I am not an income investor. However, you could also call me one future income investor. In other words, I like stocks that have the potential to generate exceptional total returns and can bolster my income when I retire in a few years.

Partners for business products (NYSE:EPD) is a good example of such a stock. I first invested in this limited partnership (LP) a few years ago. This is why I just bought more of these ultra-high yield dividend stocks.

1. A delicious distribution

How ultra-high is the return on investment of Enterprise Products Partners? It is currently above 7.3%. As an LP, Enterprise technically pays a distribution rather than a dividend. Whatever you call it, it’s delicious.

What I like even more is that distribution has to grow. Enterprise Products Partners has expanded its distribution for 25 years in a row at a compound annual growth rate of 7%. The company continues to generate enough cash flow to continue that streak.

Importantly, Enterprise’s cash flow, which is used to finance distribution, is reliable. The company operates more than 50,000 miles of pipelines (along with other midstream energy assets) and rakes in money every month regardless of commodity price fluctuations.

I do not (yet) use those benefits to supplement my income. Instead, I plan to reinvest the cash payouts.

2. A convincing valuation

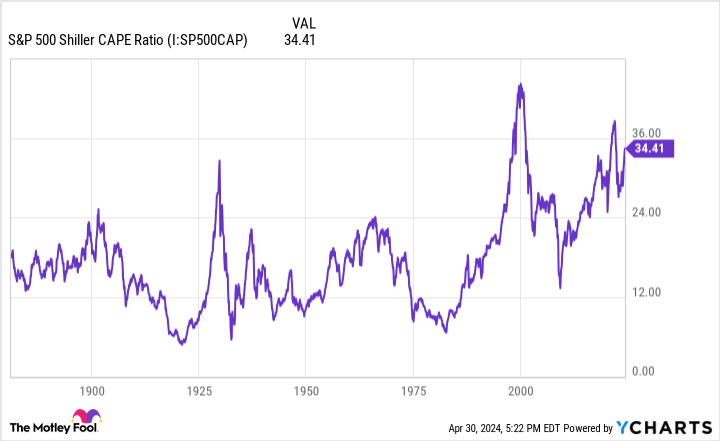

I’m at least a little nervous about the stock market’s valuation. The S&P500The cyclically adjusted price-earnings ratio (CAPE) – a measure popularized by economist Robert Shiller – is near all-time highs.

However, I’m not at all nervous about Enterprise Products Partners’ valuation. The stock trades below 10.7 times forward earnings. That’s barely more than half the S&P 500’s expected price-to-earnings multiple of 20.5 and well below the S&P 500 energy sector’s expected earnings multiple of 12.7.

Enterprise Products Partners also looks attractive using other valuation metrics. For example, the enterprise value to revenue ratio is a reasonable 1.83.

3. Solid growth prospects

Thanks to sky-high distribution returns, Enterprise Products Partners don’t need to generate much unit price growth to give me double-digit total returns. The good news is that the growth prospects look promising.

Enterprise has several growth drivers with high probability in the coming years. The company plans to commence operations at three natural gas liquids (NGLs) plants in 2025 and 2026. A new NGL pipeline is on track to open in the first half of next year. A new fractionator should be operational in the second half of 2025, and an ethane/propane export terminal should be operational in the first half of 2026.

U.S. production forecasts for crude oil, NGLs, and dry natural gas are all on an upward trend through 2030. I also don’t expect a slowdown in the next decade. In my opinion, Enterprise Products Partners is well positioned to grow for a long time.

What can go wrong?

Every time I buy a stock, whether I’m initiating a new position or adding to an existing position, I take a step back and think about what could go wrong. At Enterprise Products Partners, a major recession is probably the most worrying negative scenario.

During severe economic downturns, energy consumption typically decreases. The company’s revenues and cash flow would decline if smaller amounts of hydrocarbons flow through its pipelines, processing facilities and terminals. It is possible that the situation will become so bad that the company will have to stop its distribution.

While this could be happen, I don’t think it will happen. Enterprise Products Partners has never reduced distribution; it has continually increased the payout. Even during difficult times, such as the Great Recession from late 2007 to mid-2009 and the COVID-19 pandemic, the company’s cash flow remained remarkably resilient.

I think it’s more likely that Enterprise Products Partners will expand its distribution and achieve solid growth. And I expect the stock will one day help me retire comfortably.

Should You Invest $1,000 in Enterprise Products Partners Now?

Before purchasing shares in Enterprise Products Partners, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 30, 2024

Keith Speights holds positions at Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Why I Just Bought More of This Ultra-High Yield Dividend Stock was originally published by The Motley Fool