There is a bit more uncertainty in the markets these days. Inflation has remained stubbornly persistent, raising the question of when the Federal Reserve will cut rates. Add to that rising tensions in the Middle East and the upcoming US presidential elections, and we could be in for a more turbulent economic period.

Investors looking for a safety net for turbulent times have many options. Pipeline companies Enbridge (NYSE: ENB), Williams (NYSE:WMB)And Partners for business products (NYSE:EPD) stand out to a number of Fool.com contributors for their ability to provide their investors with safe dividends regardless of market conditions. This is why they think they are great energy dividend stocks to buy amid the current uncertainty.

Enbridge only charges tolls

Ruben Gregg Brouwer (Enbridge): The big problem with oil and natural gas stocks is the enormous impact that commodity prices have on the sector. But there is one niche that sidesteps the inherent ups and downs. There you’ll find Canadian midstream giant Enbridge and its huge dividend yield of around 8%.

The key is that the midstream sector consists of energy infrastructure such as pipelines, storage and transportation assets. This infrastructure is large and expensive to build, but once in place it will be critical for both upstream (energy producers) and downstream (chemical and refining) companies. They are happy to pay companies like Enbridge regular and reliable fees for the use of their assets, which allow oil, natural gas and the products they are processed to move easily around the world. Notably, Enbridge is one of the largest midstream companies in North America.

Although energy prices can fluctuate wildly, energy demand, which drives demand for Enbridge’s midstream assets, tends to be very stable over time. After all, energy is the foundation on which modern society is built. So oil and natural gas prices aren’t that important to Enbridge’s ability to pay dividends. In that regard, investment-grade Enbridge has increased its dividend annually for 29 consecutive years, and its 65% cash flow payout ratio is right in the middle of its target range. If you’re looking for dividend stocks in the energy sector, Enbridge should be able to continue to reward you well no matter how turbulent the sector becomes.

The fuel to grow the dividend

Matt DiLallo (Williams): Williams has proven that it can deliver a reliable dividend under a variety of market conditions. The natural gas pipeline giant has been paying dividends for fifty years in a row. While the company has not increased its payment every year, has risen steadily over the past decades. Williams has delivered compound annual dividend growth of 6% since 2018.

The natural gas infrastructure giant currently yields 5%, well above S&P500 dividend yield of the index of 1.4%. That monster payout has begun an extremely sturdy one foundation. Williams generates terribly stable cash flow backed by long-term contracts and government-regulated interest rate structures (it has delivered 32 consecutive quarters of meeting or exceeding consensus earnings estimates). The company produced enough cash last year to cover its dividend by a comfortable 2.4 times. This allowed it to retain cash to finance expansion projects and strengthen its balance sheet. Are leverage ratio was 3.6 times at the end of last year, a 25% improvement over 2018 levels.

The companies strong post-dividend free cash flow and balance sheet capacity provide this a lot of flexibility to finance expansion opportunities. Williams invests in 20 high-yield expansion projects to grow its natural gas transmission, capture and processing capacity, and Gulf of Mexico operations. Projects currently under construction will drive earnings growth at least until 2027. More than thirty additional projects are in development that could extend growth prospects into the next decade. The natural gas infrastructure company expects to grow its profits 5% to 7% per year over the long term.

Williams routinely supplements organic growth with acquisitions. It has made $6.1 billion by acquisitions since 2021 to improve its portfolio and growth profile. It has sufficient financial flexibility to continue making acquisitions as opportunities arise.

With a rock-solid financial position and visible growth on the horizon, Williams stands out as a very safe energy stock to hold in turbulent times.

A steadily increasing, high-yield payout

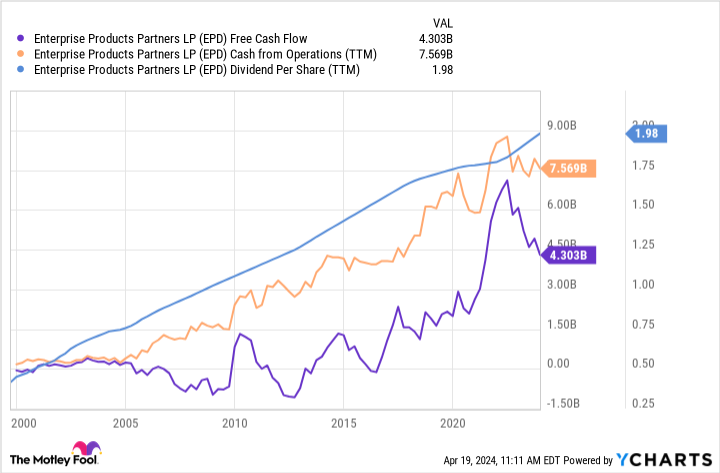

Neha Chamaria (Enterprise Products Partners): No oil and gas stock is immune to the volatility of oil and gas prices, but some can still thrive and reward their shareholders with bigger dividends even in turbulent times. Enterprise Products Partners is one such stock, and its track record is a testament to the reliability and stability of its dividend: its cash flows have only grown over time, and the company has increased its dividend every year for 25 consecutive years.

Enterprise Products’ business model is obviously a major factor behind its reliable dividends. As a midstream energy infrastructure company, Enterprise Products provides services such as the storage and transportation of natural gas, natural gas liquids, crude oil, refined products and petrochemicals to producers and consumers under long-term, fee-based contracts. That means the company earns compensation for these services regardless of where oil and gas prices are. Therefore, cash flows are stable and dividends can be supported at all times.

Enterprise Products is currently doing well and has generated $7.5 billion in distributable cash flow through 2023, which could comfortably cover dividends by 1.7 times. Simply put, the company has plenty of cash to cover and grow its dividends. Enterprise Products entered 2024 with $6.8 billion in biologics projects under construction, including two natural gas processing plants in the Permian Basin, which are expected to be completed this year and should start contributing to the company’s cash flow. Because Enterprise Products focuses on growing cash flow and is committed to returning capital to shareholders, the 7.2% yielding stock is a no-brainer energy dividend stock to own in turbulent times.

Should you invest $1,000 in Enbridge now?

Consider the following before purchasing shares in Enbridge:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Matt DiLallo holds positions at Enbridge and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge. The Motley Fool holds and recommends positions in Enbridge. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 Safe Energy Dividends for Turbulent Times was originally published by The Motley Fool