Many people try to emulate Warren Buffett’s investment strategies, but it is not easy to achieve the same level of success. Someone who has done quite well also happens to be someone to whom Buffett’s right-hand man Charlie Munger has entrusted his savings: Li Lu. The Chinese-born value investor runs a fund called Himalayan Capital Management, which was founded several decades ago with the help of Munger (now deceased).

This disciple of Warren Buffett manages a concentrated portfolio, especially with his US-listed stocks. According to the Himalayan Capital Fund’s latest update, the fund had about 70% of its US portfolio invested in just two stocks: bank of America (NYSE: BAC) And Alphabet (NASDAQ: GOOG). What is it about these two stocks that Li Lu likes so much? Should you invest alongside Li Lu and buy these stocks?

1. Bank of America: diversified global banking

Just under 30% of Li Lu’s portfolio of US stocks (foreign stocks are not required to be publicly reported) is in Bank of America. One of the largest banks in the world offers private and commercial customers a diversified package of financial services. It has four reporting segments: consumer banking, wealth management, global banking and global markets. Each of these divisions generated more than $1 billion in net revenue last quarter, and the four combined totaled $6.7 billion.

Bank of America continues to add customers to its banking division, with 245,000 accounts last quarter, and remains one of the world’s leading investment banks. While not a hyper-growth stock, this allows Bank of America to operate consistently year in and year out. Li Lu probably owns the shares because they are undervalued and return capital to shareholders.

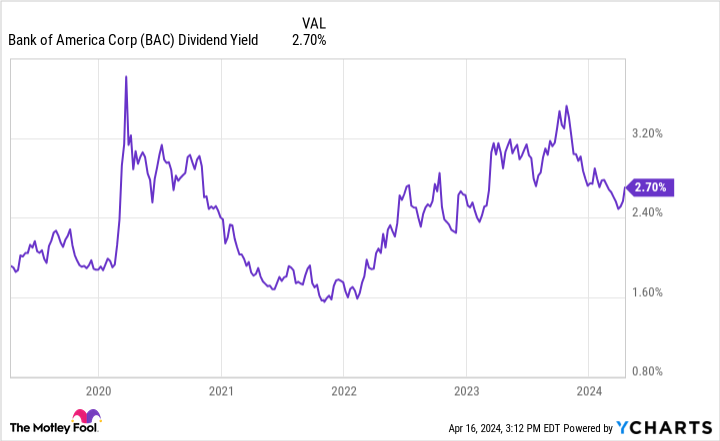

The stock trades at a price-to-book value (P/B) of just 1. P/B is the most useful valuation metric for a bank because it tells an investor the price of a stock relative to its intrinsic value. Bank of America currently has a return on equity (ROE) of 9% and has hovered around 8% to 12% in recent years, which is the return it gets on this book value. With these returns, Bank of America pays shareholders a dividend that yields 2.7%. It has bought back shares to reduce outstanding shares by 25% over the past decade.

These consistent profits, along with returning capital to shareholders through share buybacks and dividends, are likely why Li Lu has made Bank of America such a large position in his portfolio. This blue chip stock should continue to deliver solid returns for shareholders going forward.

2. Alphabet: An undervalued Magnificent Seven stock?

The other stocks that make up nearly 40% of Himalayan Capital’s U.S. portfolio are a little more exciting than a diversified bank. Meet Alphabet, the technology giant Magnificent Seven that owns Google Search, YouTube and Google Cloud.

So why does Lu like the stock? While I’m not sure, I think this is due to its reasonable valuation and consistent growth. Alphabet’s price-earnings ratio (P/E) has been below the market average for years. Even as the stock is up 77% since the start of 2023, it still has a price-to-earnings ratio of 27, which is just below S&P500 average. Although Lu first started buying stocks in 2020 amid the market turmoil surrounding the COVID-19 pandemic, he hasn’t done so recently.

Despite almost always trading below the average earnings of the S&P 500, Alphabet is growing much faster than the average company. Last year, revenue grew 9% to $307 billion, on top of 10% growth the year before. Google Search continues to grow rapidly, along with the rapid growth of YouTube and Google Cloud. YouTube now accounts for nearly 10% of TV viewing in the United States and generated $9.2 billion in ad revenue last quarter. Google Cloud also achieved $9.2 billion in revenue and is growing 26% year over year.

It appears that Alphabet still has many years of growth ahead of it. With a price just below market gains, investors could do well owning this stock alongside Li Lu.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Brett Schafer has positions at Alphabet. The Motley Fool holds positions in and recommends Alphabet and Bank of America. The Motley Fool has a disclosure policy.

This Billionaire Warren Buffett Disciple Has 70% of His US Portfolio in Just Two Stocks was originally published by The Motley Fool