Just 11 years ago, Apple, ExxonMobil, AlphabetAnd Berkshire Hathaway were the four largest American companies. Today, only two of these companies – Apple and Alphabet – remain in the top four. Berkshire Hathaway has fallen to No. 7, and ExxonMobil and Walmart have fallen out of the top 10 altogether.

A lot can change in just 11 years. Let’s take a look at the companies I think will claim the top four in 2035.

Nvidia

By 2035, Nvidia (NASDAQ: NVDA) will be the largest company in the world by market capitalization. In fact, I think it could happen even sooner.

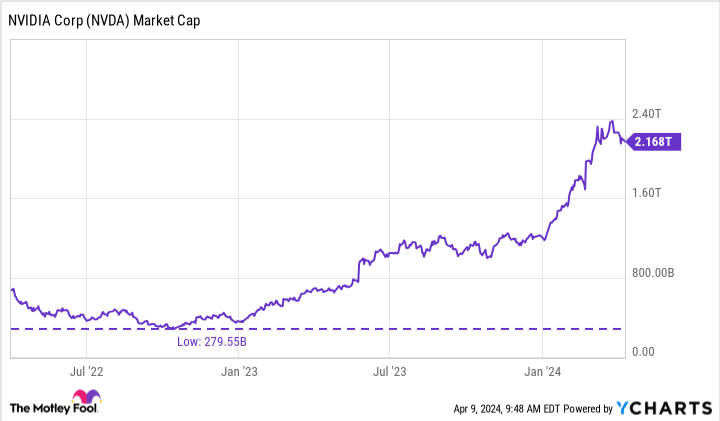

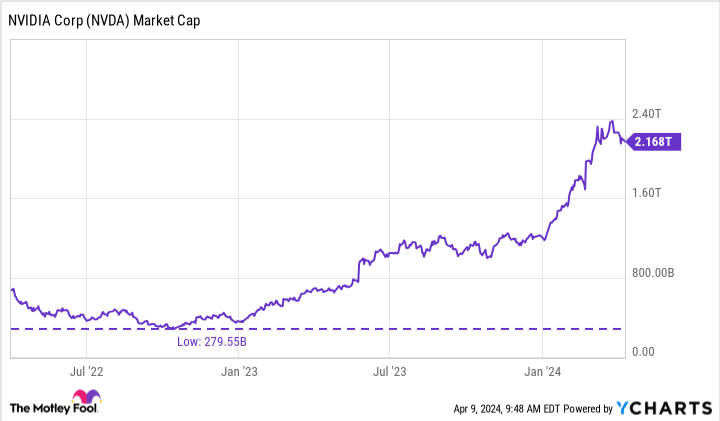

One reason is that Nvidia has already grown faster than almost anyone expected. The company’s market capitalization has grown nearly tenfold in less than two years, from $0.3 trillion to $2.2 trillion.

The enormous growth of artificial intelligence (AI) is behind the company’s rapid rise. Thanks to its leading position in the graphics processing unit (GPU) market, Nvidia is well positioned to take the crown as the largest company by 2035, if not sooner. That’s because the GPU market is expected to grow by leaps and bounds over the next decade. According to Global Markets Insights, the GPU market size will grow from $40 billion in 2022 to $400 billion in 2032.

Moreover, the surge in GPU spending has already arrived. Nvidia’s revenue rose a staggering 265% year over year in its most recent quarter (the three months ending January 28, 2024). Although sales are expected to cool somewhat, analysts still expect the company to achieve 82% growth this year.

Given the explosive growth of the overall GPU market, analysts expect Nvidia’s revenue to grow 37% annually over the next five years, meaning the company’s annual revenue could approach $300 billion by 2030.

In short, Nvidia is experiencing a tsunami of growth that could take it all the way to the top spot by 2035.

Microsoft

With a market capitalization of $3.2 trillion, Microsoft (NASDAQ: MSFT) is currently the largest company in the world and has succeeded Apple last year.

Like Nvidia, the AI revolution has significantly increased Microsoft’s market capitalization. The company’s extensive and iconic software suite provides a natural home for AI-powered tools, and the company has wasted no time in integrating AI features into its software.

In addition, Microsoft has a close collaboration with ChatGPT maker OpenAI. That partnership has already benefited both companies and puts Microsoft in a good spot to benefit from future AI breakthroughs that OpenAI enables. AI will likely be the most important factor in increasing market capitalization over the next decade, and Microsoft is well positioned to capitalize on that trend.

In terms of growth, analysts expect Microsoft to grow revenue 16% annually over the next five years, reaching annual revenue of more than $475 billion by 2030. That almost matches CEO Satya Nadella’s internal target. of $500 billion in revenue by 2030. Regardless, Microsoft’s projected growth shows that the company has staying power, and while tThe company may not be able to stay ahead of Nvidia, but it will likely maintain its lead over everyone else.

Amazon

With a current market cap of $1.9 trillion, Amazon (NASDAQ: AMZN) is currently the fifth largest company in America. But by 2035, I see a number of companies, including Apple and Alphabet, making a leap forward and taking third place.

That’s because Amazon, like Nvidia and Microsoft before it, can naturally benefit from the AI revolution. The company already uses more than 750,000 robots in its vast warehouses. They measure and package products, move heavy items, read labels and distribute shelves and packages.

Additionally, AI should help the company improve the digital side of its e-commerce operations. AI assistants can shop for customers and help with returns. AI-powered advertising tools can refine which customers see which ads, leading to a better return on investment (ROI) and generating more advertising revenue for Amazon. Additionally, the company’s crown jewel, Amazon Web Services (AWS), should continue to benefit from the cloud transition over the next decade.

Amazon is already one of the largest companies in terms of turnover; the company has generated $575 billion in the last twelve months – all but one Walmart$648 billion. However, Amazon is closing the gap quickly and should overtake Walmart soon. Analysts expect Amazon to grow its revenue 31% annually over the next five years, bringing annual revenue to an eye-watering $2.2 trillion by 2030.

Thanks to impressive sales growth, I think Amazon will rise up the rankings to third place.

Metaplatforms

The top four are rounded up Meta Platforms (NASDAQ: META). Currently, Meta is the sixth largest US company by market capitalization. I expect Meta to make a leap forward in both Alphabet And Apple by 2035.

Meta is well on her way to becoming one of the largest dairy cows in the world. The company’s lucrative advertising business continues to grow by leaps and bounds as the digital advertising market expands. Furthermore, Meta’s ambitious AI research and development could lead to revolutionary breakthroughs in the next decade.

In terms of revenue, analysts expect Meta to grow revenue 26% annually over the next five years, leading to an annual total of $429 billion by 2030.

Either way, with its family of apps (Facebook, Instagram, WhatsApp) offering ample free cash flow, Meta is well positioned to grow its market cap significantly over the next decade, so it could surpass laggards like Alphabet and Apple by 2035 .

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

View the 10 stocks

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions at Alphabet, Amazon and Nvidia. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Opinion: These will be the four largest companies in 2035, originally published by The Motley Fool