(Bloomberg) – International Business Machines Corp. fell about 9% in extended trading after weak sales of the company’s consulting units disappointed investors and its acquisition of software company HashiCorp Inc. overshadowed.

Most read from Bloomberg

First-quarter revenue rose 1% to $14.5 billion, the Armonk, New York-based company said in a statement Wednesday. IBM also reiterated its previous guidance of $12 billion in free cash flow for the fiscal year ending in December.

In addition, IBM announced that it has agreed to acquire HashiCorp, which sells software that helps companies manage their cloud computing operations, for an enterprise value of $6.4 billion. The acquisition is IBM’s largest since acquiring software company Red Hat in 2019 for $31.8 billion.

The deal is another move by Chief Executive Officer Arvind Krishna to turn the old technology hardware company into a company focused on fast-growing software and services. Big Blue has made other acquisitions in this area, such as Apptio for $4.6 billion last year, and divested managed infrastructure, weather and health businesses.

“HashiCorp has a proven track record of enabling customers to manage the complexity of today’s infrastructure and application proliferation,” Krishna said in the statement. “Combining IBM’s portfolio and expertise with HashiCorp’s capabilities and talent creates a comprehensive hybrid cloud platform designed for the AI era.”

Shares fell to a low of $166.51 in extended trading after closing at $184.10 in New York. The stock is up 13% this year, outpacing the S&P 500 Information Technology Sector Index’s rally of 6.2%.

Read more: IBM acquires software maker HashiCorp in $6.4 billion deal

With the acquisition of HashiCorp, IBM will execute the “Red Hat playbook” by pushing the product to its global customer catalog, Chief Financial Officer Jim Kavanaugh said in an interview. The deal will boost earnings before interest, taxes, depreciation and amortization within the first year, he added, and sees HashiCorp’s free cash flow margin rise to 30% to 40% as part of IBM.

IBM has eclipsed $1 billion in bookings for AI-focused products and consulting since mid-2023, Krishna said in the statement. That figure represents roughly two-thirds of consulting business and will be largely recognized as revenue by 2025, Kavanaugh added.

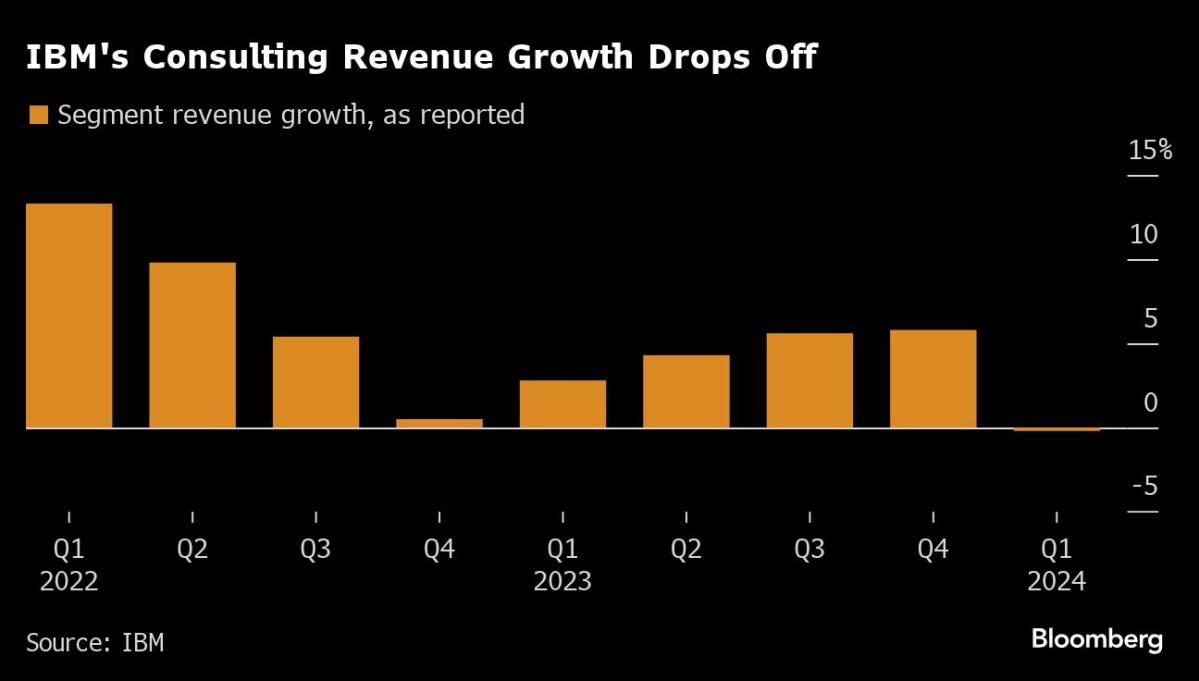

Investors are focused on the potential for slippage at IBM’s consulting division, its second-largest industry. That unit’s revenue was $5.2 billion in the period ended March 31, unchanged from the year-earlier quarter.

The consulting results reflect a “weak IT spending environment,” wrote Anurag Rana, senior analyst at Bloomberg Intelligence. Kavanaugh said customers continue to curtail their spending due to an uncertain economic environment.

Red Hat posted 9% revenue growth, another relatively sluggish stretch for a company that once regularly rose more than 20% every quarter. Profit, excluding some items, amounted to $1.68 per share.

HashiCorp posted a 22% gain in revenue to $583 million in its most recent fiscal year, which ended in January. The company has struggled recently due to a mix of sales execution and slowing cloud migrations, wrote Jason Ader, an analyst at William Blair. “As part of IBM, HashiCorp could benefit from a more standardized sales approach and a better ability to bundle tools to increase the value of paid subscriptions,” he wrote.

Most read from Bloomberg Businessweek

©2024 BloombergLP