Intel (NASDAQ: INTC) Shareholders are once again licking their wounds after the chip titan’s latest earnings report.

It’s a familiar position for Intel investors. The company has repeatedly disappointed the market and made big promises about revamping its business, only to fall short when it came time to open the books.

This time, Intel beat expectations in the first quarter with a modest revenue increase, but the second quarter forecast was worse than expected as it called for flat revenue growth (in the middle of expectations) and a decline in profits.

Intel shares have been underperforming their peers for so long that the company’s problems run much deeper than just a quarter of disappointing numbers. After all, the stock is still trading below its peak during the dot-com boom. Only once in the past decade has Intel’s annual revenue growth exceeded 10%, even as peers would like to Nvidia And AMD have delivered monster growth and returns in that time.

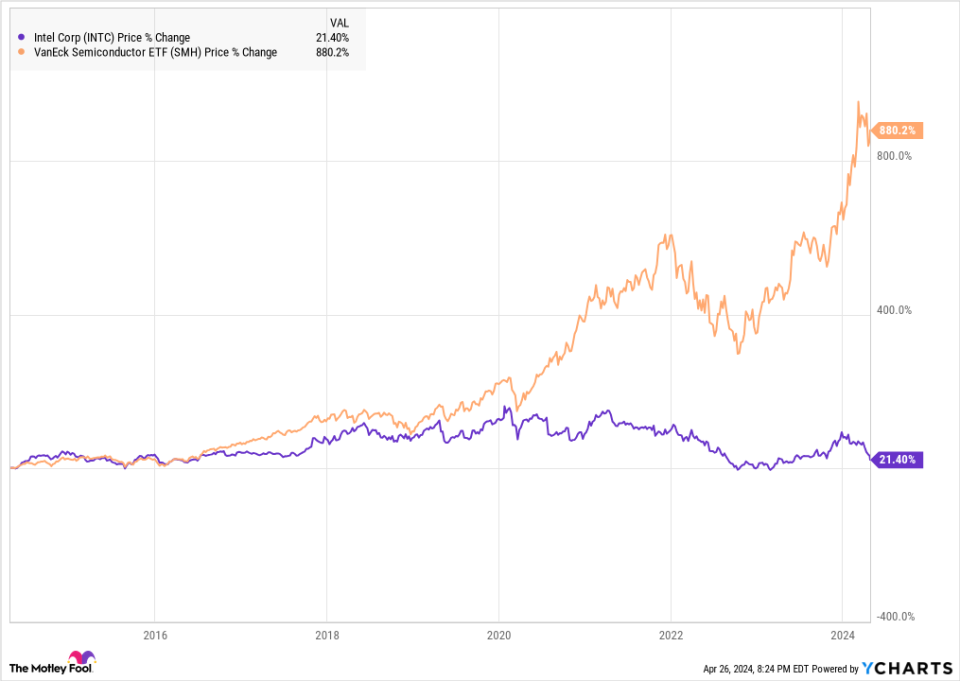

The chart below shows how Intel stock performance compares to the Van Eck Semiconductor ETFwhich has owned a diversified group of chip stocks for the past decade.

While the past decade has been a storybook chapter for the semiconductor sector, Intel has lost the plot.

There is no simple explanation for the company’s problems. Intel remains a large and generally profitable company, but it consistently lags behind its competitors.

One quote from Warren Buffett may be the best explanation for what’s behind Intel’s chronic underperformance. The Berkshire Hathaway The chief once told his deputies, “We can afford to lose money – even a lot of money. But we cannot afford to lose our reputation – even an ounce of reputation.”

A loss of reputation is not immediately visible in the figures, but it can be an invisible reason why one competitor performs better than another. While it’s not quantifiable, the consequences over time are very real, and that seems to be part of what has plagued Intel.

Intel’s reputation problem

A wide range of factors influence a brand’s reputation, including product quality, culture, corporate behavior and leadership. Reputation can influence both customer demand and employee recruitment.

A weak reputation for product quality can drive customers away, and a history of strategic mistakes and underperformance can also send investors heading for the exits.

While Intel has long dominated the PC CPU market, the company has struggled to leverage that advantage elsewhere.

It missed the smartphone and mobile revolution. It lost ground to fabled chip makers like AMD, and has had three CEOs in the last six years, while peers like AMD, Nvidia and Broadcom have had the same leader for ten years or more. It also bungled its position in the foundry market as it was slow to make 10nm chips, and now it is badly lagging in the foundry market. Taiwanese semiconductor And Samsung in advanced chip manufacturing.

Meanwhile, Intel has spent heavily on dividends and share buybacks throughout its history, seemingly at the expense of its core business. While the company is now trying to crack the AI GPU market, its track record provides plenty of reasons to doubt its capabilities.

Like beauty, reputation is in the eye of the beholder, and there is a wide range of opinions about Intel. This includes critical ones who argue that the company lacks innovation and is risk-averse due to its historical dominance of the PC market.

a New York Times In 2020, exposed a culture in which managers were complacent about outside competition and fought internally while withholding information from each other. Separate, but possibly related, Apple famously ditched Intel chips in 2020 to instead put the M1 chips in the Mac computers, offering longer battery life and a fanless design that made them quieter.

On employee review site Glassdoor, a number of commenters criticized Intel for a lack of vision, too much bureaucracy and slowness. In an industry known for ‘moving fast and breaking things’, these qualities are obvious weaknesses.

It is worth noting that Intel’s corporate reputation is still in good standing. It hasn’t yet endured the kind of scandal that, for example, Wells Fargo did so a few years ago, but the recognition for its ESG efforts is very different from the way the company is talked about by prospects at the top engineering schools or by its largest customers when purchasing decisions come up.

Why Intel stock is still best avoided

According to Intel Bulls, AI and the foundry sector are the top two reasons to bet on a turnaround.

However, Intel currently appears to be a loser in AI as enterprise demand turns away from its traditional data center chips, and it reported just 5% growth in its data center and AI segment in the first quarter. Additionally, Nvidia is launching its own AI PC chip that could take market share from Intel in its core business

Intel management said it expected more than $500 million in accelerated computing revenue from the Gaudi 3 AI chip in the second half of the year, but that’s still a relative decline of about 1% of Intel’s annual revenue.

The stock also fell a few weeks ago after revealing a $7 billion loss in its foundry division last year. The company plans to reach breakeven in the foundry sector by 2027 and achieve operating margins of 25% to 30% by 2030, but six years is an eternity in the chip sector. Intel’s own history of missed opportunities and stiff competition from the likes of TSMC mean investors should take this forecast with a healthy grain of salt.

Achieving success in any of these businesses will require improving reputation, and that can take a long time, as another Warren Buffett quote reminds us.

Buffett once said, “It takes twenty years to build a reputation and five minutes to ruin it.”

Rebuilding Intel’s reputation may not take 20 years, but investors should be skeptical of the chip giant until it proves it can innovate and compete in new markets, and that will likely take several years.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 22, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman holds positions at Broadcom and Wells Fargo. The Motley Fool holds positions in and recommends Advanced Micro Devices, Apple, Berkshire Hathaway, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls to Intel and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

This quote from Warren Buffett perfectly explains why Intel Stock is best avoided, originally published by The Motley Fool