A lot of people seem to be concerned about stock splits, so much so that we at The Motley Fool even have a special calendar just for them. A huge split is looming Chipotle Mexican Grill (NYSE:CMG)which is doing a 50-for-1 exchange, expected to take place on June 26. Investors have gotten excited, sending shares of Chipotle close to record highs of around $3,000 per share.

I’m here to tell you that stock splits don’t matter. A stock is worth the future money it will pay out to shareholders, discounted to today. For Chipotle, it is irrelevant whether it has one share trading at a price of $80 billion (its current market cap) or 80 billion shares trading at $1. An investor will make money if the company generates more revenue.

Forgetting the irrelevant stock split, how does Chipotle perform in fundamental analysis? Should you buy the shares at current prices? Let’s take a closer look and find out.

There is a lot of room for growth in the number of stores

As the leading fast-casual restaurant chain for Mexican food, Chipotle now has 3,437 retail units, primarily in the United States. In the long term, it plans to open 7,000 stores in North America, and is starting to move into international markets as well. Specifically, it has opened a few stores in Western European markets and has just launched a partnership to bring Chiptole to Dubai and the Middle East.

While it’s unclear how many locations Chipotle plans to build internationally, I think it’s reasonable that the company will reach a few thousand in the next decade or two, especially as it moves into other markets like Australia. That would create a total addressable market of at least 10,000 restaurants, which I don’t think is crazy. McDonald’sfor reference, has over 40,000 locations worldwide.

How much would this mean for sales? Today, the average Chipotle generates $3 million in annual sales, a number that has grown single digits in recent years as the company keeps pace with inflation. Ultimately, Chipotle should reach an average restaurant sales level of $3.5 million. Apply that to 10,000 locations and you have $35 billion in annual revenue, compared to $10 billion today. Of course, many more years of growth are needed to achieve these sales figures, but Chiptole has a clear view of achieving these growth targets.

Can profit margins remain higher?

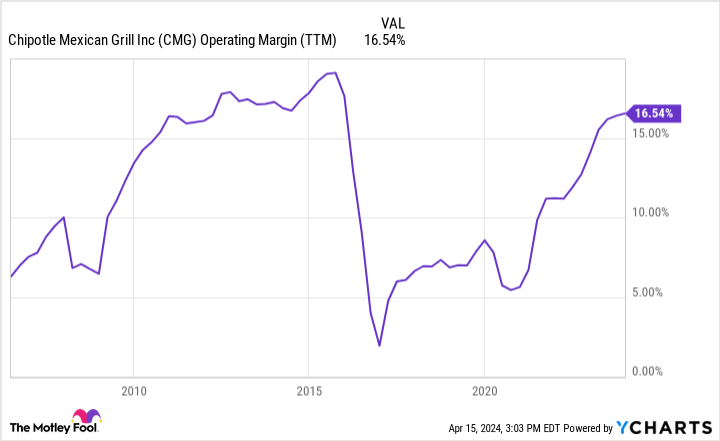

OK, we have some estimates of Chipotle’s sales potential. Now let’s look at what really matters to investors: profit. Chipotle has done a great job of growing its operating margin in recent years, rebounding to 16.5% over the past twelve months. It took almost a decade for the company to recover from the foodborne illness outbreak, even as profit margins soared toward 20%.

Over the long term, investors should expect some small levels of operating leverage as Chipotle continues to expand globally. However, don’t expand the huge margins of a restaurant concept. There will always be large labor and food costs for Chipotle, which will likely keep its profit margins between 15% and 20%.

Assuming Chipotle can achieve a consolidated margin of 18% on its future revenue estimate of $35 billion at 10,000 locations, the company will generate $6.3 billion in annual profits at some point.

Don’t worry about a stock split, focus on valuation

Again, investors don’t have to worry about a 50-to-1 stock split for Chipotle. It doesn’t affect Chipotle’s intrinsic value, how many people will visit its stores, or its input costs. What matters is how much it will make in cash for shareholders over the next few years.

I think Chipotle can generate over $6 billion in revenue once it reaches 10,000 locations. At a current market cap of $80 billion, Chipotle stock would yield a cheap-looking price-to-earnings (P/E) ratio of 13. The problem is that it will take Chipotle many years to reach this level of profit. Even if the number of stores opened increases to 400 per year (271 opened by 2023), it will take Chipotle more than sixteen years to reach 10,000 locations worldwide.

This is not an overnight growth story Nvidia. Chipotle is a good company, but one with more than a decade of earnings growth already priced in. Forget the stock split: Here’s why you shouldn’t buy shares of Chipotle stock. The stock is currently overvalued and will likely disappoint investors who buy today.

Should You Invest $1,000 in Chipotle Mexican Grill Now?

Before you buy shares in Chipotle Mexican Grill, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $526,933!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Fool has a disclosure policy.

Time to Buy Chipotle Before the Massive Stock Split? was originally published by The Motley Fool