-

According to Stephen Suttmeier, technical analyst at BofA, the stock market rally is likely to continue.

-

In a note on Tuesday, Suttmeier highlighted four positive signs that point to a healthy bull market.

-

“Rotation, the lifeblood of a bull market, suggests the SPX reached last week’s highs from a position of strength,” Suttmeier said.

With the stock market hitting a series of record highs in 2024, there are positive signs that the rally could continue.

In a note Tuesday, Bank of America technical analyst Stephen Suttmeier said the ongoing bull market is in good health thanks to a broad rotation into smaller-company stocks.

“A broadening of the rally and rotation, which is the lifeblood of a stock market bull, suggests the SPX reached last week’s highs from a position of strength, not weakness,” Suttmeier said of the S&P 500.

Suttmeier said solid seasonality toward the end of an election year, combined with strong technicals, could push the stock market to record highs later this year.

These are the four positive indicators that give Suttmeier confidence in a continued market rally.

-

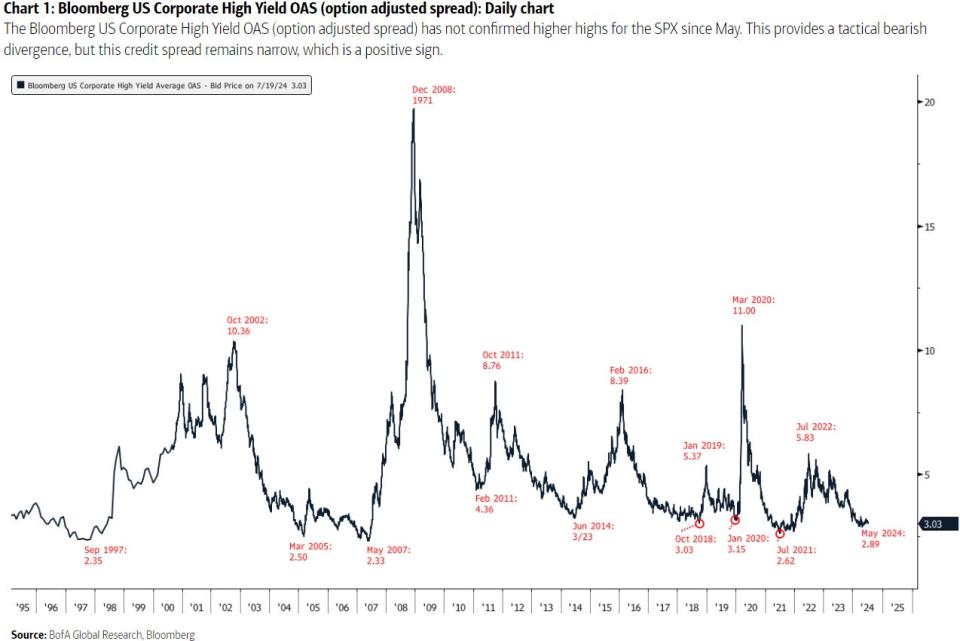

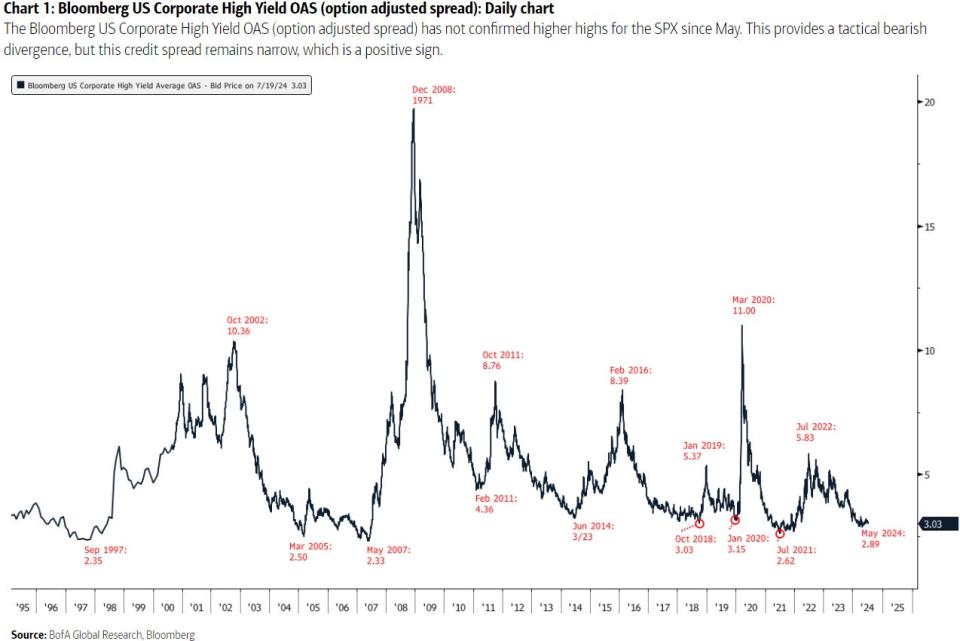

Junk bond spreads are narrow

The difference in returns on risky corporate debt and ultra-safe government debt is not a concern for the stock market in general.

