Last year, bank stocks fell due to some of the largest bank failures since the Great Recession. However, bank stocks have outperformed over the past six months as the Federal Reserve pumped the brakes on its rate hike campaign.

Despite the run-up, there are still attractive long-term investment opportunities in bank stocks that have overcome challenges in recent years. Here are three banks that can make solid additions to your portfolio today.

1. Citi Group

Citi Group (NYSE:C) is one of the largest banks in the United States, with nearly $1.7 trillion in assets. But despite its size and scale, it has failed to keep pace with its larger competitors. Citigroup’s sprawling global operations have proven to be a headache, making it difficult to analyze and manage risk. As a result, the bank underperformed its peers on profitability measures such as return on equity (ROE).

In 2021, Jane Fraser became CEO of Citigroup. When Fraser took on the top role, he laid out plans to increase the bank’s operational efficiency and profitability. To achieve this, Citigroup announced it would phase out or sell fourteen consumer franchises, including its profitable operations in Mexico. It would also reduce workforces and flatten the management structure, eliminating 300 senior management positions.

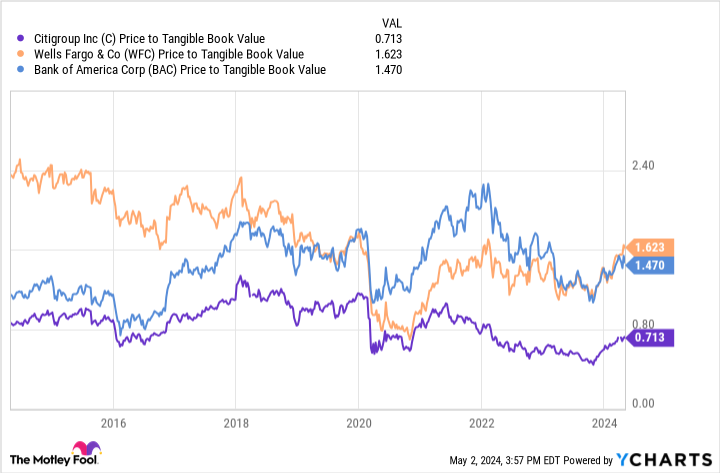

Citigroup has historically underperformed, which is a key reason why it trades at a 29% discount to its tangible book value. For comparison: peers bank of America And Wells Fargo trade at 47% and 62% premium to tangible book value.

Citigroup’s restructuring is in full swing. As of March, it had sold or terminated nine of its 14 consumer franchises. It also said its Mexican consumer business is on track for a planned initial public offering (IPO) in 2025. Citigroup continues to make progress, and a cheap valuation makes it an attractive opportunity for value-oriented investors today.

2. Goldman Sachs

When interest rates started rising two years ago, volatile market conditions put pressure on one of the hottest IPO markets ever. The uncertainty surrounding interest rates and the impact on markets caused many unicorns to put their IPO plans on hold, resulting in some of the slowest IPO activity in decades.

Investment banking income from Goldman Sachs (NYSE:GS) fell 56% over a two-year period ending in 2023. However, green shoots are emerging, which could be a good sign for Goldman and its heavy investment banking operations.

In the first quarter, Goldman saw investment banking fees increase 32% year-on-year, driven by strong growth in the advisory (mergers and acquisitions), equity underwriting (IPOs) and debt underwriting segments. CEO David Solomon told investors that major IPOs, including Redditwere well received and showed an increased risk appetite among investors.

Solomon also sees improving conditions for debt issuance and acquisition financing and expects “solid levels of debt underwriting activity to continue this year.” With equity and debt insurance markets improving, Goldman Sachs looks like an excellent value stock to pick up, trading at around 11.8 times forward 2024 earnings.

3. Charles Schwab

Charles Schwab (NYSE: SCHW) is a stable long-term performance for investors thanks to its solid return on equity. A key part of its performance is its reliance on cheap deposits. This has added to Schwab’s strong performance over the past fifteen years, but has also created problems in times of rising interest rates.

Because Schwab relies heavily on low-cost deposits, the company feels this when these deposits are moved to assets with higher interest yields, which it calls “customer money sorting.” The problem with sorting cash became apparent in 2022 during the Federal Reserve’s aggressive rate hike campaign.

From August 2022 through April 2023, total deposits into Schwab’s bank accounts fell 32% as customers moved their money to higher-yield alternatives. As a result, the company had to rely on available credit facilities, such as the Federal Home Loan Bank (FHLB), to ensure it had sufficient capital and avoid a liquidity problem for the bank.

Schwab is now paying down some of those more expensive debt arrangements and has seen deposit outflows slow to a much more manageable pace.

It should also benefit from falling interest rates. According to the CME FedWatch Tool, markets are pricing three rate cuts of 25 basis points for the coming year. With the stock worth about 17.1 times one-year expected earnings, now is a good time to buy Charles Schwab.

Should You Invest $1,000 in Citigroup Now?

Consider the following before buying shares in Citigroup:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Citigroup wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $564,547!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 6, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Bank of America, Charles Schwab, and Goldman Sachs Group. The Motley Fool recommends CME Group and recommends the following options: Short June 2024 Put $65 on Charles Schwab. The Motley Fool has a disclosure policy.

3 Bank Stocks to Buy By Hand in May was originally published by The Motley Fool