Warren Buffett is perhaps the most famous investor of all time. He is known for building his holding company, Berkshire Hathaway, to one of the largest companies in the world. His secret? He buys great companies and keeps them for a long time.

Minds conglomerate Diageo Plc (NYSE: DEO) is one of Buffett’s newer investments; Berkshire bought its shares in the first quarter last year. Interestingly, stocks are cheaper now than when Buffett got in. Does that make the stock a bargain that shouldn’t be ignored, or has Buffett made a mistake?

Diageo will stand the test of time

Not everyone will recognize Diageo’s name, but most people of legal drinking age are familiar with the products. The company owns more than 200 brands. The most popular names are Guinness, Johnnie Walker, Tanqueray, Baileys, Smirnoff, Captain Morgan, Crown Royal and Don Julio.

You wouldn’t know if Diageo owned them by looking at the bottle. But make no mistake: Diageo is a consumer products powerhouse. Many of the brands go back generations and have years of brand loyalty and recognition. The history of Guinness beer company goes back to the 18th century!

Alcohol is a cultural staple around the world and has been for generations. It’s hard to see that changing overnight, making Diageo a company that will likely survive decades into the future.

Why would Buffett have bought the shares?

You can’t distill Warren Buffett’s genius into some formula. However, you can see that his stock purchases usually follow some basic rules. First, he likes brand recognition. His largest holdings are companies that almost everyone knows, including Apple And Coca-Cola. Consumers may not recognize Diageo, but as you saw above, they know the products.

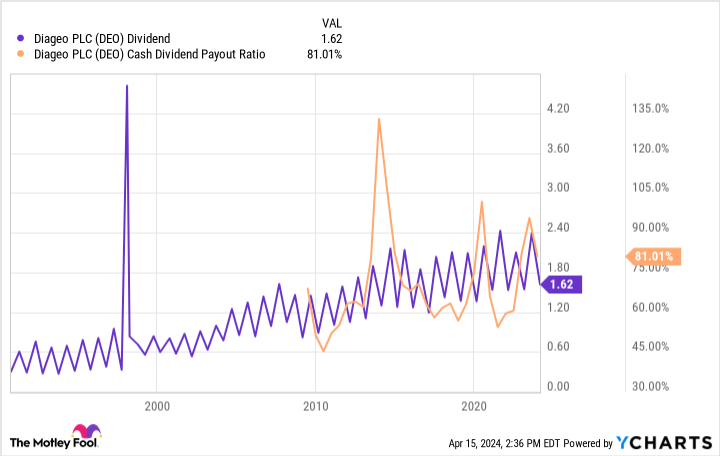

Second, Buffett likes companies that pay dividends. Diageo pays a hefty dividend that yields 2.3% at the current share price. Investors should note that Diageo is a European company, so if you are a US investor, the dividend must be converted into US dollars. This may affect the payout you receive. In addition, Diageo pays its dividend twice a year instead of quarterly.

That has nothing to do with the health of the company; it’s just how some non-US companies do things. Diageo pays a different amount halfway through the year than at the end of the year. That’s why you see the zigzag pattern below. More importantly, the long-term trend is up:

Diageo has a decades-long history of dividend payments. Investors can buy the shares with confidence in the dividend and Diageo’s ability to pay it with a manageable payout ratio of 81%.

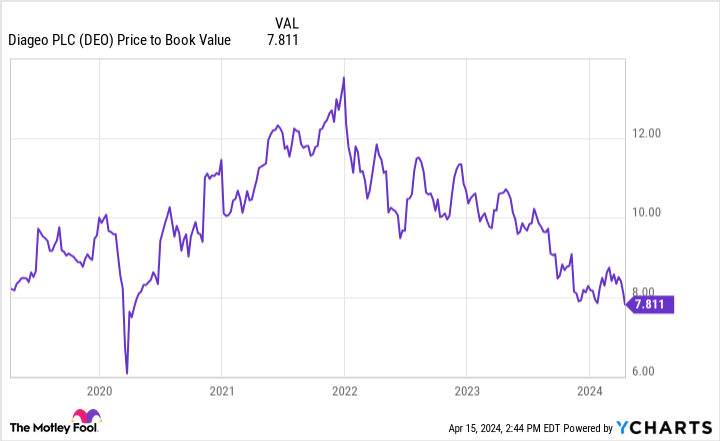

Finally, Buffett doesn’t like to overpay for any stock. He only buys if he sees enough value in the stock relative to its intrinsic value. Today, shares are trading at their lowest price-to-book value since the 2020 COVID-19 market crash:

Should Investors Buy the Stock Today?

Diageo won’t make you rich overnight. Analysts estimate the company is poised to grow earnings by mid-single digits annually over the next three to five years. But Diageo can undoubtedly help you build wealth. Steady earnings growth and a reliable dividend have added up over the years, and that’s exactly how Buffett built his fortune with Berkshire Hathaway.

Investors get a recession-proof, technology-resistant and diversified company that will deliver slow and steady returns for as long as they want to own it. As a bonus, investors can get the shares for less than the great Warren Buffett paid. That’s nothing to shake a stick at.

Should you invest $1,000 in Diageo Plc now?

Before you buy shares in Diageo Plc, you should consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Diageo Plc wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $535,597!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Apple. The Motley Fool recommends Diageo Plc. The Motley Fool has a disclosure policy.

These Ridiculously Cheap Warren Buffett Stocks Could Make You Richer was originally published by The Motley Fool