When investors are concerned about the economy and the broader market, they typically demand higher yields on risky junk bonds compared to risk-free government bonds, causing credit spreads to widen dramatically.

“This credit spread remains narrow, which is a positive sign,” Suttmeier said.

-

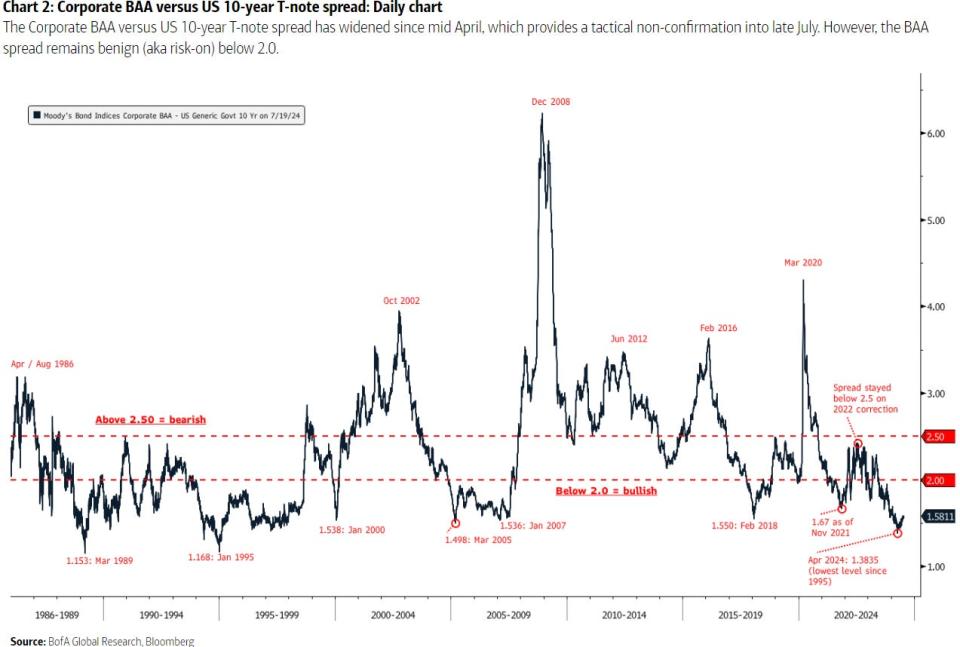

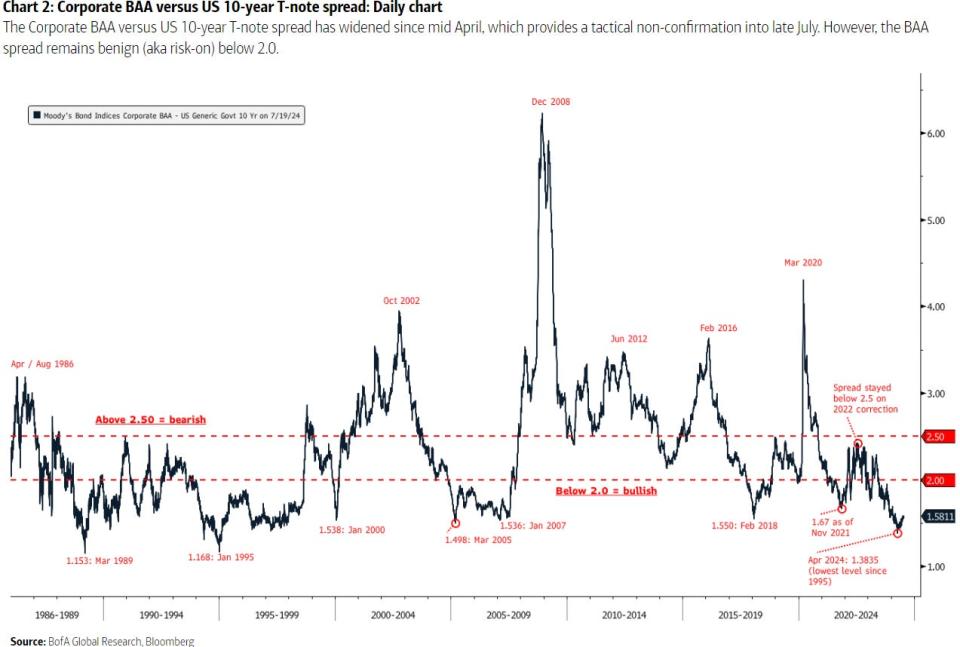

Corporate bond spreads are tight

Similar to the signal coming from junk bonds, the chart below shows the difference in yields between higher quality corporate debt and 10-year U.S. Treasuries.

“The BAA spread remains favorable (or risk-on) below 2.0,” Suttmeier said.

The spread hit 1.38 in April, its lowest level since 1995. It currently stands at around 1.58, well below the 2.0 level that Suttmeier said represents a “risky” environment for stocks.

