Rep. Jeff Thompson, R-Lizton, speaks during a Tax Reform Task Force meeting on April 17, 2024, on overtax appeals and school referendums. (Whitney Downard/Indiana Capital Chronicle)

The chief budget architect for the Indiana House of Representatives on Wednesday outlined property tax concerns for the next legislative session, focusing on school referendums and the use of appeals against overtaxes.

Other topics included: remonstrance requests, the formula for the maximum tax growth quotient and debt thresholds. Many of the issues were ones that Rep. Jeff Thompson, the chairman of the Budget Ways and Means Committee, tried to address during the 2023 session but failed to reach an agreement with senators.

“I’m working on simplicity,” Thompson said afterward his presentation for the State and Local Tax Review Task Force. “(But) I don’t think we can solve it all in one session. I’ve come to the conclusion that it’s so big that you have to take… (a) series of steps.”

Warning for agricultural land

Thompson warned panel members that “we will see a significant increase in the assessed value of agricultural land.”

To determine the basic agricultural amount for a given assessment year, the local government’s Ministry of Finance calculates a moving average based on six years of capitalized net operating income and net cash rent. The highest value of the six is dropped from the formula and the remaining five years are averaged to determine a base rate.

For 2024, the base amount was set at $2,280 per acre, which is $380 per acre higher than for the 2023 tax year.

An increase in assessed value does not automatically mean an increase in a farmer’s property taxes, but it can.

Thompson said he estimates the base rate for farmland could soon rise to $3,100 due to the nature of the moving average.

“And so we will see a shift to agricultural land. It’s coming based on the current formula. And so I think it’s just a policy issue. Do we want that to happen or not?” he asked.

Appeal for excessive levies and school funding

Thompson also examined the past three years of growth in the number of overcharge appeals. Communities in Indiana can demand property tax levies beyond traditional caps when property values rise faster than the state average.

A boom in assessed values during the COVID-19 pandemic has increased the use of the maximum tax as local government units tried to pay for schools, fire protection and more. But while the number of appeals didn’t change much between 2022 and 2023, Thompson noted that the amount approved nearly quadrupled.

“… what these levy requests often do is just shift who gets the money. Taxpayers are not paying anymore,” Thompson said.

That’s partly because a large portion of payers, 90% in some areas, have already reached their ceiling. But Thompson said he doesn’t see this growth as a major concern.

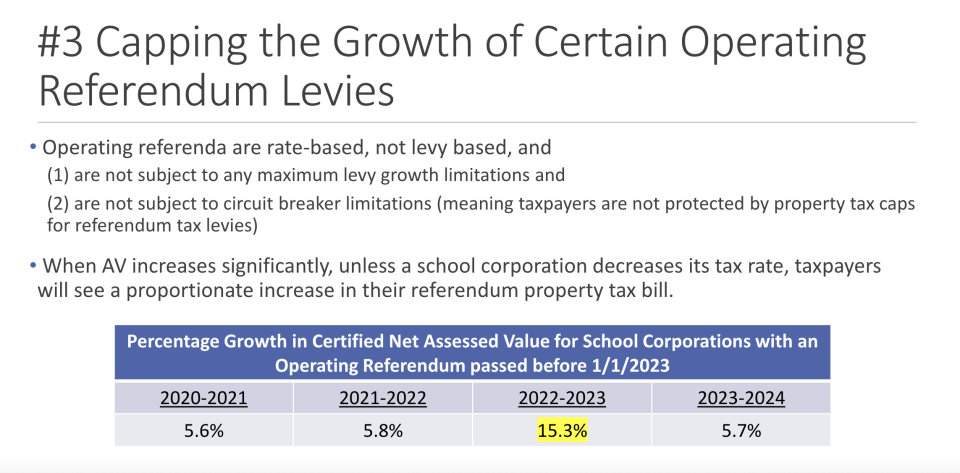

Instead, he pointed to rate-based school referendums that are neither subject to maximum levy growth restrictions nor curbed by circuit breaker restrictions.

This means that as a homeowner’s assessed value increases, schools will see a funding increase unless they lower their tax rates — and taxpayers will see their property tax bills increase in the referendum.

“In most cases, that worked pretty well until we hit 2022 (taxes paid in) 2023 … we had a significant increase in the statewide levy amount,” Thompson said. “Some of it was related – and now not all of it – to the huge increase in assessed value.”

Such referendums are approved by taxpayers, Thompson acknowledged, but homeowners don’t always anticipate double-digit jumps in assessed values that will drive up tax bills if they vote to approve a referendum.

A slide from Rep. Jeff Thompson’s property tax presentation illustrates why it’s necessary to limit certain school referendums.

A 2023 bill authored by Thompson implemented a cap that limited increases to a “typical” 5-6%. Follow-up action in 2024 expanded that for some, but provided more flexibility for growing school businesses.

But Thompson warned that if the cap was not extended to 2030, property owners were expected to see a 14.2% increase in taxes paid in 2026 in 2025.

Rep. Greg Porter, a Democrat from Indianapolis, questioned whether some voters have approved referendums on a more conceptual basis, rather than on the line item basis, to prioritize better teacher pay and educational development in their communities.

“I think people don’t necessarily try to sit back and figure out your assessed values — unless you’re trying to sell your house — but they just look at the overall situation as it relates to education level or outcomes,” Porter said. “I understand what you’re saying, but the argument on the other side is what the intent of that said voter was (was).”

Thompson reiterated his concerns about a 15% increase for homeowners, but said that as a former teacher, he even understood that the standard 6% increase was sometimes not enough for some schools.

Proposals for change

Cris Johnston, the director of the Office of Management and Budget, said he personally thought the referendums should perhaps be based on fees instead of rates.

“But the average taxpayer, I don’t think, understands the property tax. So the rate is something they can understand a little bit better…” Johnston said.

Adding so much more context to inform a voter of the complexities could make a ballot question about approving a referendum “quite long-winded,” Thompson said.

Would you like to contact us?

Do you have a news tip?

Another problem, Thompson said, arose when companies resorted to issuing bonds because of “poor governance,” which hurt taxpayers.

But Democratic Sen. Fady Qaddoura of Indianapolis said he sees the problems as more systemic and the result of decades of plans to shift funding from public schools to other areas, such as charters or vouchers for private schools.

“I (can’t) help but think this is a very complex problem and I feel like we are dealing with the symptoms. The whole discussion today was about the symptoms of the problem,” he said.

Qaddoura even pushed to eliminate property taxes as a source of local funding for schools. For example, property taxes in wealthier communities can generate more money than those in low-income areas. Indiana took a hybrid approach that combines state dollars and local property taxes to offset that disparity, but some say it doesn’t deliver enough.

“I hope there comes a day when property taxes in the state of Indiana are no longer used to fund our schools and we can look at funding at the state level,” he said.

Qaddoura said referendums are “a symptom of unfunded needs” for school businesses.

The two-year task force is working generally to reform Indiana’s tax system, with a particular focus on income, sales and property taxes.

Editor-in-Chief Niki Kelly contributed to this story.

GET THE MORNING HEADLINES IN YOUR INBOX

The post Property Taxes in Tax Reform Spotlight appeared first on Indiana Capital Chronicle.