Crude oil prices are off to a stormy start to 2023. West Texas Intermediate, the main U.S. oil price benchmark, has risen from about $70 a barrel early this year to more than $85 a barrel this month. Several factors have fueled oil prices, including rising tensions in the Middle East. Oil prices could rise even further if these tensions escalate into a regional war.

Rising oil prices will benefit oil companies. They should generate more free cash flow, which would give them more money to return to investors. While higher prices should boost most oil stocks, Devon Energy (NYSE: DVN), Diamondback energy (NASDAQ: FANG)And ConocoPhillips (NYSE:COP) stand out as three of the best ways to make money when crude oil prices rise.

An oil-driven dividend

Devon Energy offers investors one of the best ways to profit from higher oil prices. The oil company pays out an innovative fixed plus variable dividend. It pays a base dividend of $0.22 per share every quarter, which was recently increased by 10%. That payout gives it a dividend yield of 1.7% at the recent share price, which is above S&P500‘s dividend yield of 1.4%.

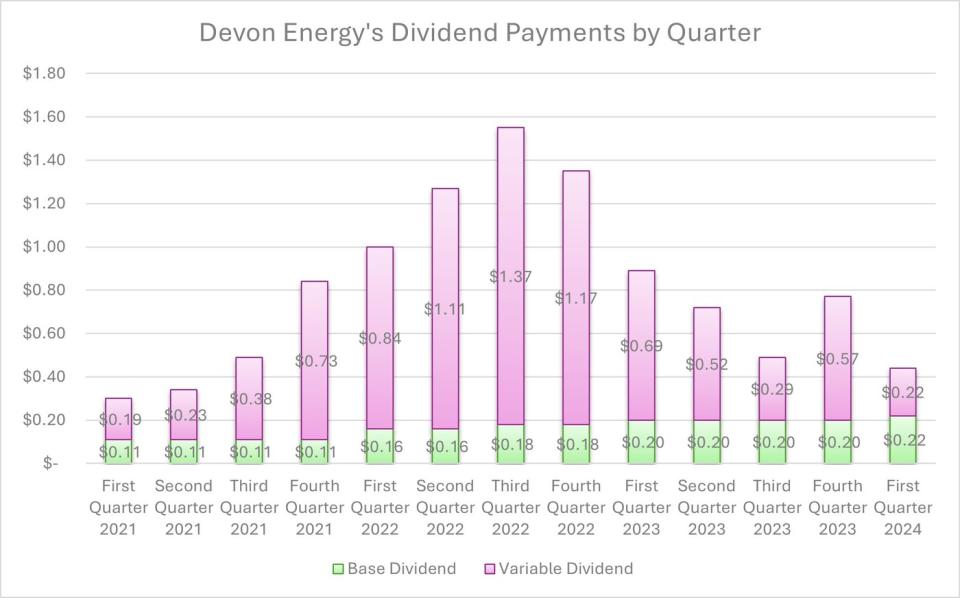

Additionally, Devon pays a variable dividend with a portion of its excess free cash flow. That payout has varied over the years, rising and falling with oil-driven cash flows:

As the chart shows, Devon’s last combined dividend payment was $0.44 per share. That brought the annualized dividend yield to 3.3%. Given the rise in oil prices this year, Devon could pay higher variable dividends in the coming quarters.

In addition to paying dividends, Devon plans to use more of its oil-fueled free cash flow to buy back its dirt-cheap shares. These shareholder returns, combined with rising free cash flow and higher oil prices, could give Devon the fuel to generate strong total returns.

A needle-moving deal could prove to be an even bigger catalyst

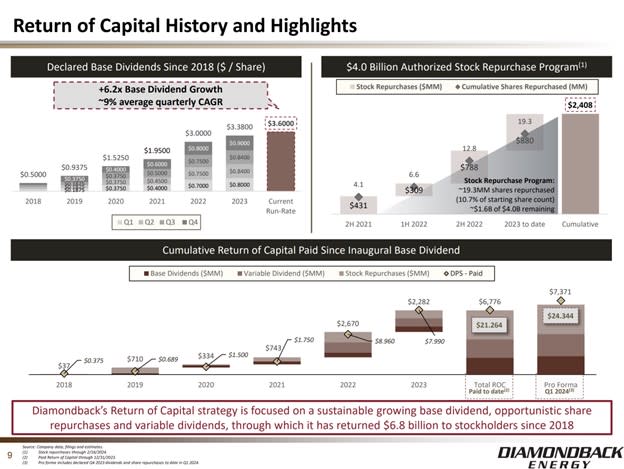

Diamondback Energy has followed Devon Energy’s playbook. The oil company also pays a growing fixed quarterly dividend, which is supplemented by variable dividends and share buybacks:

As this slide shows, Diamondback Energy has increased its base dividend by a solid quarterly compound rate of 9.2%. The company has delivered industry-leading dividend growth since it started paying out in 2018. It currently offers a similarly above-average dividend yield of 1.7% on the base payout.

Meanwhile, the company routinely pays a variable dividend. Most recently, the company paid $2.18 per share, on top of the base quarterly rate of $0.90 per share (an increase of 7% from the previous level). That pushed the annualized return against the recent share price to 6%.

Diamondback Energy recently made a big move to increase its ability to benefit from higher oil prices. It is buying rival Endeavor Energy Resources in a $26 billion deal to create a premier producer focused on the fertile Permian Basin. The company expects the deal to increase free cash flow per share by 10% next year, assuming flat oil prices. Higher oil prices would further boost that deal. That would allow the company to generate even more free cash flow that it could return to shareholders through dividends (basic and variable) and its meaningful share buyback program.

The potential to drive return on capital program

ConocoPhillips sets a capital return target each year that it adjusts based on market conditions. Last year, it planned to return $11 billion in cash to shareholders through the three-pronged framework of paying regular quarterly dividends, making quarterly variable return on cash (VROC) payments and buying back shares. It achieved that goal by paying out $5.6 billion in dividends and VROCs and purchasing $5.4 billion in stock.

The oil company initially targeted a lower return on capital of $9 billion this year due to lower oil prices at the start of 2023. Although the company planned to reduce total returns, it increased its regular quarterly dividend by 14% late last year. Instead, the reduction would come about by paying a lower VROC (VROC declared $0.58 per share in the first quarter, compared to $0.60 per share in the year-ago period) and buying back fewer shares.

However, a stronger oil price could give ConocoPhillips the cash flow and confidence to raise its return target this year. The company did so in 2022, when oil prices soared. Initially, the company set a goal of returning $7 billion to shareholders, but ultimately sent them $15 billion through higher VORC payments and share buybacks.

These oil stocks will send investors some of their oil-driven cash flows

Higher oil prices will allow oil companies to generate more free cash flow this year. Many return some of their excess earnings to investors through dividends and stock buybacks. Devon, Diamondback and ConocoPhillips stand out because they typically boost their cash returns when prices rise by paying higher variable dividends. Their investors stand to benefit if crude oil prices continue to rise this year.

Should You Invest $1,000 in Devon Energy Now?

Before buying shares in Devon Energy, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $526,933!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns April 15, 2024

The 3 Best Oil Stocks to Buy as Crude Prices Continue to Rise was originally published by The Motley Fool