(Bloomberg) — Taiwan Semiconductor Manufacturing Co.’s profit beat analysts’ high expectations for growing AI investment globally.

Most read from Bloomberg

Market expectations had risen in the weeks leading up to TSMC’s report on Thursday, and the AI craze and associated investments showed no signs of abating.

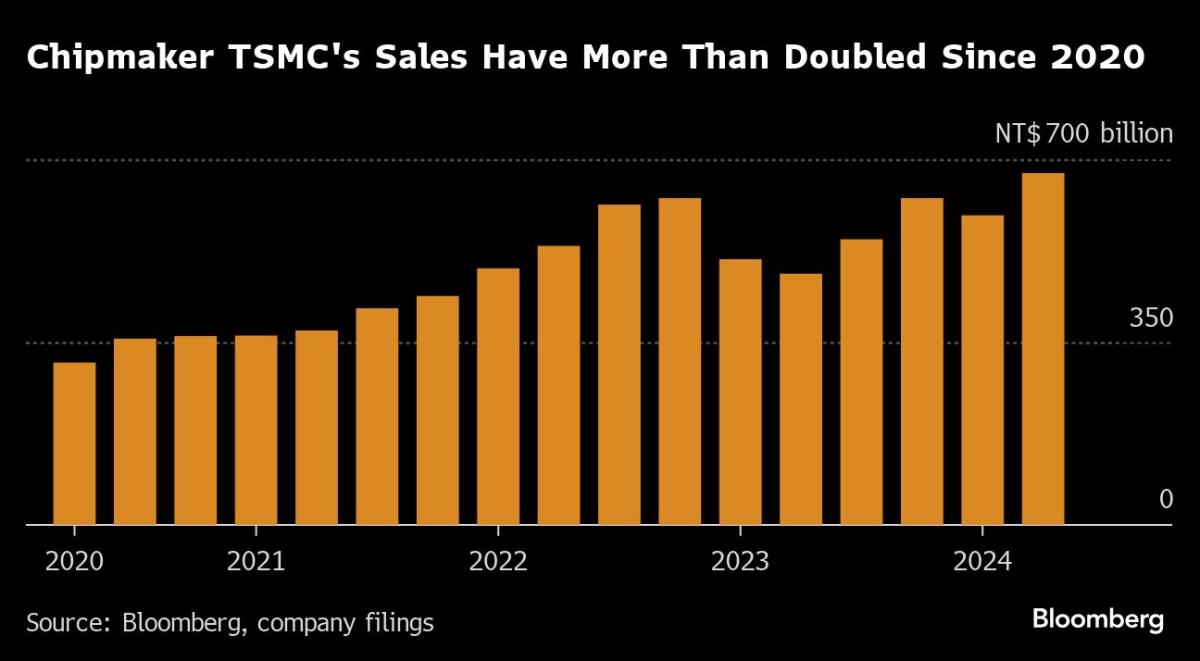

The chipmaker for Apple Inc. and Nvidia Corp. said net profit rose to NT$247.8 billion ($7.6 billion), beating the average estimate for a 29% increase and many expected TSMC to raise its full-year outlook after sales surged in the June period. The company said last week that sales grew in the second quarter at the fastest pace since 2022.

Click here for a live blog about the figures.

Shares of the world’s largest maker of advanced chips have more than doubled since the AI boom in late 2022, hitting a series of record highs, with the company’s market capitalization briefly surpassing $1 trillion.

Insatiable demand for Nvidia chips has buoyed TSMC’s performance as the broader smartphone market moves toward recovery. Apple has seen handset sales stabilize and has given its suppliers an optimistic forecast for deliveries of the upcoming iPhone 16 based on the potential power of its new AI tools.

Read: Apple wants to deliver 10% more new iPhones after bumpy 2023

What Bloomberg Intelligence Says

ASML’s 23.7% jump in order bookings in 2Q suggests that TSMC’s N2 development is progressing healthily, potentially accelerating capacity build-out. TSMC is scheduled to start mass production in 2H25, starting with a monthly capacity of around 30,000 wafers in Hsinchu, Taiwan. The N2 process will be at least 15% more expensive than N3 in our view.

— Charles Shum, BI Analyst

Still, investor euphoria over TSMC’s prospects faded on Wednesday after Bloomberg Businessweek published comments from U.S. Republican presidential candidate Donald Trump saying he is lukewarm at best about defending Taiwan in the event of Chinese aggression.

In addition, the U.S. is considering tougher restrictions on China’s chip market, Bloomberg News reports, sparking a global selloff in tech stocks as investors worry about the impact on the world’s largest semiconductor market.

And caution about AI is now emerging in corners of the market. This month, Goldman Sachs warned that the biggest U.S. tech companies may be spending too much on AI.

SemiAnalysis’ Chaolien Tseng warned that TSMC’s stock could take a hit if expectations that the chipmaker will boost its revenue growth to at least 25% by 2024 don’t materialize. In the latest earnings call, TSMC Chief Executive Officer CC Wei reiterated the company’s full-year revenue estimate of a growth rate of the low to mid-20% in U.S. dollars.

In the near term, the buildout of AI infrastructure that is driving chip sales is raising expectations for TSMC to increase its capital spending. This year’s capex forecast is $28 billion to $32 billion, with analysts estimating $29.5 billion.

Read: TSMC’s $420 Billion Stock Rally Relies on Further Valuation Upgrades

–With assistance from Vlad Savov, Cindy Wang and Mayumi Negishi.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP