Palantir Technologies (NYSE:PLTR) is one of the most polarizing stocks on the market right now. It has had a very strong performance over the past year, with an increase of more than 150%. However, this has also led to a very high rating.

The case against Palantir

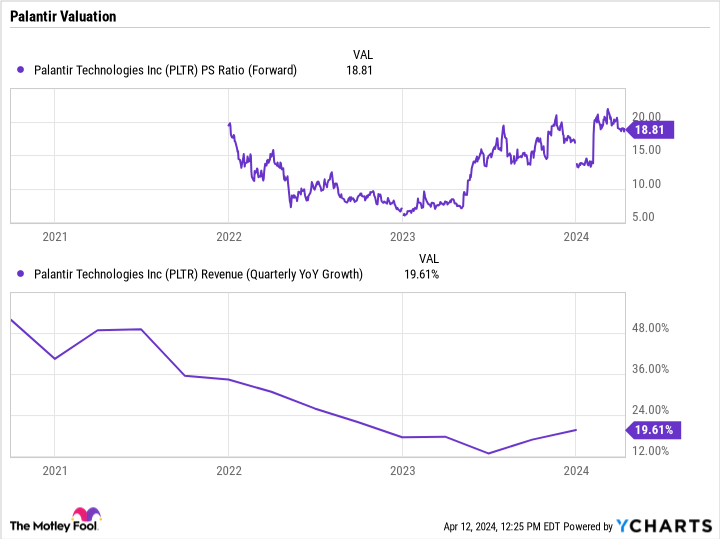

The bearish argument for Palantir largely revolves around its valuation and current growth rate. The stock is currently trading at a price-to-sales ratio (P/S) of just under 19.

PLTR PS Ratio (Forward) data according to YCharts

If Palantir were to grow its revenues at a breakneck pace, that valuation could easily be justified. However, the company only grew its revenue by 17% in 2023. That’s solid growth, but probably not enough to justify a P/S multiple of 19. Sales started to accelerate as the year progressed, with the best quarterly sales growth on the horizon. in the fourth quarter. However, sales growth in the fourth quarter was still only 20%.

Looking ahead, the company expected full-year 2024 revenue to be between $2.652 billion and $2.668 billion. That would mean growth of 19% to 20%.

Software-as-a-service (SAAS) companies growing around 17% to 20% have generally traded closer to seven times revenue in recent years, so Palantir’s current valuation is much higher than the most SaaS companies with similar growth.

The case in favor of Palantir

The positive case for Palantir revolves around the mission-critical technology serving the private sector, and the growing opportunities in the public sector and with artificial intelligence (AI).

The company rose to prominence for its data collection and analytics platform that helps U.S. government intelligence agencies detect and combat terrorism and assist with other mission-critical tasks. The technology also played a big role in helping the Centers for Disease Control and Prevention (CDC) track the spread of COVID-19.

However, government revenues have slowed in recent years, with growth of 19% in 2022 and just 14% in 2023. That said, awarding government contracts to private sector contractors is notoriously bumpy, especially when it comes to the U.S. government . as long periods may pass without any awards, followed by a number of major awards in quick succession. In fact, the US government only last month passed a spending bill for the current fiscal year ending in September 2024, well after the start of the budget year in October 2023. Palantir’s US government operations could certainly start to recover now that a spending bill has been passed prepared, and management has indicated that government activities should accelerate again this year.

However, income from the commercial sector has already started to rise faster. It grew 32% in the fourth quarter, while US commercial sales rose 70%. Palantir’s commercial success is driven by its new Artificial Intelligence Platform (AIP) product and boot camps.

The company uses boot camps to introduce AIP to potential customers. These workshops demonstrate how AIP can be applied to mission-critical operations and potential use cases, and provide onboarding and training. Management has said that using boot camps reduces sales cycle times and helps accelerate new customer acquisition.

More recently, Palantir announced a partnership with Oracle (NYSE: ORCL) where Planatir’s AI and decision acceleration platforms will be deployed on Oracle’s distributed cloud platform. Oracle’s cloud platform is growing quickly, so it should help fuel Palantir’s growth. However, Oracle’s cloud services segment is still much smaller than the big three Microsoft‘s Azure, Amazon Web services, and Alphabet‘s Google Cloud.

If AI and Palantir’s recent deal with Oracle can help Palantir accelerate its growth again, the company could grow beyond its current valuation.

Where Palantir’s stock will be in three years

If Palantir can boost its revenue growth to 30% this year and next before returning to revenue growth of 25% in 2026 and 20% in 2027, the company could see revenue of approximately $4.7 billion in 2026 and $5.0 billion in 2027. can generate $6 billion. and unique technology, I think the stock could achieve a slightly higher multiple than its peers. If you put a 9x P/S multiple at the end of 2026 on the stock’s 2027 sales, the stock would be trading right around where it currently trades with a market cap of $50.5 billion.

While Palantir stock will see a lot of volatility in the coming years, I believe the stock will be trading close to current levels by the end of 2026.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

View the 10 stocks

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool holds positions in and recommends Alphabet, Amazon, Microsoft, Oracle and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Where Will Palantir Technologies Stock Be in Three Years? was originally published by The Motley Fool