-

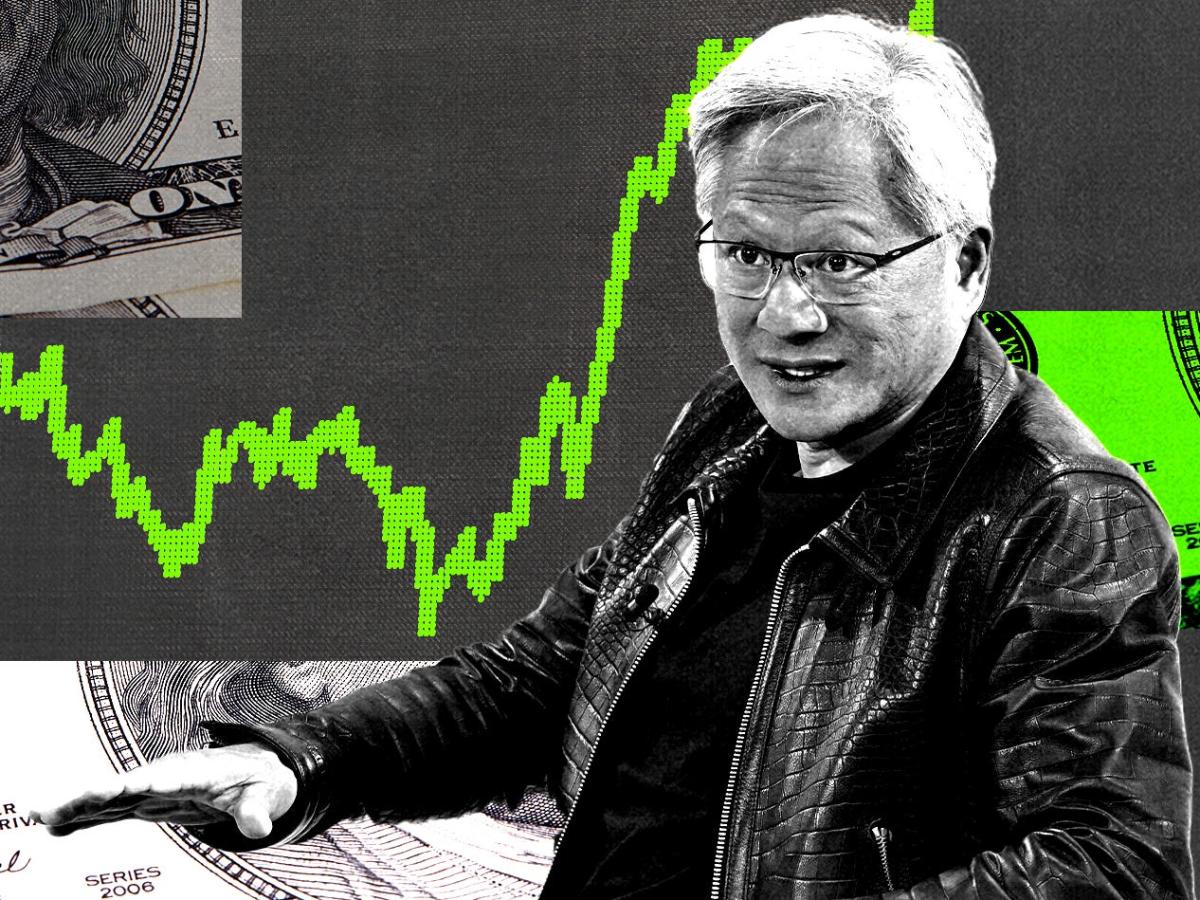

Nvidia has been a cash cow for investors lucky enough to buy in before the AI-powered rally.

-

The company’s shares are up 1,500% since 2019 as GPUs drive the AI revolution.

-

Early retail investors told Business Insider that their profits paid for cars, vacations and dream homes.

The dizzying rise in Nvidia stock in recent years has delivered extraordinary profits for many retail investors, especially those who got in before the chipmaker became an artificial intelligence superpower.

The stock’s steep climb — up more than 1,500% since 2019 — has transformed the lives of some of Nvidia’s long-term investors, resulting in a more comfortable retirement, new cars and profits worth millions for some.

Business Insider reviewed brokerage and account statements to verify the profits and account balances of the investors it spoke to. Some of them asked to be identified only by their first names to protect their privacy.

Tom, a 48-year-old private investor from New Jersey, first bought Nvidia in 2011, when its stock was valued at about $5 per share. He invested $12,000 at the time and another $50,000 in 2022. His total stake is now worth $3 million.

