-

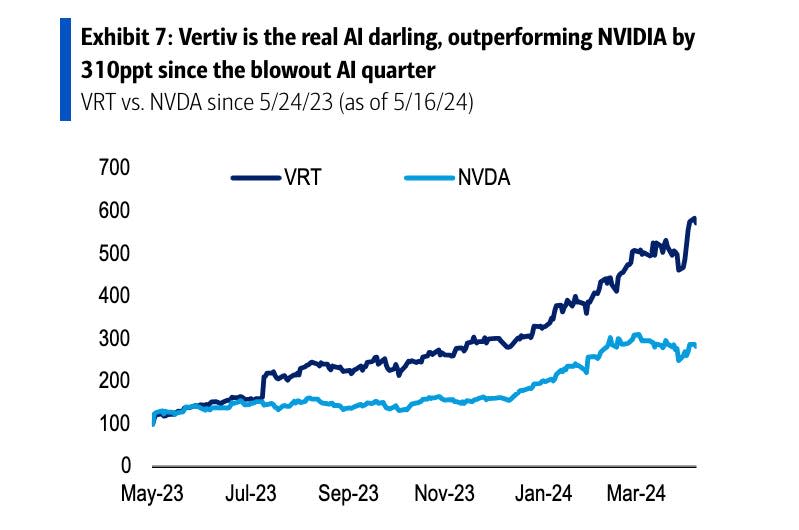

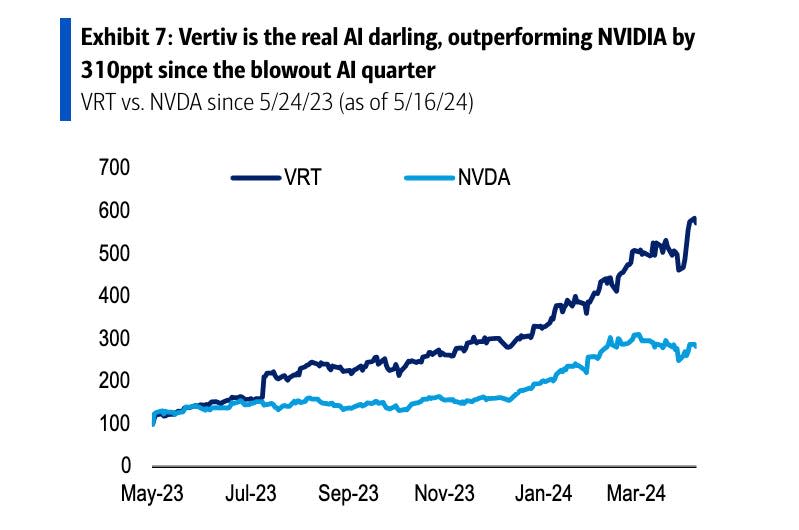

AI investments are about more than just GPUs. Energy companies have also dominated, says Bank of America.

-

The company notes that Vertiv, which makes power and cooling equipment for data centers, has beaten Nvidia by 315% in the past year.

-

The achievements represent a broadening of the AI business to include utilities, industrials and commodity companies.

Nvidia remains a frontrunner amid the artificial intelligence frenzy, but investors who focus too narrowly on GPU chips have missed an even more lucrative opportunity.

In a new note, Bank of America notes that stock gains for Vertiv — which makes power and cooling equipment for data centers — have surpassed Nvidia’s returns by as much as 315 percentage points over the past year. They start the comparison on May 24, 2023, right after Nvidia’s first blowout quarter that sparked the entire AI boom in stocks.

To be precise, Vertiv is up 516% since the date, easily surpassing Nvidia’s gain of 211%. The benchmark S&P 500 is up a relatively paltry 29% over the same period.

“Vertiv is the real AI darling,” BofA wrote in a customer note.

BofA says Vertiv’s stellar performance is representative of the AI rally that is expanding into an increasing number of industries. Much of that comes from the advanced chips that power AI – such as the chips Nvidia produces – which require significantly more electricity to function. According to the company, this offers benefits for industry, utilities and raw materials.

“GPUs require 2 to 2.5x more power than CPUs, and projected power consumption for U.S. data centers under construction is equal to more than 50% of the power currently used by U.S. data centers,” Bank of America wrote on Monday. “The power used by AI applications is expected to grow at a CAGR of 25-33% in the coming years.”

Others, like “Big Short” investor Steve Eisman, have pointed out that the increase in power consumption is also making these GPUs significantly hotter, putting pressure on companies like Vertiv to improve cooling systems in data centers.

Eisman has long been a bully on American infrastructure. In addition to AI, he expects that green policies will also boost these sectors.

As Nvidia gears up for earnings season on Wednesday, expectations remain strong, Bank of America said. The company has also set its own bar high, judging by the last twelve months: It’s added $1.5 trillion in market cap and its earnings per share have skyrocketed 617%.

“But it’s not just about NVDA anymore,” the note said, adding: “The fundamentals are broadening and so should the market: NVDA drove 37% of S&P’s earnings growth over the LTM (and 11% of the return), but is also expected to yield only 9% over the next twelve months.”

Previously, Goldman Sachs had similarly outlined the expansion of AI investments, characterizing Nvidia as the first of four phases. Ultimately, utility investments will prevail, and companies that can best integrate AI software will win.

Read the original article on Business Insider