-

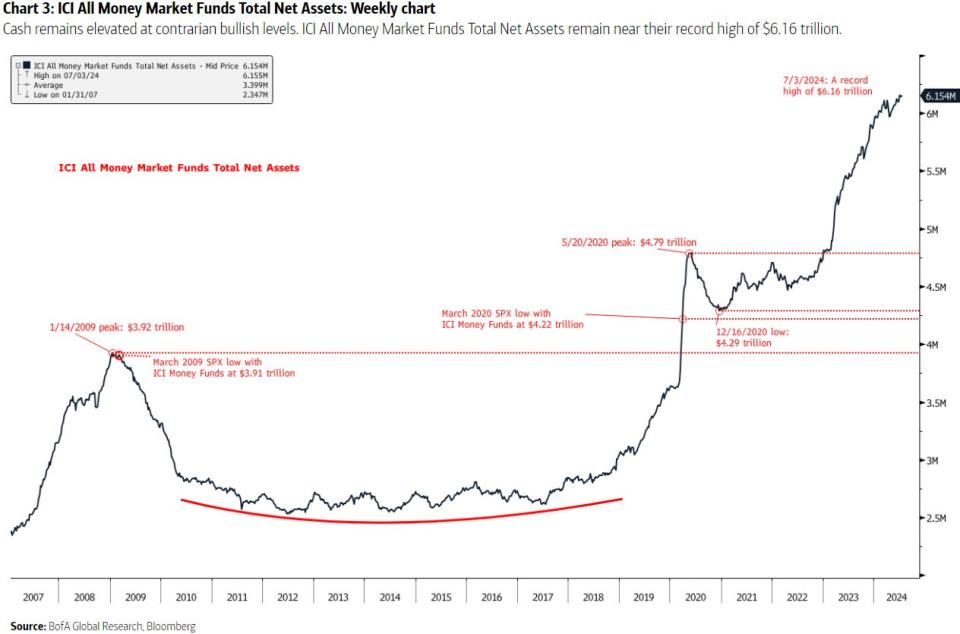

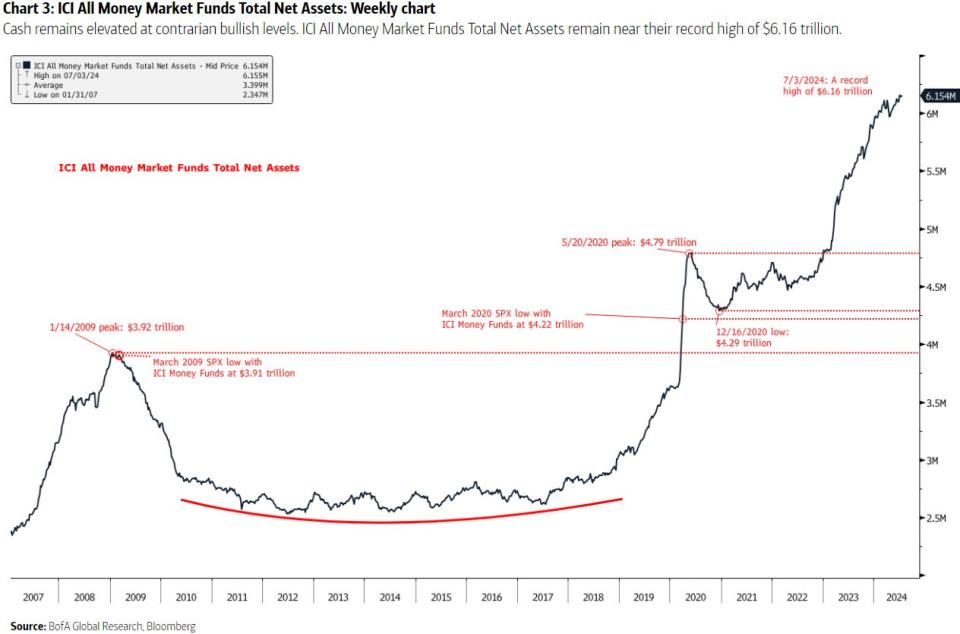

$6 Trillion in Cash is a Bullish Signal

According to BofA, the fact that investors are holding a record $6 trillion in money market funds is a positive sign.

That money could fuel a sustained stock market rally, especially if the Federal Reserve cuts interest rates, making the current 5% cash rate less attractive.

Such a scenario could lead investors to evaluate their liquidity position and ultimately consider buying shares.

-

Fed financial conditions confirm rally

According to Suttmeier, the new highs in the stock market in recent weeks have been confirmed by new cyclical bullish highs for the Chicago Fed National Financial Conditions Index.

That’s a healthy signal that should support sustainable gains in the market.

The financial conditions index last produced a large negative divergence toward the end of 2021, when the S&P 500 rose while the financial conditions index fell.

With the financial conditions index recently hitting its highest level since early 2022, there is still room to surpass the 2021 peak, suggesting there is still room for the stock market to rise.

Read the original article on Business Insider