In books and films you know that you have to pay attention when everything goes well with the main character. There is always some disruption that throws things out of balance.

Investors could now find themselves in a similar situation. The S&P500 up 24% last year. The index is up in the high single digits so far this year. Everything seems to be going great.

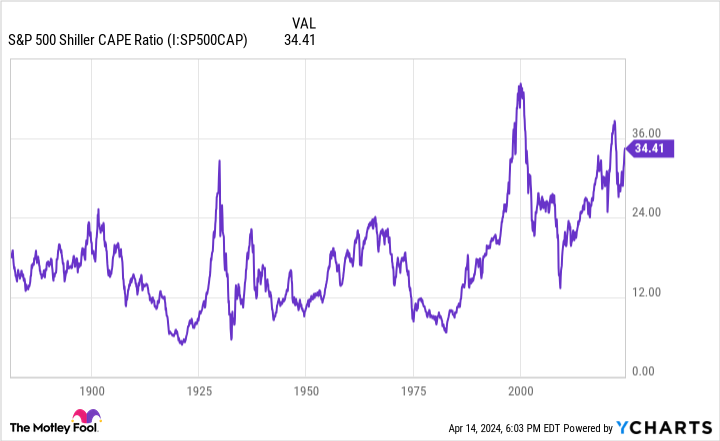

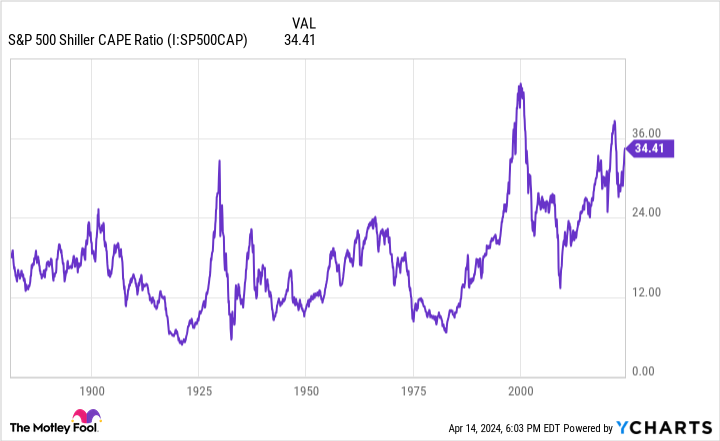

However, you don’t have to look far to find potential disruptions to this sunshine-and-roses market. One valuation metric of the S&P 500 is at its third-highest level ever. Could Stocks Be About to Plunge?

A market with a premium price

In 1988, economists Robert Shiller and John Y. Campbell introduced a new way to value stocks. They called this the cyclically adjusted price-to-earnings ratio (CAPE). Over time, this metric came to be known as the Shiller P/E ratio.

The CAPE ratio offers a twist on the commonly used price-to-earnings (P/E) ratio. Instead of looking at just twelve months of income, a ten-year average of income is used. The idea is that this longer period will help smooth out short-term volatility and provide a better valuation picture. A higher CAPE ratio reflects a steeper valuation and vice versa.

While the CAPE ratio can be used for individual stocks, it is also used with indexes such as the S&P 500. In particular, the S&P 500 CAPE ratio can help determine whether or not the index is attractively priced compared to historical levels.

The historical average CAPE ratio for the S&P 500 is around 16. Any value of 10 or less is considered low (and indicative of an attractive valuation). Any value of 25 or more is considered high (and reflects a market that is priced higher).

What is the S&P 500 CAPE ratio today? More than 34. The measure has peaked at a higher level only twice before: in late 1999 and late 2021.

CAPE anxiety

A sky-high S&P 500 CAPE ratio has often led to significant market declines in the past. For example, the valuation measure peaked at almost 38.6 at the end of 2021. The following year, the S&P 500 fell by more than 19%.

The highest S&P 500 CAPE in history was 44.2 at the end of 1999. In 2000, the S&P 500 fell 10%. That decline was just the beginning. By the end of 2002, the index had fallen by 40%.

There was also another point where the S&P 500 CAPE ratio spiked significantly. In September 1929 the rating reached almost 32.6. The infamous stock market crash of 1929 occurred the following month. The Great Depression followed.

These examples explain why some investors worry that stocks could fall again if the S&P 500 CAPE ratio is at such high levels. However, at the start of 2021, the benchmark was almost as high, but the S&P 500 was up 27% that year.

Some also think that comparing the S&P 500 CAPE ratio to previous levels is not as useful as it once was. They note that there have been changes in accounting standards that affect the way companies report profits. They also argue that structural changes, including technological advances, allow companies to generate higher revenues today than in the past.

What should investors do?

An elevated S&P 500 CAPE ratio doesn’t necessarily mean stocks will plummet anytime soon. However, there is no doubt that the S&P 500 is valued at a higher level than historically.

I think investors would be wise to follow Warren Buffett’s example. The legendary Berkshire Hathaway The CEO has amassed a huge stash of cash. What’s important, though, is that Buffett hasn’t gone all out and sold off many or all of Berkshire’s holdings.

However, he no longer buys shares as often as when the market was more attractively priced. Buffett is not staying completely on the sidelines. He’s bought several stocks in recent quarters, but none were valued at a premium.

In my opinion that is a good strategy. Hold the stocks of well-managed companies that are built to last. Build your cash position to take advantage of any future sell-offs. However, if you see great stocks that are attractively priced, don’t be afraid to buy them.

Remember that in books and films, a resolution always follows the conflict. It works the same way in the stock market. Even if stocks fall due to high valuations, investors will eventually start buying again. In the long run, you should be able to have a Hollywood ending.

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, you would have $20,963!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $33,315!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $335,887!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns April 15, 2024

Keith Speights holds positions at Berkshire Hathaway. The Motley Fool holds positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

This valuation measure of the S&P 500 is at the third highest level ever. Could Stocks Be About to Plunge? was originally published by The Motley Fool