(Bloomberg) — Taiwan Semiconductor Manufacturing Co. expects sales to rise as much as 30% this quarter, due to a boom in AI development that will boost demand for the advanced chips it makes for the likes of Nvidia Corp. stimulates.

Most read from Bloomberg

The better-than-expected outlook follows the first profit increase in a year, after strong demand for AI revived growth at the world’s largest contract chipmaker. The main chipmaker of Nvidia and Apple Inc. expects revenue of $19.6 billion to $20.4 billion in the June quarter, compared to estimates of around $19.1 billion.

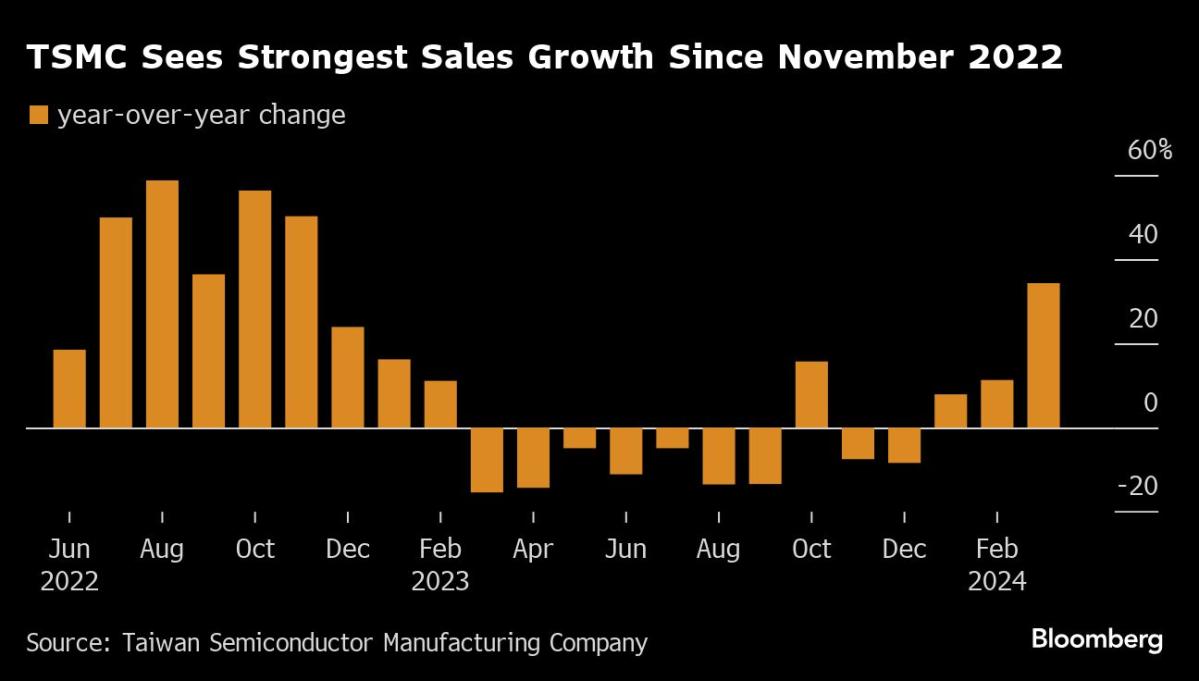

Taiwan’s largest company last week reported the fastest sales growth since 2022, indicating that demand for chips that accelerate the development of artificial intelligence is beginning to offset the impact of a slump in the smartphone market. Apple, which accounted for about a quarter of its revenue in 2023, started the year with a deep decline in Chinese iPhone sales.

Click here for a live blog on TSMC’s earnings.

TSMC has gained about $340 billion in market value since its October 2022 low, and expects it to be one of the clearest winners from a global boom in AI development. The company set an investment budget for 2024 of $28 billion to $32 billion at the beginning of this year. On Thursday, it posted a better-than-expected 9% rise in net profit to NT$225.5 billion ($7 billion) for the March quarter.

The company said in January that it expects sales to grow by at least 20% this year as the broader semiconductor market recovers, although uncertainty remains given global macroeconomic volatility. Key supplier ASML Holding NV – the sole supplier of the world’s most advanced chip-making machines – reported a 22% loss on first-quarter bookings on Wednesday.

In the longer term, investors expect AI-focused chips to gradually take a larger share of sales. TSMC’s AI revenues are growing 50% annually, the company said in January. Still, some investors have warned that the current level of demand for AI chips is unsustainable in the long term. Others remain wary given the uncertainty hanging over the Taiwan Strait, the narrow body of water between China and an island that China considers part of its territory.

–With help from Ville Heiskanen, Gao Yuan and Mayumi Negishi.

Most read from Bloomberg Businessweek

©2024 BloombergLP