After last year’s great performances, S&P 500 and tech-heavy Nasdaq Composite have continued to grow by double digits so far in 2024.

One of the biggest catalysts driving positive market sentiment is artificial intelligence (AI). While AI can take many forms, some of the biggest beneficiaries of the technology are semiconductor stocks.

Broadcom (NASDAQ: AVGO) offers a really interesting opportunity at the intersection of AI and semiconductors. The company offers networking and data center solutions, as well as cloud-based tools through its subsidiary VMware.

Investors have taken notice of Broadcom’s potential, sending shares up 77% in the past year. Given this huge move in such a short time frame, it’s no surprise that Broadcom management decided to execute a 10-for-1 stock split earlier this month.

Let’s take a look at whether now is a good time to buy Broadcom stock after the stock split, or whether investors missed this opportunity and should look elsewhere.

AI will be the next big wave of enterprise

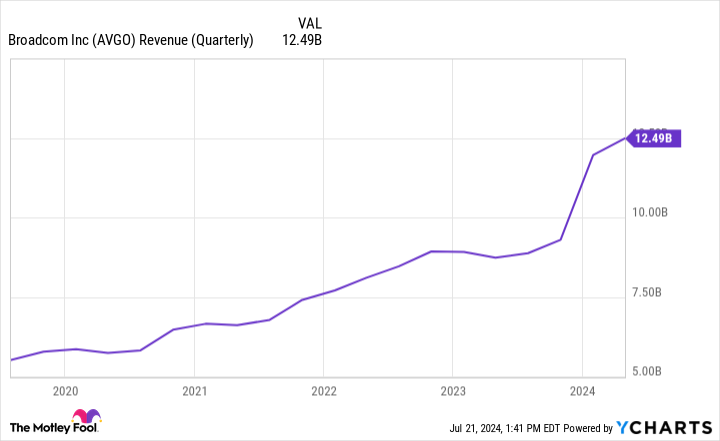

As the chart below shows, the company’s quarterly revenue has entered a new growth phase and shows no signs of slowing down.

Broadcom reports its revenue in two segments: semiconductor solutions and infrastructure software. Today, approximately 60% of Broadcom’s business comes from the semiconductor solutions operation.

In the second quarter of fiscal 2024, which ended May 5, Broadcom’s semiconductor division generated revenue of $7.2 billion, up 6% from the previous year.

While this level of growth may seem trivial, I think it sheds light on the idea that the AI revolution is still in its infancy. I’m actually encouraged by Broadcom’s prospects and think its semiconductor business has plenty of room for growth.

One of the bigger reasons investors are cheering Broadcom stock right now is because the company’s infrastructure software business is soaring in value. Infrastructure software revenue jumped 175% year over year to $5.3 billion during the company’s fiscal second quarter.

It’s important to note, however, that not all of this new growth is organic. In late 2023, Broadcom completed its acquisition of VMware, bringing a new layer of products and services to augment the company’s existing semiconductor networking solutions.

Nevertheless, I am encouraged by the impact VMware is already having on Broadcom’s business. So far, the acquisition appears to be paying off in a big way.

While I think many investors are making valid predictions about the potential AI will have for Broadcom’s semiconductor solutions, I think AI could also play a more subtle role in shaping the company’s infrastructure software and cloud solutions.

Broadcom appears to be experiencing a true renaissance right now and AI is central to its growth.

Is it too late to buy Broadcom stock?

Evaluating stock split stocks can be a bit tricky. Generally, stock split stocks can experience excessive momentum leading up to and shortly after the actual split.

Since trading began on a split basis on July 15, Broadcom shares have fallen about 6% through the market close on July 19.

While this decline may provide an opportunity to profit from the downward price trend, I encourage investors to take a broader view and look at the bigger picture.

As my fellow Fool.com contributor Adria Cimino pointed out, stock-split stocks have historically outperformed the S&P 500 in the 12 months following a split. While that’s an interesting statistic, investors know that historical performance isn’t always indicative of what the future holds.

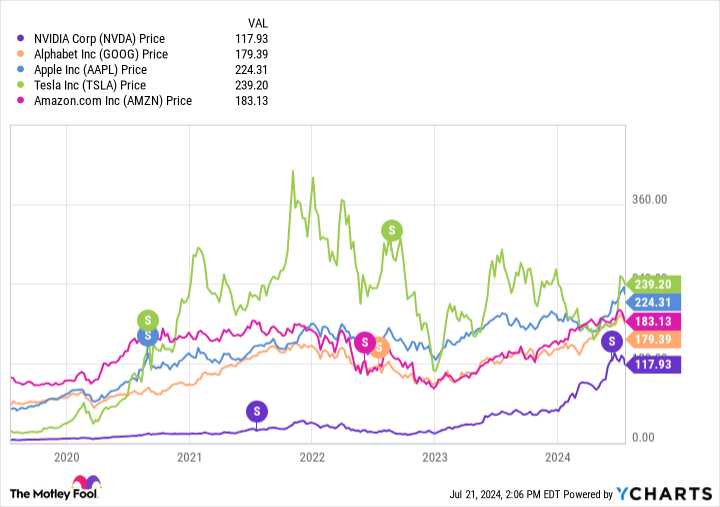

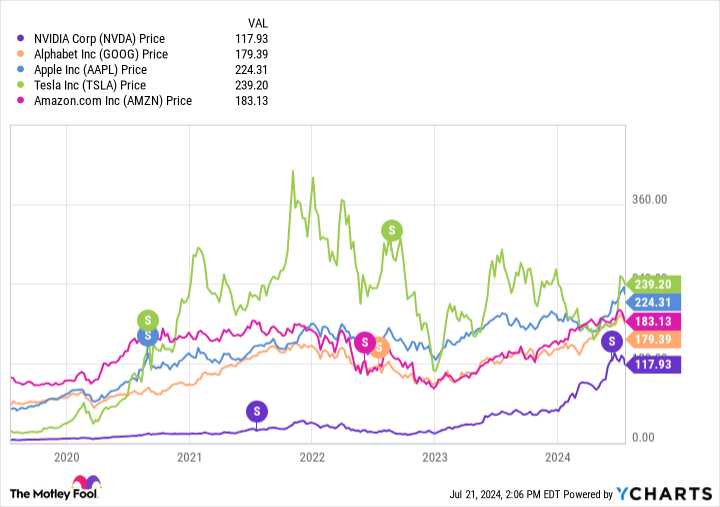

However, the chart below may be a good indication of what Broadcom investors can expect.

As pictured above, large technology companies Nvidia, Alphabet, Apple, TeslaAnd Amazon have all completed stock splits in the past few years. The splits are indicated by the letter “S” in the colored circles above.

With the exception of Tesla, the stock price of all the companies in this group is higher today than it was at the time of the stock split. It should be noted that Tesla shares did indeed rise after the split in 2020.

While the data above only captures a small group of companies, I think the broader ideas are pretty clear. First, quality companies tend to see long-term stock price appreciation. Second, recent stock splits in the tech sector have largely been great investments — even if investors decided to buy shares after the divorce.

Given that Broadcom is in the early stages of its new growth story, supported by strong secular tailwinds in AI, and given the historical performance of tech stock splits, I see Broadcom stock as an attractive buy right now. I don’t think it’s too late to get in.

Should You Invest $1,000 in Broadcom Now?

Before buying Broadcom stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now…and Broadcom wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Nvidia and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Nvidia and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Broadcom Stock After the 10-for-1 Split? was originally published by The Motley Fool