says this ETF may be a better choice, originally published by The Motley Fool