His fortune, which remains largely invested and untouched, was a matter of research and good timing, he said.

“They were the original makers of the GPUs,” he said. “I’m not even much of a techie. I’m not a computer person at all, but I knew the GPUs would be worth something someday.”

Nvidia went from a gaming icon to an AI superpower seemingly overnight. In the early days of the pandemic, the stock rose as gamers, with time on their hands under COVID-19 lockdowns, sought to upgrade their computer rigs with the latest Nvidia GPUs.

Then, in November 2022, the debut of OpenAI’s ChatGPT fueled a series of stunning growth for Nvidia, as its GPUs were the only game in town when it came to powering such AI programs. The stock has essentially gone parabolic since then.

Nvidia has become the top stock among retail investors, surpassing the retail portfolio concentrations of Apple, Tesla and SPY, the S&P 500’s most popular exchange-traded fund, according to Vanda Research.

Tom said his stake in Nvidia was worth about three times what he had in his 401(k) and that he felt more comfortable that he could live well in retirement, a concern that loomed over him before he joined Nvidia went to work.

Generational wealth

Kiana Danial is the 40-year-old founder of Invest Diva, a company that helps women take control of their financial future and create generational wealth.

Danial had never heard of Nvidia before 2015, when she married her husband, who was a gamer in his spare time. Danial said she enjoyed investing in products she used, but when she heard her husband talk about how much he loved Nvidia, she decided to buy the stock.

She first bought Nvidia in June 2016. She bought 10 shares and soon after continued to place new buy orders every month.

“Investments started to grow quite quickly,” Danial said.

Nvidia shares plummeted more than 30% in 2018. During that time, Danial continued to add to her holdings and began adding Nvidia to her Roth IRA and a Roth IRA she set up for her daughter.

Danial sold most of her shares in February and March 2023 to partially cover a large down payment for a second home.

Danial sold 800 shares for approximately $188,795 over a six-week period, bringing her total number of shares to 323.

“I’m clearly kidding myself,” Danial said of the stock sale. “But we bought our dream house and it is beautiful.”

The shares she still owns have made her a profit of $202,940. She has no plans to sell her shares anytime soon and plans to buy more.

Danial’s daughter recently turned six and the account Danial set up for her has grown 568% and is worth approximately $11,000.

The investors Business Insider spoke to turned to Nvidia early on because of its fame among PC gamers, but today the company’s chips are at the heart of the AI revolution — and there’s virtually no competition.

The company’s dominance has made it difficult to find anyone willing to buy the bear case, although some analysts have recently sounded more hesitant about further gains following the stock’s rapid rally.

New financial security

Rick, a 36-year-old private investor in Texas, started buying Nvidia in 2009. The stock caught his attention because the company seemed like the future of gaming at the time. He invested $600, which he described as a wild card bet.

“And just like that, $600 became $140,000,” Rick said.

With Nvidia, Rick said he felt like he had a safety net to fall back on. He’s spent only a small portion of his winnings so far: $15,000 to flip a car he’s been working on, a hobby he said he wouldn’t have done without the Nvidia money. For his tenth anniversary, he and his wife packed their bags for a $14,000 getaway to Costa Rica.

“I didn’t have any stress about it. It was like, ‘We can spend as much as we want on this trip,'” he said.

That sense of security that such a windfall provides was the top theme among the Nvidia investors BI was associated with.

It’s a similar story for Chris Downs, a 66-year-old who lives in rural Missouri and retired as a math teacher three years ago.

He has been investing for a while, but his interest in Nvidia started when he bought a new computer for video editing at the start of the COVID-19 quarantines. Downs said he purchased an Nvidia graphics card for his installation and was impressed.

He bought 112 shares in March 2020 for $79 each.

In July 2023, he sold 28 shares of Nvidia for $436 each to offset losses on other investments. Now he’s left with 84 shares, worth more than $65,000 based on Monday’s prices, among other stocks.

He said he would likely sell some of his Nvidia stock closer to the election, but he plans to invest the proceeds in his four children, as his parents and grandparents had done for their children.

Downs said his lifestyle was not lavish, but he tried to travel every month. Places he has been include Bolivia, Paris and Mexico City, and he plans to go to Spain at the end of April.

He said safety was the biggest benefit of his investment, and he knew he could weather unpredictable financial setbacks.

“It’s nice not to have to worry when you’re retired,” Downs said.

Read the original article on Business Insider