Dividend stocks are an important anchor for well-balanced portfolios. Regular cash distributions can protect a portfolio from market volatility and provide stable income throughout business cycles.

Still, choosing dividend stocks is no easy task. Companies operating in high-tech areas such as healthcare often face unique competitive pressures that can reduce free cash flows, reducing their ability to reward shareholders through increasingly large dividend checks.

Bristol Myers Squibb (NYSE: BMY), or BMS for short, is a good example. The drugmaker’s shares are down more than 17% year to date and more than 33% in the previous twelve months.

Despite one of the highest dividend yields in the sector at 5.6% and a reasonable payout ratio of just 59.8%, investors have been moving away from the stock for three main reasons:

-

Newer drug launches, such as heart medication Camzyos, are taking off more slowly than expected.

-

BMS faces one of the industry’s steepest patent cliffs in 2028, when cancer drugs Opdivo and blood thinner Eliquis could both face generic competition.

-

BMS is dealing with the loss of patent protection for its cancer drug Revlimid, which it acquired through its 2019 acquisition of Celgene.

Here’s why contrarian investors may want to scoop up this unpopular dividend stock now.

Bristol Myers Squibb: a proven value creator

Developing new drugs is incredibly difficult. In many therapeutic categories, the sports failure rate is above 90%. BMS has successfully lowered the risk profile of new drug development by acquiring promising drugs that are in late stages of development. For example, in March the pharma giant completed the acquisition of Karuna Therapeutics, adding the potential blockbuster schizophrenia treatment KarXT to its neuroscience portfolio.

Acquisitions slowly create value in the pharmaceutical industry, often adding significant debt to a company’s balance sheet. But they also ease some of the unknowns of drug development, giving shareholders a clearer picture of the path forward.

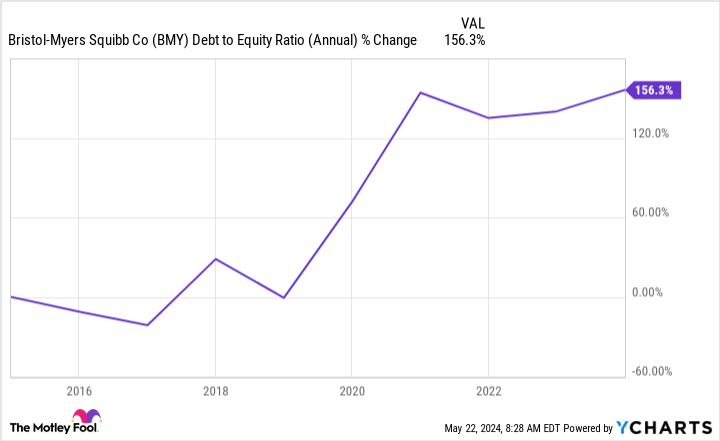

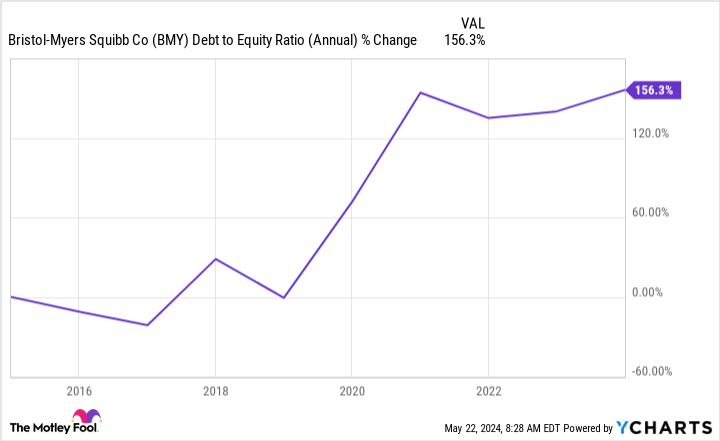

BMS’s debt-to-equity ratio has soared recently thanks to its acquisitive approach. However, investors need to keep the long term in mind with these types of deals.

BMY debt-to-equity ratio data (annual) according to YCharts.

KarXT has enormous commercial potential, with some analysts estimating peak sales at more than $7 billion per year, depending on its ability to expand into other indications such as Alzheimer’s disease psychosis, Alzheimer’s disease agitation and the bipolar disorder.

Additionally, BMS’s battle with Camzyos and other newer medical launches should eventually subside. The company has a long tradition of creating shareholder value by expanding drug labels, creating unique marketing campaigns and leveraging its extensive infrastructure to gain market share.

It will take time for these initiatives to bear fruit. But it’s probably also a bad idea to bet against a proven value creator like BMS.

Final thoughts

The years-long decline in BMS may be exaggerated at this point. Yes, the drugmaker is going through a rough patch with slower-than-expected sales of new drugs, an emerging patent cliff and a growing need to quickly deleverage.

But it’s also important to remember that high-yield dividend stocks tend to outperform most other asset classes when held for longer periods (greater than twenty years). So if you have a long-term horizon and don’t mind some short-term volatility, this unpopular dividend stock could be a great addition to your portfolio.

Should you invest $1,000 in Bristol Myers Squibb now?

Before you buy shares in Bristol Myers Squibb, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Bristol Myers Squibb wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $584,435!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool holds and recommends Bristol Myers Squibb. The Motley Fool has a disclosure policy.

This Unpopular Dividend Stock Is a Buy was originally published by The Motley Fool