When it comes to artificial intelligence (AI), most investors and Wall Street analysts use the ‘Magnificent Seven’ stocks as a key barometer. There are good reasons for this.

Microsoft has poured billions of dollars into OpenAI, the developer of ChatGPT. Moreover, there is a demand for it NvidiaThe company’s graphics processing units (GPUs) can provide a good window into where and how companies are exploring AI-driven use cases.

Nevertheless, investment bank Goldman Sachs sees another member of the Magnificent Seven as the clear winner of the AI revolution so far.

Just a few days ago, Goldman was greeted Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) as a leader among mega-cap AI companies. The reason? Facts. Lots of data.

Let’s take a look at why data is Alphabet’s competitive advantage, and explore why now is a lucrative time to grab shares at a bargain price.

Alphabet dominates the internet

There’s no doubt that ChatGPT has captured the interest of AI enthusiasts, corporate workplaces, and even students.

One of the pushbacks against Alphabet over the past year was that ChatGPT would threaten traditional search habits. Given that Alphabet is the parent company of Internet search engine Google and video sharing platform YouTube, some became skeptical that the company was facing an existential crisis and losing momentum when it comes to user preferences on the Internet.

But even with increasing competition, Google and YouTube remain the two most visited websites in the world, each with more than 100 billion site visits per month.

Why is Alphabet’s data so important?

The website traffic Alphabet generates gives the company more data points than any other competitor. Alphabet can in turn use this data as input for training its large language model (LLM), Gemini.

Hedge fund manager and Alphabet investor Bill Ackman called Alphabet’s “substantial distribution moat” a unique feature for the company to maintain its lead in AI.

This allows Alphabet to develop, hone and release generative AI applications faster than alternative platforms. Additionally, the company can integrate its AI-powered tools into its large and growing ecosystem: advertising, cloud computing, social media, workplace productivity software and more.

Alphabet stocks look dirt cheap

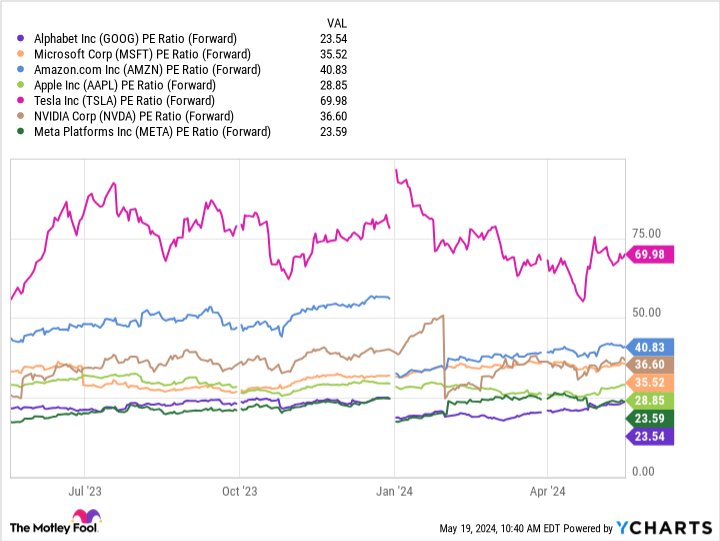

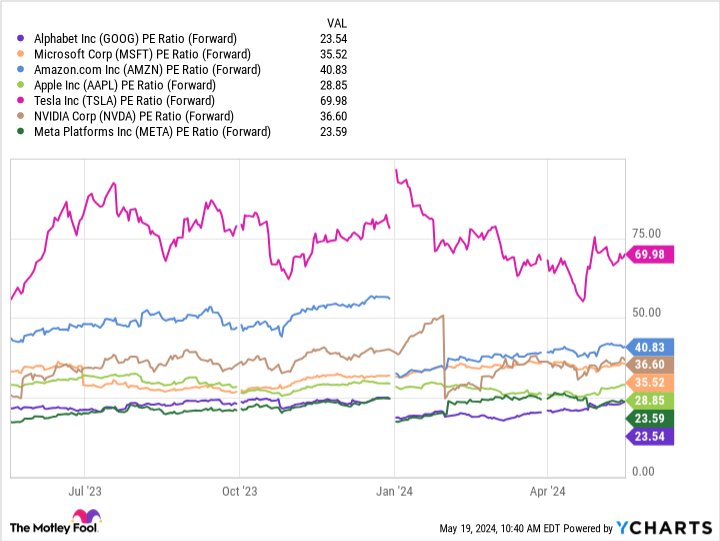

According to the chart below, Alphabet has the lowest price-to-earnings (P/E) ratio among its Magnificent Seven peers.

My view is that investors are discounting Alphabet’s growth prospects, and the reason for this largely lies in the competition.

Sure, ChatGPT is undoubtedly popular, and Microsoft has seen impressive growth since integrating the AI tool into its entire ecosystem. Furthermore, semiconductor companies are likely to benefit from the broader AI movement in the long term as long-term tailwinds continue to drive chip demand.

This doesn’t necessarily mean that Alphabet’s business model is in jeopardy. Increasing competition and expanding use cases of AI could very well lead to a new chapter in Alphabet’s growth story.

I think investors are missing the forest for the trees here. Alphabet is well positioned to benefit from various aspects of AI. As people continue to rely on Google and YouTube for sources of information and entertainment, Alphabet will remain at the forefront of data collection. This should ultimately serve as a catalyst for the company’s long-term AI roadmap.

To me, Alphabet stock is dirt cheap, and the discount to its mega-cap peers is a buying opportunity. Investors with a long-term horizon should consider taking advantage of the valuation differential in Alphabet stock and picking up some shares right now.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Alphabet, Microsoft and Nvidia. The Motley Fool holds positions in and recommends Alphabet, Goldman Sachs Group, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

This ‘Magnificent Seven’ Company Is Leading the Artificial Intelligence (AI) Revolution, According to Goldman Sachs (Hint: It’s Not Nvidia) was originally published by The Motley Fool