Nvidia And Intel have both announced big news in recent weeks – news that could result in rising revenues from artificial intelligence (AI) customers. Nvidia, the world’s largest AI chip company, plans to launch its Blackwell architecture along with its highest-performing chip ever later this year. And Intel will release its new Gaudi 3 AI accelerator in the coming months, an accelerator it says can outperform Nvidia’s current H100 chip.

Nvidia’s new products and services could secure its leading position, helping the company maintain its 80% market share in AI chips. And Intel’s Gaudi 3 could help the company gain ground after falling behind earlier in the AI race. But the biggest winner from these big AI chip launches could be another company. This player is benefiting from the demand for its own products as well as the demand for the most popular chips, and that has helped its profits and share price to skyrocket in recent times.

Let’s take a closer look at this AI stock, which could rise even further.

AI servers and workstations

It’s important to remember that customers often want to purchase AI chips as part of a larger system, such as a server or workstation. And for this many turn to Super microcomputer (NASDAQ: SMCI), a leader in this field. Supermicro has been around for 30 years, but only saw its business take off in recent years, thanks to demand from AI customers for its products.

The company recently reported its first quarter of $3 billion — that’s more than an entire year of revenue — in 2021. Supermicro said it’s seeing continued record demand for rack-scale AI systems, including the latest chips from Nvidia, Intel and Advanced micro devices. Because of this momentum, Supermicro’s full-year revenue forecast of at least $14.3 billion implies growth of more than 100% year over year. Chief executive officer Charles Liang says we may be facing “an AI revolution” and says high demand could continue for years to come.

Specifically, Supermicro benefits from new product launches from Nvidia, Intel and others. The equipment manufacturer works closely with these companies and follows their innovations and launch schedules so that the latest features can be quickly made available in its systems. At the same time, Supermicro’s building block method, which uses common elements across all its platforms, also supports the idea of speed.

All this means that when Nvidia or a competitor launches a new chip, Supermicro can offer its platforms with that chip quite quickly.

Top chip launches

I said earlier that Supermicro could benefit from this even more of upcoming launches than Nvidia and Intel. That’s because these companies only generate growth through sales of their own new products – but Supermicro could see more demand and revenue growth from all the product launches from the top chip companies. Considering that every chip designer is working hard to maintain or grow their market position, and that means regularly releasing new chips, the growth in demand for Supermicro’s systems incorporating these innovations may be far from over.

So, should you really forget about Nvidia and Intel? Not necessary. These chip leaders still represent solid buys today. But the advantage of Supermicro is that it is not solely dependent on the future of one chip company. The company’s profits will benefit regardless of whether Nvidia remains in the lead or Intel gains market share.

As a result, Supermicro allows you to bet on the overall demand for AI chips and systems, and this could be a win for your portfolio over time. After all, the AI market is predicted to reach a value of over $1 trillion by 2030, so this growth story may be just beginning.

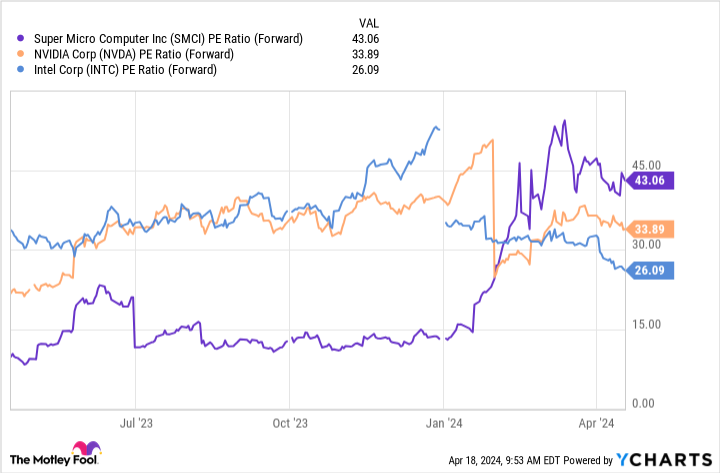

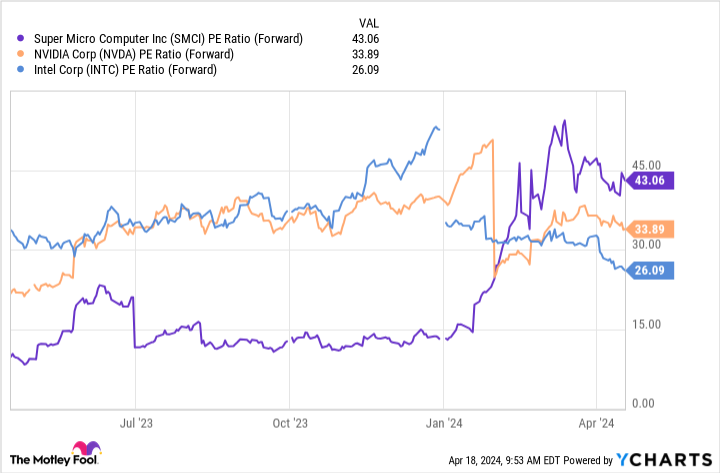

Now let’s look at the rating. Supermicro is trading at a premium to Nvidia and Intel relative to forward earnings estimates.

I think Supermicro is worth this premium because it benefits from overall chip demand regardless of which chip company leads – and this makes it less risky than the chip companies. At the same time, Supermicro’s special features, such as systems tailored to customer needs and its own liquid cooling technology, should keep orders flowing.

So yes, Nvidia and Intel are buys. But Supermicro can be one buy even better right now, because it is about to win from its own innovations – and those of others.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy shares in Super Micro Computer, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Adria Cimino has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 relying on Intel and short May 2024 $47 relying on Intel. The Motley Fool has a disclosure policy.

Forget Nvidia and Intel: This stock could be the biggest winner from their new chip launches was originally published by The Motley Fool