Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) recently hit a new all-time high. While this may make some hesitant to buy the stock, I think it’s a good sign that investors are finally starting to realize Alphabet’s potential.

If you’re on the fence about buying Alphabet stock right now, I would consider picking up some shares before April 25, as there could be some big news that day that could trigger a massive bull run in the stock.

Advertising is an important part of Alphabet’s activities

What’s so important about April 25? April 25 is the day of Alphabet’s first quarter conference call, and I think this could be a big day for the company. In early 2024, Alphabet faced bad press related to the rollout of its artificial intelligence (AI) products. All indications are that Alphabet is lagging behind many of its competitors in key areas, but investors forgot that AI is not Alphabet’s main business; advertising is.

In the fourth quarter, Alphabet’s advertising revenue rose 11% to $65.5 billion. That’s an acceleration in growth compared to the 9% increase in the third quarter. Since advertising made up about 76% of Alphabet’s revenue in the fourth quarter, it plays a much bigger role than AI.

However, with a large portion of this revenue coming from the Google search engine, many might argue that with the rise of products like ChatGPT, Google’s days could be numbered. While this is a fair argument, Google’s search engine market share has barely budged from its 95% or greater hold on the market, despite Bing integrating ChatGPT months ago. It’s hard to break consumer habits, and Google is still embedded in most people’s daily lives.

When Alphabet reports on April 25, I expect another quarter of robust ad growth, as the year-over-year comparison will be fairly easy considering many companies were concerned about a recession in the first quarter last year. Additionally, with other advertising companies, such as Metaplatformspredicting strong growth in the first quarter bodes well for Alphabet.

While advertising should have a strong quarter, Alphabet’s AI game is also improving.

Alphabet’s latest AI products have been more accepted by the market

Alphabet is competing against several competitors in the AI world at the same time.

The generative AI model, Gemini, may have struggled initially when it launched. However, Gemini 1.5 has several advantages over competitors such as ChatGPT. Gemini 1.5 outperforms benchmark tests such as the massive multitask language comprehension test, the first model to outperform human experts.

Alphabet is also improving the performance of its AI models in its cloud computing offering, Google Cloud. Although it still buys a lot Nvidia graphics processing units (GPUs) for its data centers, Alphabet is also introducing its new tensor processing unit (TPU), created by Arm. While TPUs won’t completely replace GPUs, they are faster and more efficient than GPUs at processing workloads designed specifically for the hardware, such as training AI models.

This gives Google Cloud users significant advantages over other providers, making it a logical choice when deciding where to run AI workloads.

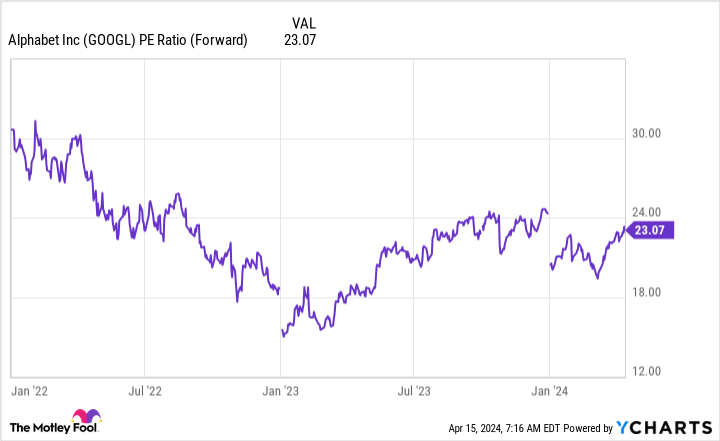

With Alphabet’s primary businesses still performing strongly and its AI business starting to pick up the pace, I’m confident Alphabet shares can move higher after a strong first-quarter earnings report. Add in a reasonable valuation of 23 times forward earnings, and the stock looks like a solid buy.

Alphabet is primed for more upside, and I think investors would be wise to start or add to their positions before the first quarter results are announced.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $535,597!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Meta platforms. The Motley Fool holds positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Here’s Why I’m Buying Alphabet Stock Before April 25, originally published by The Motley Fool